How Modern Payment Solutions Drive Profits and Enhance Player Retention

Picture this: a player finally hits a win and wants to cash out — only to wait days for the payout to land. They try again. Still slow. By the third attempt, they’ve moved on to another platform.

Picture this: a player finally hits a win and wants to cash out — only to wait days for the payout to land. They try again. Still slow. By the third attempt, they’ve moved on to another platform.

It’s not bad luck — it’s bad payments.

In iGaming, where attention spans are short and competition is brutal, legacy payment systems are quietly eroding both player trust and operator profits. Delayed withdrawals, failed transactions, high decline rates — it’s a slow bleed that few operators can afford to ignore.

Let’s break down why the payment back-end might be your platform’s weakest link — and what to do about it.

According to YouGov, 69% of online gamblers cite instant payouts as a top priority — and 60% say they’d switch platforms if withdrawals are slow or clunky. Yet many operators still rely on outdated, patched-together payment stacks that were built for a different era.

The result?

These aren’t edge cases. They’re daily operational headaches.

And the worst part? You might not even realize how much you’re losing.

Legacy PSPs don’t just come with steep transaction costs — they drag entire systems down with inefficiencies that operators rarely calculate until it’s too late.

According to a global study by LexisNexis Risk Solutions, only 26% of cross-border payments are processed straight-through without manual intervention. That means nearly three out of four transactions require some kind of manual repair, additional verification, or enrichment. And that inefficiency comes at a price.

The root cause? Manual checks, outdated infrastructure, and clunky processes. Over 70% of respondents still check payment details manually — a friction point that slows everything down.

Compare that to modern orchestration platforms using real-time APIs, intelligent data validation, and fully automated routing. These systems not only cut failure rates but free up teams to focus on strategic growth instead of cleaning up payment messes.

So the question isn’t whether outdated systems are costing you — it’s how much.

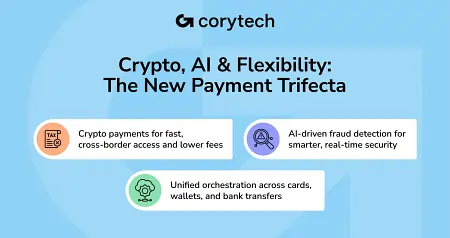

Today’s players want options — and speed. Increasingly, that means:

According to Deloitte’s 2025 payments report, platforms across digital industries are turning to integrated payment systems to improve speed, flexibility, and compliance.

In other words: fewer headaches, happier players, and better margins.

This isn’t just a tech issue — it’s a strategy issue. You don’t need more PSPs. You need fewer silos.

That’s the model companies like Corytech are quietly pushing forward. Their integrated orchestration platform combines fiat and crypto, automated compliance, and smart routing in a single backend — without overhauling your entire system.

It’s not a rebrand. It’s a rethink. From “get the payment done” to “make payments drive growth.”

And if it works for major operators handling multiple jurisdictions, it’ll work for you.

If you're an iGaming operator or payment service provider, ask yourself:

If those answers aren’t sharp, it might be time to reassess.

Because here’s the thing: Players don’t wait. And the ones who do? They’re not loyal. They’re just stuck — for now.

Legacy payment systems are costing you more than processing fees. They’re eating into your margins, killing retention, and leaving you vulnerable to fraud and compliance risks.

Modern payment platforms — like those developed by Corytech — offer an alternative that is aimed at providing faster, more flexible, and future-ready infrastructure, which may help keep players satisfied and operations lean.

Disclaimer: This article was prepared in collaboration with Corytech and reflects the company’s perspectives, product positioning, and views on payment infrastructure in the iGaming sector. Any references to performance, efficiency, player experience, or operational impact describe Corytech’s intended capabilities and are not guarantees of results. Actual outcomes may vary depending on operator, market, and implementation.

Cryptocurrency is a digital or virtual currency that uses cryptography for security and operates on decentralized networks based on blockchain technology.

A chargeback is a reversal of a transaction, initiated by the cardholder's bank, which refunds the customer after a dispute, often due to fraud or dissatisfaction.

Automated reconciliation is the process of using software to match transactions and balances automatically, reducing manual effort and errors in financial reporting.

Real-time payment processing allows transactions to be completed instantly, providing immediate confirmation and access to funds, enhancing customer satisfaction.

Explore more articles in the Finance category