HOW BANKS CAN IMPROVE CUSTOMER LOYALTY WITH BIG DATA

Published by Gbaf News

Posted on March 11, 2014

4 min readLast updated: January 22, 2026

Published by Gbaf News

Posted on March 11, 2014

4 min readLast updated: January 22, 2026

GFT creates a uniform database that transcends system borders. Simulations in real time forecast customer behaviour close to reality.

How Banks Can Improve Customer Loyalty With Big Data

When a good customer suddenly becomes an ex-customer, the cries of dismay in many banks are loud: How could something like this happen? In most cases, there are warning signs – but the task of automatically spotting them amid the mass of daily data and interpreting them correctly has so far been virtually impossible. New Big Data solutions are now changing this. GFT is enabling banks to identify customers who are looking to leave, allowing them to quickly put countermeasures in place.

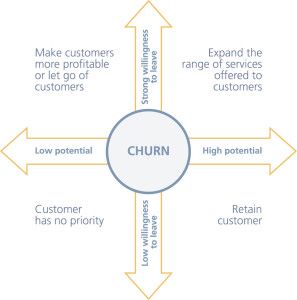

The churn rate, as it is known, has long since been one of the most important KPIs for telecommunications companies. It shows how many customers a company has lost within a given period. For banks, the churn rate has been of rather secondary importance in the past. They profited for many years from customer’s low desire to change banks. New competitors and products, coupled with the financial and confidence crisis, have however reduced customer loyalty significantly. Structured churn management is needed – i.e. efforts to retain customers, especially the good ones.

GFT supports financial service providers in the planning and implementation of a churn management system. “Every bank that wants to retain its customers’ needs to ask itself three questions,” says Marika Lulay, Member of the Board of the GFT Group and the person responsible for GFT’s operations. “First: Who are my good customers? Second: How do I bring my customers’ data together to recognise its signals? And third: What do I need to do if one customer is ready to change?” All of this essential information is recorded in a bank’s different databases. But it is unstructured and often unlinked. “With our Big Data approach, we are ensuring that IT is no longer the stumbling block to a bank’s opportunities. With our solution based on in-memory technology and the expertise of our consultants, we can create a uniform database for each client that transcends system borders. Regardless of the bank’s IT landscape and without any new interfaces.”

Because every bank is different, GFT’s experts work closely with their clients to understand their needs. Firstly, they analyse the IT environment and clarify the following issues: Which database contains which data? How do I get to the data? How can I harmonise the overall data records of each customer so that I can obtain all of the relevant information in real time? In the second stage, GFT works with the bank to develop a process to make this new data repository usable. “This is where we take a very close look: What patterns are visible in the data from customers that have already left? How can we transfer these patterns to existing customers? And very importantly: How do I recognise a potentially good customer?” says Marika Lulay.

In other words, Big Data in a pure culture. To control this new mass of quality data, GFT uses SAP HANA on its churn management solution. All manner of different scenarios can then be simulated, such as the reactions of customers to a change in interest rates on overnight deposits. Or how customers react to special offers, i.e. how cross-selling potential can be utilised. “Of course, we are not recreating reality with these simulations. But thanks to the vast amount of data available, we’re able to come very close to it. This represents an opportunity for financial service providers to step up their customer loyalty activities in a targeted manner. And finally, it’s much cheaper to keep an existing customer than it is to win a new one,” says Marika Lulay.

Explore more articles in the Banking category