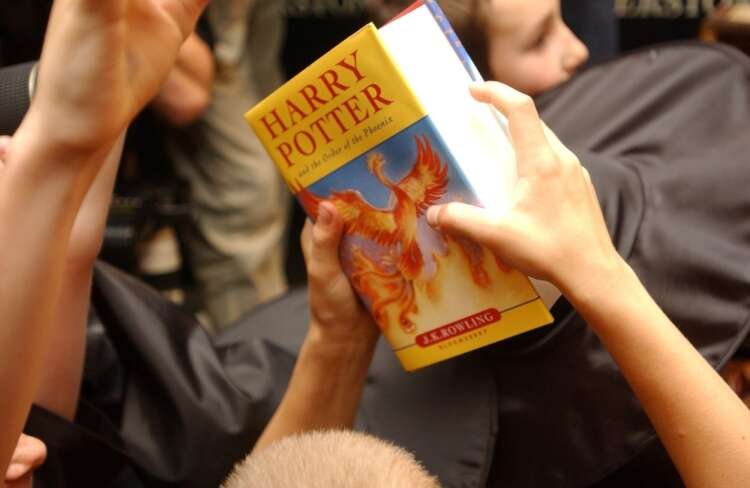

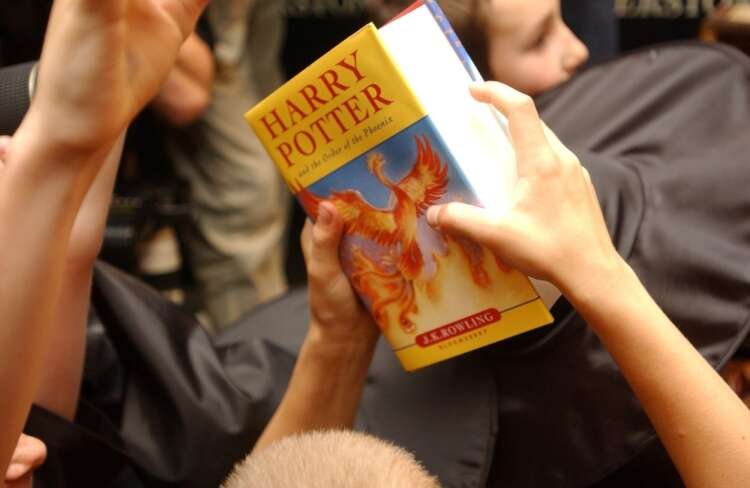

Harry Potter publisher hands out meaty dividend after bumper profits

(Reuters) – Bloomsbury Publishing Plc on Wednesday reported a 40% jump in annual profit and raised its final dividend payout by about a quarter, buoyed by a reading boom which stayed even after the pandemic lockdowns.

(Reuters) – Bloomsbury Publishing Plc on Wednesday reported a 40% jump in annual profit and raised its final dividend payout by about a quarter, buoyed by a reading boom which stayed even after the pandemic lockdowns.

The London-listed publisher, best known for picking up J.K. Rowling’s Potter series in 1997 after its rejection by a dozen others, “achieved its highest ever results” as more and more people picked up the habit of reading.

Bloomsbury said trading for the 2023 fiscal year has started in line with the board’s expectations, adding that it would invest robustly and look to make further acquisitions.

“The surge in reading, which seemed to be one of the only rays of light in the darkest days of the pandemic is perhaps now being revealed as permanent…,” Chief Executive Officer Nigel Newton said in a statement.

Sales of American fantasy author Sarah J. Maas’ titles grew 86%, while sales of academic publications benefited from the structural shift to online learning, the company said.

Profit rose to 26.7 million pounds ($32.07 million) for the year ended Feb. 28, while sales grew 24% to 230.1 million pounds. Sales were up 41% and profits up 70% on the two-year comparative period.

The firm also proposed a 24% increase in its final dividend to 9.40 pence per share.

($1 = 0.8326 pounds)

(Reporting by Aby Jose Koilparambil in Bengaluru; Editing by Shailesh Kuber)

A dividend is a portion of a company's earnings distributed to shareholders, typically in cash or additional shares, as a reward for their investment.

Corporate profit refers to the net income that a company earns after all expenses, taxes, and costs have been deducted from total revenue.

Sales growth is the increase in sales revenue over a specific period, often expressed as a percentage, indicating a company's performance and market demand.

An acquisition occurs when one company purchases most or all of another company's shares to gain control, often aimed at expanding market reach or resources.

Explore more articles in the Top Stories category