GLOBALLY, 1 IN 4 CONSUMERS VICTIMISED BY CARD FRAUD

Published by Gbaf News

Posted on June 27, 2014

3 min readLast updated: January 22, 2026

Published by Gbaf News

Posted on June 27, 2014

3 min readLast updated: January 22, 2026

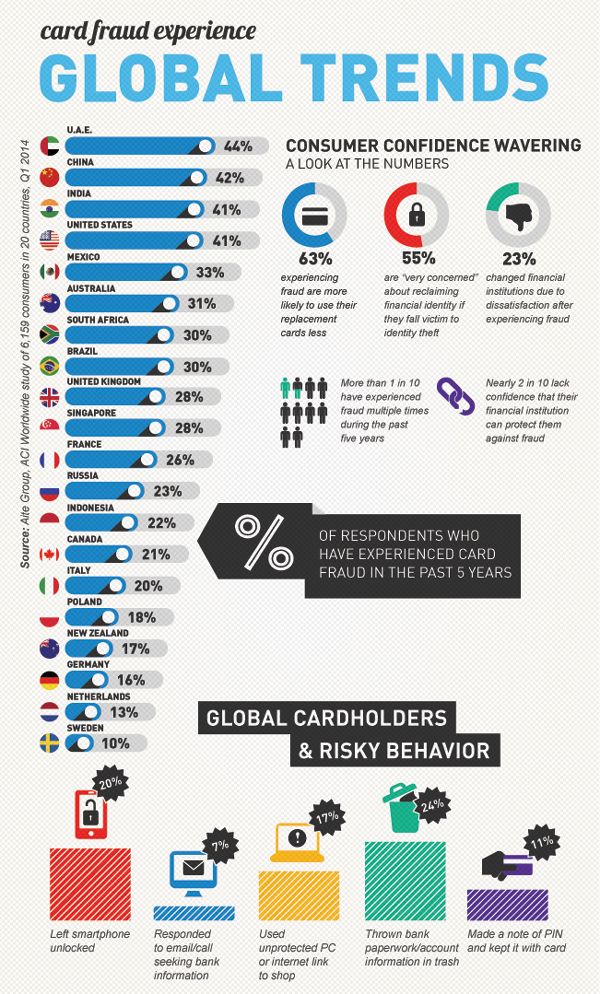

U.A.E. tops list of countries with highest rate of fraud overall, followed closely by China, India and the U.S., in latest ACI Worldwide Global Consumer Fraud Survey

A global fraud study of more than 6,100 consumers across 20 countries revealed that one in four consumers is a victim of card fraud in the last five years. The study, conducted by ACI Worldwide(NASDAQ: ACIW) and Aite Group, also highlighted that 23 percent of consumers changed financial institutions due to dissatisfaction after experiencing fraud.

Card fraud is comprised of unauthorised activity on three types of payment cards—debit, credit and prepaid. Cardholders experience fraud at very different rates around the globe, and each type of card has unique fraud challenges. The U.A.E. has the highest rate of fraud overall at 44 percent, followed by China at 42 percent and India and the United States at 41 percent each.

“Given this latest data, financial institutions have their work cut out for them, both in terms of educational and preventative measures,” said Shirley Inscoe, senior analyst, Aite Group. “Consumers lack confidence in their bank’s ability to protect them from fraud, so banks must remain vigilant in their fraud migration efforts or face increased customer attrition.”

Confidence wavering in the face of fraud

With 1,367 confirmed data breaches [1] in 2013 alone, the security of the financial services value chain is top-of-mind. As organised fraud rings relentlessly develop new methods of stealing funds and identities, consumers are increasingly losing confidence that there is anything that can be done to reverse this downward spiral.

“Consumers are increasingly concerned about fraud, and are losing confidence on a variety of levels,” said Mike Braatz, senior vice president, Payments Risk Management Solutions, ACI Worldwide. “They are unsure that their financial institutions can protect them against fraud; they use replacement cards less often due to a loss of confidence in the card or card issuer, after experiencing fraud; and post-fraud, they often change providers or their cards go to back of wallet. This has immediate and long-term implications on customer loyalty, revenue and fee income.”

A detailed analysis of the 2014 Global Consumer Fraud Report will be presented via webinar on June 26 at 10:00am ET. To register for the webinar and receive a complimentary copy of the two-part report, please click here or visit www.aciworldwide.com/2014fraudsurvey.

1. Verizon, 2014 Data Breach Investigations Report, http://www.verizonenterprise.com/DBIR/2014/

Explore more articles in the Top Stories category