GLOBAL WEALTH MANAGEMENT M&A ACTIVITY QUICKENS AS VALUATIONS DIP; IN 2013 NEARLY USD 0.76 TRN IN HNW ASSETS CHANGES HANDS THROUGH DEALS

Published by Gbaf News

Posted on December 18, 2013

10 min readLast updated: January 22, 2026

Published by Gbaf News

Posted on December 18, 2013

10 min readLast updated: January 22, 2026

The pace of global wealth management consolidation activity appears to have reached a fever pitch in various markets with over USD8 billion being spent on deals involving private client assets this year. This is the conclusion based on the latest analysis of industry M&A prepared by Scorpio Partnership, the strategic research and intelligence experts in global wealth management.

In 2013, over 60 deals occurred with the valuation average price: AuM ratio sliding to 1.22%. Crucially, the volume of assets changing hands in 2013 reached USD760 billion as the year reached its close. This figure is 43% of all assets that have been acquired through M&A for all deals tracked since 2008. “The M&A tempo has reached a new level. Most deals appear to be pursuing scale with the cost of doing business surging for many while the income levels are still under pressure. Notably, with valuations falling to a record low, we have seen more private equity firms taking active stakes in the market. Having analysed the financials of the operating models we expect the M&A pace to be high in 2014. The question these findings raise is: how much further can M&A valuations actually fall? Our view is that 1.22% may be running close to the baseline with some higher quality deals still securing a premium.” said Sebastian Dovey, managing partner.

These findings are drawn from the latest Wealth Management Deal Tracker from Scorpio Partnership which is to be released this month. While focusing on the 2013 activity, the report also tracks a total of 236 wealth deals which took place from 2008. The study’s objective seeks to provide a gauge for the industry on the state of valuation trends in the sector along with analysis of cost benefit analysis of M&A.

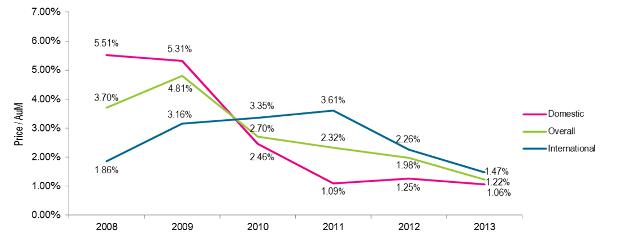

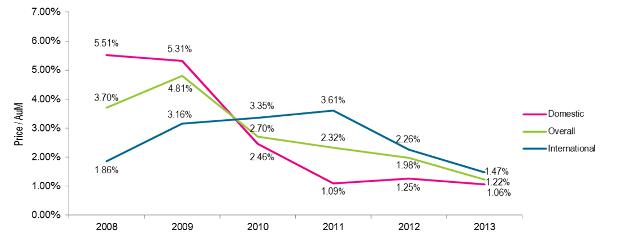

The report analysis uncovered the ongoing pricing differential between international cross-border deals and domestic onshore deals. Over the last four years, valuations were at their widest chasm in 2011 with international deals peaking at 3.61% and domestic prices falling to 1.09%. Two years later they converged to a price ratio spread of 1.06%-1.47%.

The pricing trend for wealth M&A including the price variance between international cross-border deals and domestic-market only deals (Note: % is a calculation of the Price / AuM ratio)

pricing trend for wealth M&A including the price variance between international cross-border deals and domestic-market only deals

Key findings from the global M&A wealth management industry:

The report covers 236 deals across a six year period from Q1 2008 to October 2013. The volume of HNW assets purchased through deals during this period totalled USD1.77 trillion of which USD0.76 trillion changed hands in 2013.

Regional assets volumes have markedly increased in the last year on the North American and European continents. 47.6% of all US AuM acquired in the last 6 years has occurred in 2013. Whereas 39.2% of all UK AuM acquired in the last 6 years has occurred in 2013.

The UK market is the most active deal country for 2013. At the time of this press release, 25 of the UK deals involved independent financial advisory (IFA) business models. The same pressures which are having an impact on the UK’s market are influencing other markets as well; compliance, consolidation and aggressive expansion.

The average AuM acquired per deal over the 6 year period was USD11.74 billion. In APAC this was USD17.9 billion and in North America this was USD16.1 billion per deal.

ABOUT THE 2014 WEALTH MANAGEMENT M&A DEAL TRACKER

The release above is encompassed in the 2014 M&A Dealtracker report which is due for release at the year end. This is the 3rd report in the series tracking deals in the wealth management industry. The report is available for purchase. Below is a selective list of the analytical tables in the report.

|

Selection of tables and charts from the 2013 Wealth Management Deal Tracker |

|

1 Price / AuM ratio: 2008 – 2013 |

|

2 Total global deals: 2008 – 2013 |

|

3 Total global wealth assets acquired through deals: 2008 – 2013 |

|

4 Average global wealth assets acquired through deals: 2008 – 2013 |

|

5 Distribution of deal strategies by business model: 2008 – 2013 |

|

6 Total UK deals : 2008 – 2013 and 2013 |

|

7 Clients and AuM acquired |

|

8 Average assets per deal: 2008 – 2013 |

|

9 International and Domestic Price / AUM: 2008 – 2013 |

|

10 Regional distribution of deals |

Scorpio Partnership is pleased to offer the full report for purchase in either PDF or print format.

Details of the report are available on the Scorpio Partnership website. Please note, the figures listed in this press release encompass deals until the end of October 2013. The full report will include M&A activity data until year-end 2013.

About Perpetual Wealth Systems

Perpetual Wealth Systems is a vanguard wealth strategy company that specializes in showing people and businesses non-traditional ways to grow and protect wealth. They are based out of Clinton Township, Michigan but have clients in dozens of states and Canada.

Perpetual Wealth Systems services a unique sector of the investment and insurance worlds. Their best clients are people not happy with the traditional financial vehicles and want to explore the possibility of reallocation of assets into guaranteed vehicles as well as non guaranteed programs. They help people invest in real estate, private loans, private notes, tax deeds as well as help people and businesses set up their own private banks and private pension systems.

The pace of global wealth management consolidation activity appears to have reached a fever pitch in various markets with over USD8 billion being spent on deals involving private client assets this year. This is the conclusion based on the latest analysis of industry M&A prepared by Scorpio Partnership, the strategic research and intelligence experts in global wealth management.

In 2013, over 60 deals occurred with the valuation average price: AuM ratio sliding to 1.22%. Crucially, the volume of assets changing hands in 2013 reached USD760 billion as the year reached its close. This figure is 43% of all assets that have been acquired through M&A for all deals tracked since 2008. “The M&A tempo has reached a new level. Most deals appear to be pursuing scale with the cost of doing business surging for many while the income levels are still under pressure. Notably, with valuations falling to a record low, we have seen more private equity firms taking active stakes in the market. Having analysed the financials of the operating models we expect the M&A pace to be high in 2014. The question these findings raise is: how much further can M&A valuations actually fall? Our view is that 1.22% may be running close to the baseline with some higher quality deals still securing a premium.” said Sebastian Dovey, managing partner.

These findings are drawn from the latest Wealth Management Deal Tracker from Scorpio Partnership which is to be released this month. While focusing on the 2013 activity, the report also tracks a total of 236 wealth deals which took place from 2008. The study’s objective seeks to provide a gauge for the industry on the state of valuation trends in the sector along with analysis of cost benefit analysis of M&A.

The report analysis uncovered the ongoing pricing differential between international cross-border deals and domestic onshore deals. Over the last four years, valuations were at their widest chasm in 2011 with international deals peaking at 3.61% and domestic prices falling to 1.09%. Two years later they converged to a price ratio spread of 1.06%-1.47%.

The pricing trend for wealth M&A including the price variance between international cross-border deals and domestic-market only deals (Note: % is a calculation of the Price / AuM ratio)

pricing trend for wealth M&A including the price variance between international cross-border deals and domestic-market only deals

Key findings from the global M&A wealth management industry:

The report covers 236 deals across a six year period from Q1 2008 to October 2013. The volume of HNW assets purchased through deals during this period totalled USD1.77 trillion of which USD0.76 trillion changed hands in 2013.

Regional assets volumes have markedly increased in the last year on the North American and European continents. 47.6% of all US AuM acquired in the last 6 years has occurred in 2013. Whereas 39.2% of all UK AuM acquired in the last 6 years has occurred in 2013.

The UK market is the most active deal country for 2013. At the time of this press release, 25 of the UK deals involved independent financial advisory (IFA) business models. The same pressures which are having an impact on the UK’s market are influencing other markets as well; compliance, consolidation and aggressive expansion.

The average AuM acquired per deal over the 6 year period was USD11.74 billion. In APAC this was USD17.9 billion and in North America this was USD16.1 billion per deal.

ABOUT THE 2014 WEALTH MANAGEMENT M&A DEAL TRACKER

The release above is encompassed in the 2014 M&A Dealtracker report which is due for release at the year end. This is the 3rd report in the series tracking deals in the wealth management industry. The report is available for purchase. Below is a selective list of the analytical tables in the report.

Selection of tables and charts from the 2013 Wealth Management Deal Tracker |

1 Price / AuM ratio: 2008 – 2013 |

2 Total global deals: 2008 – 2013 |

3 Total global wealth assets acquired through deals: 2008 – 2013 |

4 Average global wealth assets acquired through deals: 2008 – 2013 |

5 Distribution of deal strategies by business model: 2008 – 2013 |

6 Total UK deals : 2008 – 2013 and 2013 |

7 Clients and AuM acquired |

8 Average assets per deal: 2008 – 2013 |

9 International and Domestic Price / AUM: 2008 – 2013 |

10 Regional distribution of deals |

Scorpio Partnership is pleased to offer the full report for purchase in either PDF or print format.

Details of the report are available on the Scorpio Partnership website. Please note, the figures listed in this press release encompass deals until the end of October 2013. The full report will include M&A activity data until year-end 2013.

About Perpetual Wealth Systems

Perpetual Wealth Systems is a vanguard wealth strategy company that specializes in showing people and businesses non-traditional ways to grow and protect wealth. They are based out of Clinton Township, Michigan but have clients in dozens of states and Canada.

Perpetual Wealth Systems services a unique sector of the investment and insurance worlds. Their best clients are people not happy with the traditional financial vehicles and want to explore the possibility of reallocation of assets into guaranteed vehicles as well as non guaranteed programs. They help people invest in real estate, private loans, private notes, tax deeds as well as help people and businesses set up their own private banks and private pension systems.

Explore more articles in the Top Stories category