FICO DATA: UK CONSUMERS’ SPENDING PER CREDIT CARD HITS 10-YEAR HIGH, WHILE DELINQUENCIES CONTINUE TO FALL

Published by Gbaf News

Posted on March 18, 2014

2 min readLast updated: January 22, 2026

Published by Gbaf News

Posted on March 18, 2014

2 min readLast updated: January 22, 2026

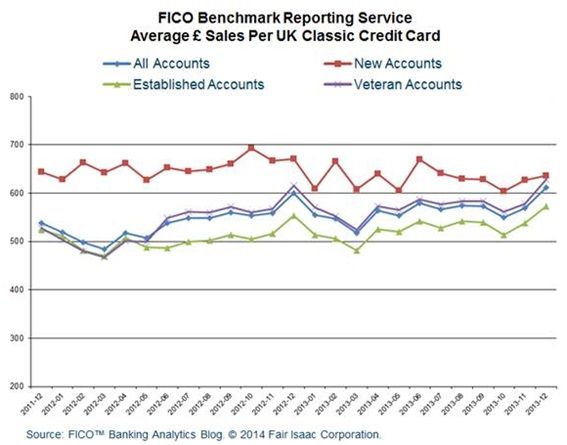

FICO (NYSE:FICO), a leading predictive analytics and decision management software company, released its quarterly UK cards data showing that average spend on “classic,” non-premium credit cards hit a 10-year high in December 2013. In addition, the proportion of classic UK credit cards with no delinquencies also hit a 10-year high.

FICO Data: UK Consumers’ Spending Per Credit Card Hits 10-Year High, While Delinquencies Continue To Fall

Data from the FICO® Benchmark Reporting Service show that sales per average card rose £74 to £612 between December 2011 and December 2013. Veteran accounts (open for at least five years) drove this growth, with average sales per card rising £101. In the same period, average sales grew by £46 for cards open less than five years, and fell by £35 for cards opened within the last year. Average sales per classic card hit their low point of £339 in September 2003.

Nearly 95 percent of classic cards were current (no delinquencies) in December 2013. For 2011, the figure was just over 93 percent.

“UK consumers are fuelling the economic recovery and card trends bear this out,” said Stacey West, a Fair Isaac® Advisors business consultant who works with UK card issuers. “Positive results for delinquency measures and payments to balance indicate that cardholders with more mature accounts have renewed confidence in their ability to repay card balances. Our latest data shows a number of positive trends for both classic and premium cards.”

The FICO Benchmarking Reporting Service also showed positive trends for credit lines and payments. Average credit lines have risen to £4,364, their highest point since June 2009. Cardholders are paying off more of their balance each month, with the percentage of payments to balance rising from 23.4 percent in December 2011 to 27.5 percent in December 2013.

The FICO Benchmarking Reporting Service also showed positive trends for credit lines and payments. Average credit lines have risen to £4,364, their highest point since June 2009. Cardholders are paying off more of their balance each month, with the percentage of payments to balance rising from 23.4 percent in December 2011 to 27.5 percent in December 2013.

Explore more articles in the Top Stories category