FICC PAIN FORCES I-BANK MOVES

Published by Gbaf News

Posted on May 29, 2014

3 min readLast updated: January 22, 2026

Published by Gbaf News

Posted on May 29, 2014

3 min readLast updated: January 22, 2026

By David Brierley and Salman Aleem Khan

It remains a painful conundrum for European and U.S. investment banks.

The ongoing downturn in fixed-income, commodities and currencies remains a critical challenge. This has been underlined by the actions of Barclays Plc, UBS AG, Royal Bank of Scotland Group Plc and Credit Suisse Group AGon the one hand, and Deutsche Bank AG on the other.

There appears to be no easy solution. Deutsche Bank, an exception among European banks, is committed to expansion funded by fresh capital while the others named have already curtailed their FICC business more or less radically and, indeed, could be looking to do more. Costs and personnel are being cut.

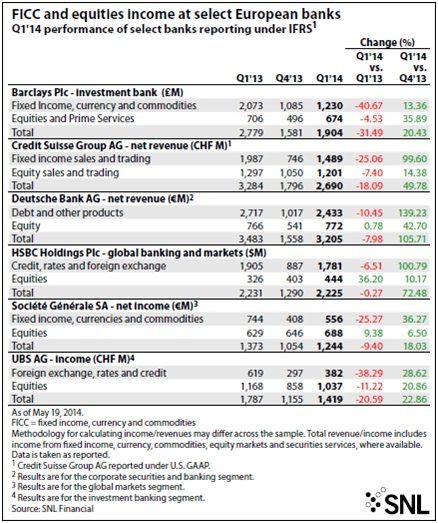

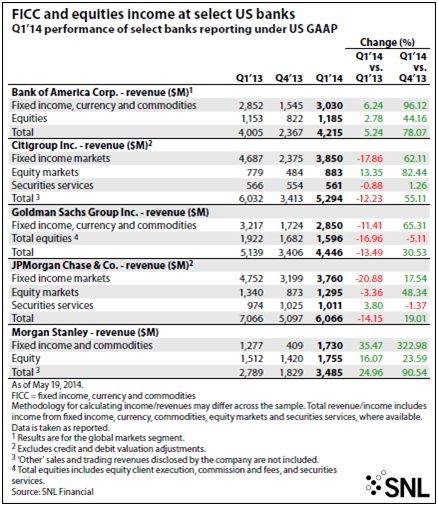

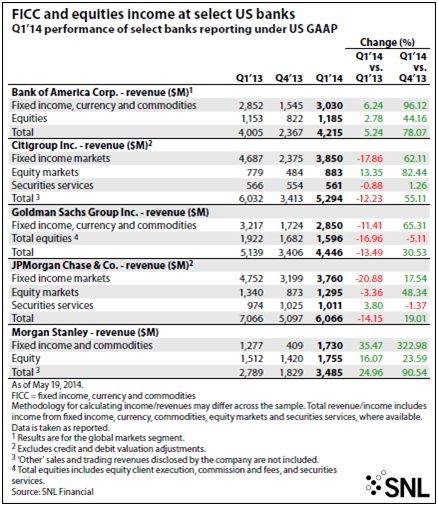

SNL Financial’s charts starkly reveal the issue. They present the performance of the leading European and U.S. investment banks in FICC and equities in the first quarter compared to the prior quarter and year-ago quarter. There is too much red and too little green. Revenues in FICC are declining sharply and they are not being offset by revenues from equities.

Moreover, the European banks are performing clearly worse than their U.S. peers, which are generally gaining market share.

However, not even JPMorgan Chase & Co., Goldman Sachs Group Inc. or Citigroup Inc. can be satisfied, given their double-digit year-over-year FICC declines in the first quarter — which crucially sets the tenor for the rest of 2014.

JPMorgan CFO Marianne Lake told analysts on the bank’s first-quarter earnings call April 11 that the downturn was due to “a whole bunch of different things,” including lower debt and mortgage issuance. CEO Jamie Dimon expressed confidence amid uncertainty about his company’s FICC operations: “Great business with great people, technology, sales, research, but we can’t predict it going forward. It will be what it is.”

Christian Bolu, an analyst at Credit Suisse, told SNL: “The U.S. banks seem to be there or thereabouts in terms of their structures. Morgan Stanley has already laid out its plan to get its fixed-income risk-weighted assets down to under $180 billion and Goldman Sachs is retooling its business but will remain a major player, and has significant operating leverage if the environment improves.” He added that Morgan Stanley remains committed to the business, but to one that is more flow-orientated and less capital-intensive.

Change is certainly happening among the U.S. investment banks. JPMorgan, along with many other banks, is exiting the commodities business; FICC is becoming FIC but it still does, in fact, embrace a wide range of differing businesses.

Correspondingly, the results are far from uniform.

For Morgan Stanley, strength in commodities was, as CFO Ruth Porat said on the firm’s call to discuss earnings, “a big driver” in the first quarter; corporate credit and mortgages were also strong areas. Bank of America Corp.enjoyed a good first quarter too, bucking the trend.

Generally, it is accepted that FICC markets were down about 20% in the first quarter — that was the view of Barclays CFO Tushar Morzaria, explaining to analysts why the bank, which is radically reducing its FICC business and exposures, saw a 40.7% year-over-year decline in the sector. He attributed 10% of the decline to restructuring, making its underlying quarterly performance worse, but not radically worse, than most of its European competitors.

Explore more articles in the Top Stories category