Endeavor nears deal to buy Vince McMahon’s WWE -sources

By Milana Vinn, Anirban Sen and Dawn Chmielewski

(Reuters) – Endeavor Group Holdings Inc, the parent of the popular UFC mixed martial arts franchise, is in advanced talks to acquire World Wrestling Entertainment Inc (WWE) in an all-stock deal, according to people familiar with the matter.

The sources requested anonymity because the matter is confidential. Endeavor and WWE did not immediately respond to requests for comment on Sunday.

The deal could be announced as early as this week, the sources said. Endeavor shareholders will own 51% of the combined company, while WWE shareholders would get 49%, the sources said.

WWE shares, which have risen more than 30% this year, closed at $91.26 on Friday, giving the company a market capitalization of $6.8 billion. Endeavor has a market value of $11.3 billion.

Endeavor is led by Hollywood power broker Ari Emanuel, who earlier this month declined to answer questions about a possible deal.

Emanuel has worked to transform Endeavor into a sports and entertainment powerhouse, making more than 20 acquisitions. His investments – in bull riding events, fashion shows and the Miami Open and Madrid Open tennis competitions – sought to diversify the company, which grew from a legacy rooted in representing film and television talent.

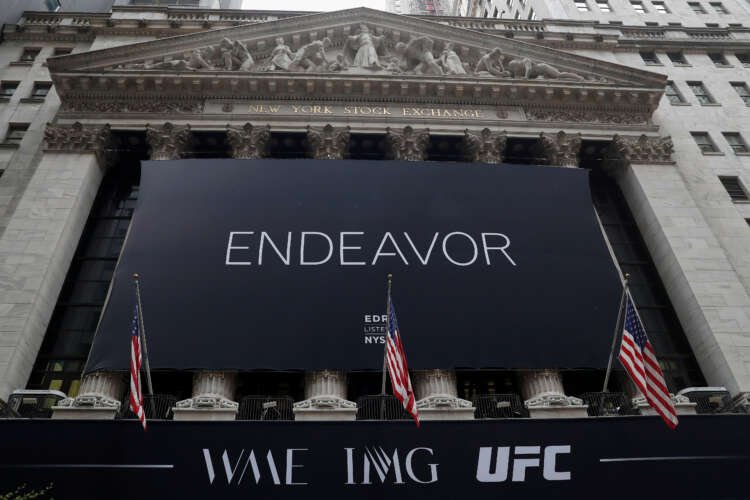

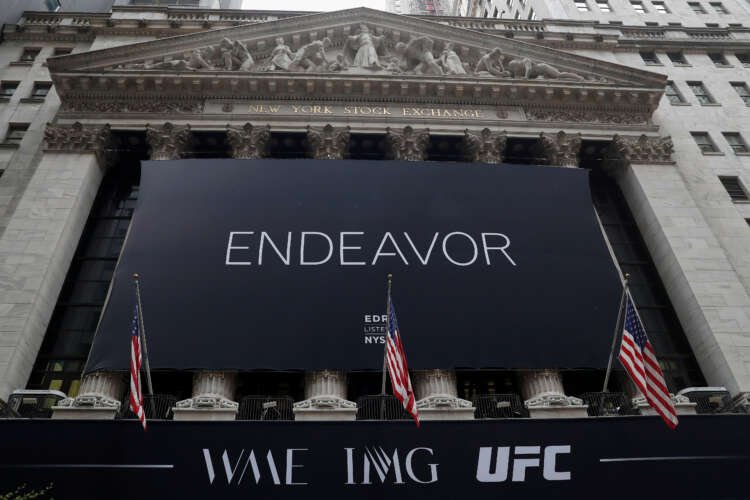

Endeavor took a majority holding in the Ultimate Fighting Championship, the world’s largest martial-arts organization, in 2016, in a $4.2 billion deal, and acquired the remaining stake in the company along with its IPO five years later.

In regulatory filings, Endeavor argues that it benefits from the rising value of owning a scarce – but popular – asset like sports.

In January, WWE said it would explore strategic options that could include a sale, shortly after Vince McMahon’s return to the company. WWE hired the Raine Group and law firm Kirkland & Ellis as its advisers for the review.

McMahon had retired in July last year as the company’s CEO and chair, following an investigation into his alleged misconduct. His daughter, Stephanie McMahon, resigned as the company’s co-CEO and chair less than a week after her father returned to the board.

Upon his return, McMahon, who holds a majority of the company’s stock, launched a strategic review, seeking to negotiate a sale before WWE’s media rights, including for programs such as “SmackDown,” came up for renegotiation, according to published reports.

(Reporting by Milana Vinn and Aniban Sen in New York and Dawn Chmielewski in Los Angeles; Editing by Matthew Lewis and Josie Kao)

A merger is a business combination where two companies join to form a single entity, often to enhance competitiveness, increase market share, or achieve economies of scale.

Market capitalization is the total market value of a company's outstanding shares, calculated by multiplying the stock price by the total number of shares. It reflects the company's size and market value.

An all-stock deal is a type of acquisition where the purchasing company uses its own stock as the currency to buy another company, rather than cash or other assets.

A strategic review is an assessment process conducted by a company to evaluate its business strategy, operations, and market position, often to identify potential improvements or changes.

A shareholder is an individual or entity that owns shares in a company, representing a claim on part of the company's assets and earnings. Shareholders can influence company decisions through voting rights.

Explore more articles in the Top Stories category