Drowning in Data, Financial Services and Insurance Industries Seek Technology and Talent to Close Global Insights Gap

Published by Gbaf News

Posted on November 21, 2019

6 min readLast updated: January 21, 2026

Published by Gbaf News

Posted on November 21, 2019

6 min readLast updated: January 21, 2026

Aite Group global study commissioned by TransUnion explores challenges faced by financial services and insurance industries, with UK executives showing strong appetite for talent and technology investment opportunities

Shail Deep

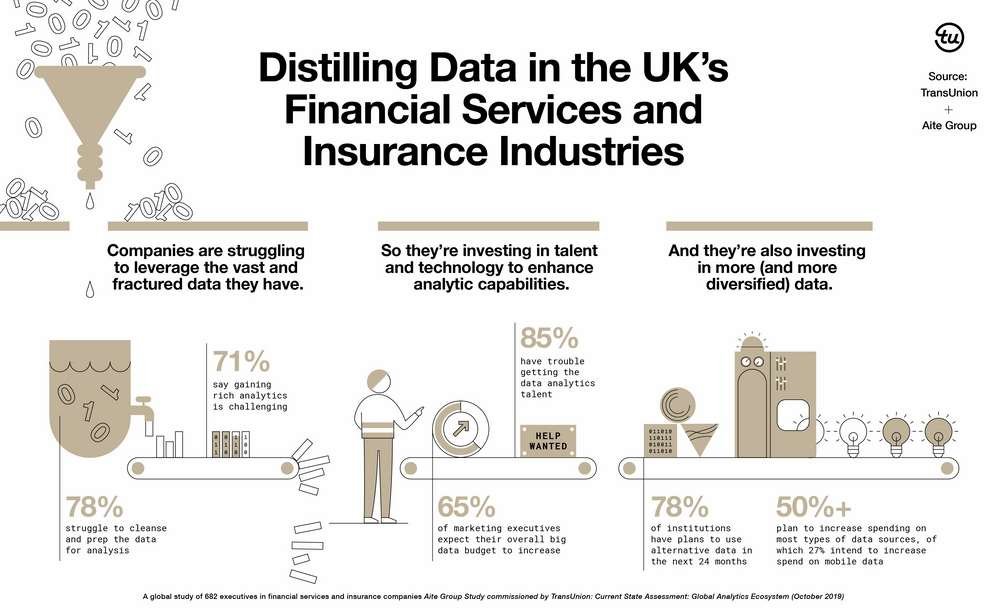

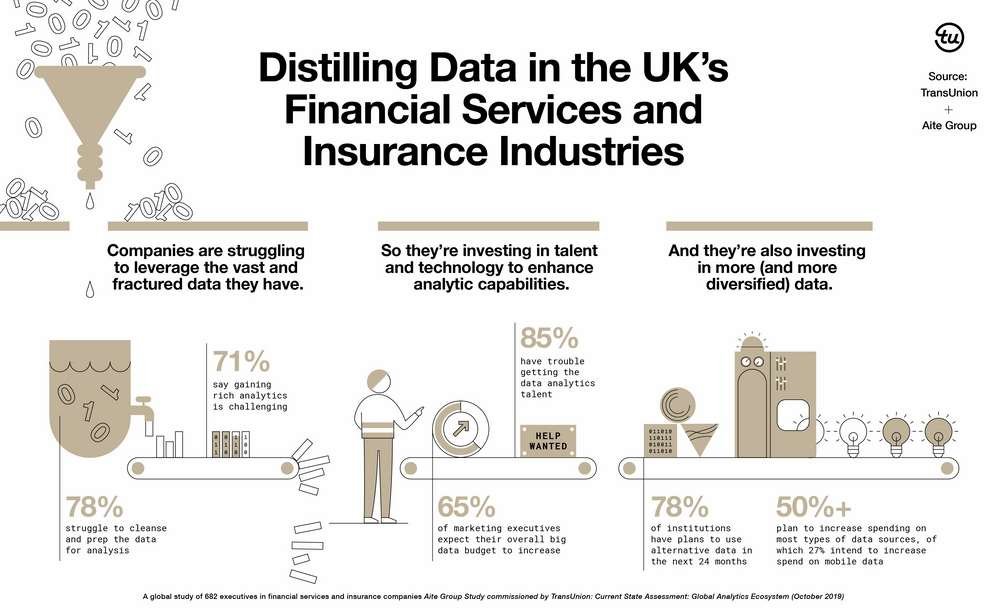

Across the globe, companies are amassing volumes of data with the intent of optimising performance, identifying trends and meeting rising consumer expectations. Yet nearly 75% of global financial services and insurance executives admit they are challenged by the fractured nature and vast amount of data available, citing rich analytics capabilities as difficult to achieve. In the UK alone, 71% of executives admit they are challenged by the immense data they have.

With these challenges in mind, a new Aite Group study commissioned by TransUnion found that executives in the financial services and insurance industries plan on continuing to secure more data sources. Furthermore, they look to incorporate more artificial intelligence (AI) and machine learning (ML) technology into their analytic platforms to help them make sense of the information.

The global study explored the existing analytical processes, tools, data sources and operational effectiveness of analytics solutions used by the financial services and insurance industries. The quantitative online survey recorded the feedback of 682 marketing and risk executives at financial institutions located in the UK, the US, Canada, Hong Kong and India, many of whom do business across the globe.

The study found that the proliferation of AI/ML is expected to continue over the next 24 months, with 68% of UK executives, and three in four globally, considering integrating new analytic technology into their platforms. There’s good reason for this implementation as AI and ML can shorten the traditional analytic lifecycle from months to just weeks or even days.

Shail Deep, chief product officer at TransUnion in the UK, commented: “The collection, use and management of data has never been more strategically critical to business operations than it is today. And this importance is only set to grow. However, with the variety of data sources becoming increasingly diverse, it’s unsurprising that more businesses are adopting machine learning and artificial intelligence as tools to help them improve their analytical processes. It’s only by correctly analysing the data that we can draw meaningful insights. Otherwise businesses face the risk of being saturated with information, yet not reaping the benefits that data can deliver.”

Help Wanted: Talent and Technology to Enhance Analytic Capabilities

To stay competitive in a data-rich world, companies need access to cutting-edge analytic solutions and data science expertise. However, the study found that inflexible legacy technology, talent shortages and regulatory barriers are among the factors that prevent businesses from harnessing the power of analytics with speed and ease.

“Most financial institutions lack a single, cohesive analytics platform,” said Tiffani Montez, senior analyst at Aite Group. “Firms may have vastly different data repositories and teams managing analytics functions, often leading to multiple approaches – by line of business, role and channel – across their institutions. To address these issues, many financial institutions are looking to centralise their data into a single platform that can quickly support change and integrate new data models.”

Enhancing analytic capabilities through AI/ML technology is a top priority globally, but with distinct differences across geographies. Specifically, 14% of global executives indicate they currently do not have any solutions that can implement AI/ML into analytical models. Slightly more UK executives (18%) indicate similar limitations. Globally, 66% of respondents – and a slightly lower number of UK respondents (58%) – believe this technology to be a major competitive differentiator.

The data scientist talent shortage is another pressing issue contributing to the global insights gap. As the volume of data has increased, the need for data science and analytics professionals has increased exponentially. Globally, 86% of respondents noted there are challenges with accessing the right data science and analytics talent. Similarly, 85% of UK responses cited the same challenge.

Analytics Challenges Across Regions

| Region | Percent of Respondents Stating that the Finding Data Science Talent is a Challenge | Percent of Respondents Stating that AI/ML is a Competitive Differentiator

| Percent of Respondents Stating that they have no AI/ML Analytical Models |

| United Kingdom | 85% | 58% | 18% |

| Canada | 82% | 58% | 7% |

| United States | 74% | 66% | 22% |

| Hong Kong | 88% | 62% | 14% |

| India | 97% | 78% | 13% |

| Total | 86% | 66% | 14% |

*The Aite Group Global Survey of Marketing and Risk Executives was conducted in Q3 2019.

To enable purposeful insights development, it is crucial for companies to streamline their processes and have closer alignment between the technical tools that are readily available and talent with specialised knowledge of turning data into insights. In the report, financial institutions noted they are increasing their investments in both talent and in analytics technology – but these firms are also greatly increasing their investments into another resource, more data.

Despite Challenges Surrounding Analytic Capabilities, Data Sources are Expected to Grow

Financial institutions have placed an increasing amount of influence on the value of expanding data sources. The desire to invest in data includes new sources such as non-traditional, third-party and alternative data among the banking and insurance communities. Over the next 24 months, 89% of institutions globally – and 78% of UK institutions have plans to use alternative data.

More than half of global respondents plan to increase spending on most types of data sources with 65% intending to increase spending on newer forms of data such as mobile information about web browsing and app usage. In the UK, this percentage was significantly lower at just over a quarter (27%) of respondents intending to use new forms of data. Yet, about one third (34%) of UK executives indicated that the integration of new data sources will be very important to their business strategies. It is the lack of the right tools that seems to pose one of many issues, as only 17% of UK firms can integrate new data sources across all of their analytic solutions.

UK Investment in Alternative Data Sources Expected to Increase Over the Next Two Years

| Alternative Data Source | Investment Increase of More than 15% | Investment Increase of 5% to 15% | Investment Increase of Less than 5% |

| Mobile Data (browsing, app usage, etc.) | 8% | 15% | 4% |

| Purchase (Spending) Data | 0% | 23% | 15% |

| Social Media Data | 10% | 14% | 20% |

| Transactional or Bank Account Data | 8% | 13% | 21% |

*The Aite Group Global Survey of Marketing and Risk Executives was conducted in Q3 2019.

The survey also found that in the UK, 65% of marketing executives and 67% of risk executives expect their overall budget for data analytics to increase year-over-year. This was lower than the global average of 78% and 70% respectively, yet still points to a significant investment in expanding the amount of data available despite ongoing challenges such as data cleansing and preparation, which 78% of UK respondents said can be challenging. Global executives found this similarly challenging at 76%. This is in addition to the larger operational issues such as cumbersome technology and the talent deficit.

To learn more about the state of analytics in the financial services and insurance industries, please access the full Aite Group and TransUnion report, Current State Assessment: Global Analytics Ecosystem. More information about TransUnion’s analytics solutions can be found here.

Explore more articles in the Top Stories category