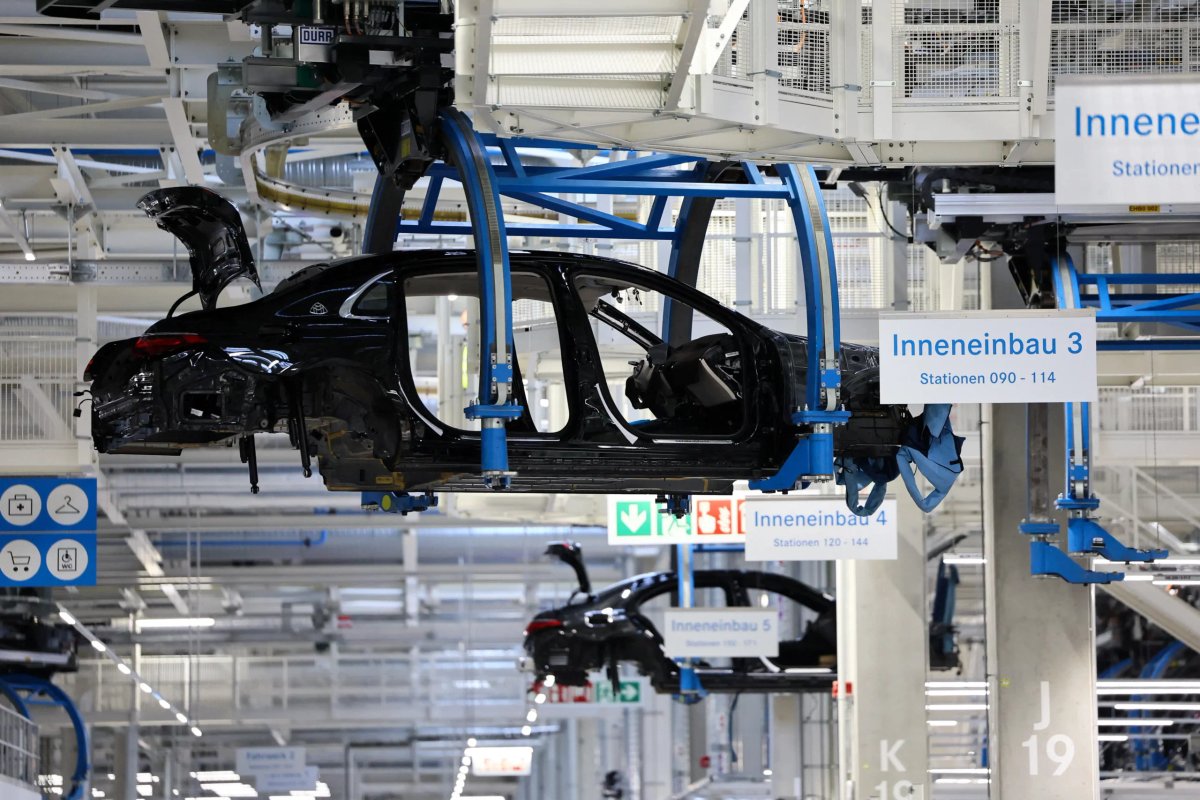

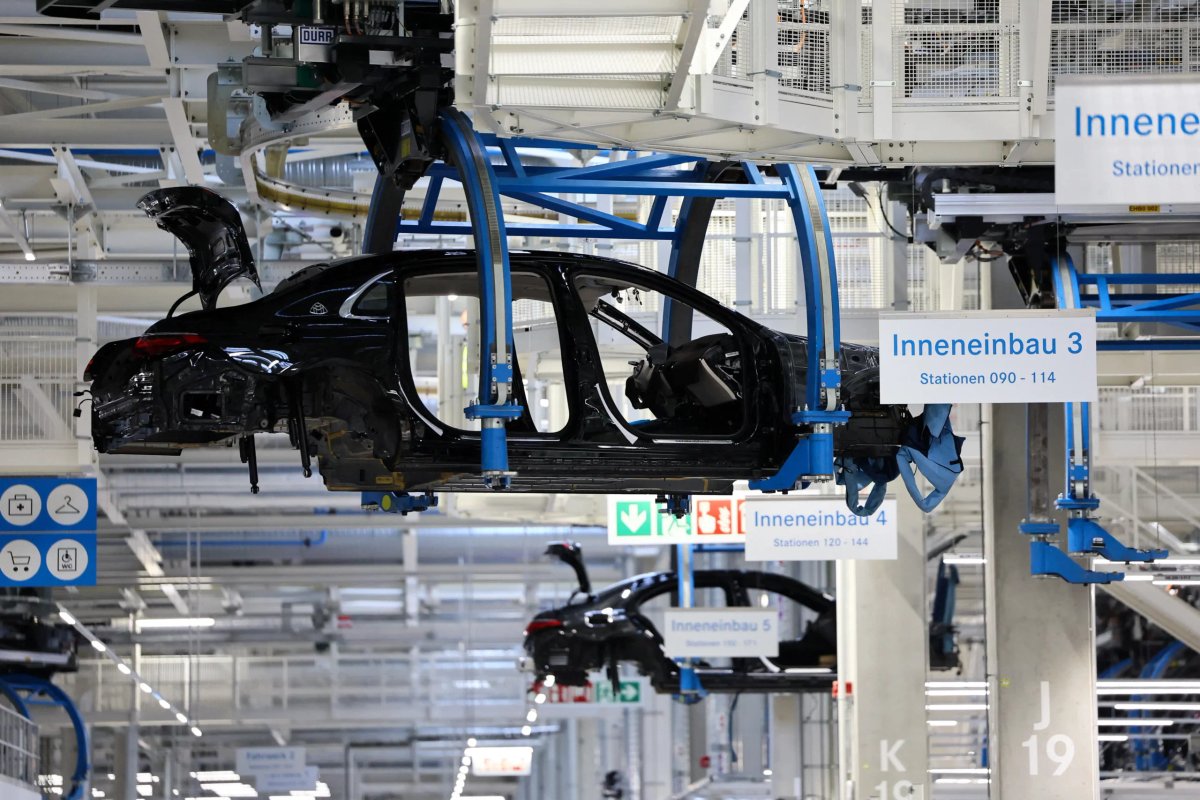

Downturn in German manufacturing may be bottoming out, PMI shows

BERLIN (Reuters) – The downturn in Germany’s manufacturing sector, which accounts for about a fifth of Europe’s biggest economy, showed signs of bottoming out in May as output and new orders declined at a much slower pace than the month before, a survey showed on Monday.

BERLIN (Reuters) – The downturn in Germany’s manufacturing sector, which accounts for about a fifth of Europe’s biggest economy, showed signs of bottoming out in May as output and new orders declined at a much slower pace than the month before, a survey showed on Monday.

The HCOB final Purchasing Managers’ Index (PMI) for German manufacturing rose to 45.4 in May from 42.5 in April, confirming a preliminary flash estimate and still below the 50 level that marks growth in activity.

The main boost came from new orders, which posted the weakest decline in two years in May, while the fall in output also softened to its slowest rate in more than a year.

“While not yet at an ideal point, there are signs of a turnaround,” said Cyrus de la Rubia, chief economist at Hamburg Commercial Bank.

“New orders are still declining, but it looks like we could see an increase in demand in the coming months after more than two years of drought,” he added.

This aligns with an accelerated decline in inventory levels, de la Rubia said, suggesting many firms had underestimated demand and had to draw from their stocks of finished products and intermediate goods.

“Additionally, the fact that delivery times are not shortening as quickly as in the previous two months suggests a less severe demand situation,” he added.

Although firms continued to show a willingness to reduce staff, indicating a lack of pressure on operating capacity, for an 11th consecutive month, optimism about growth prospects in the next 12 months rose to its highest since February 2022.

Surveyed companies cited hopes of a rebound in investment and demand helped by lower interest rates.

(Reporting by Miranda Murray; Editing by Susan Fenton)

New orders in manufacturing refer to the total number of new contracts or requests for products that manufacturers receive during a specific period, indicating future production levels.

Inventory level in manufacturing refers to the amount of goods and materials that a company has on hand at any given time, which affects production and sales.

Explore more articles in the Top Stories category