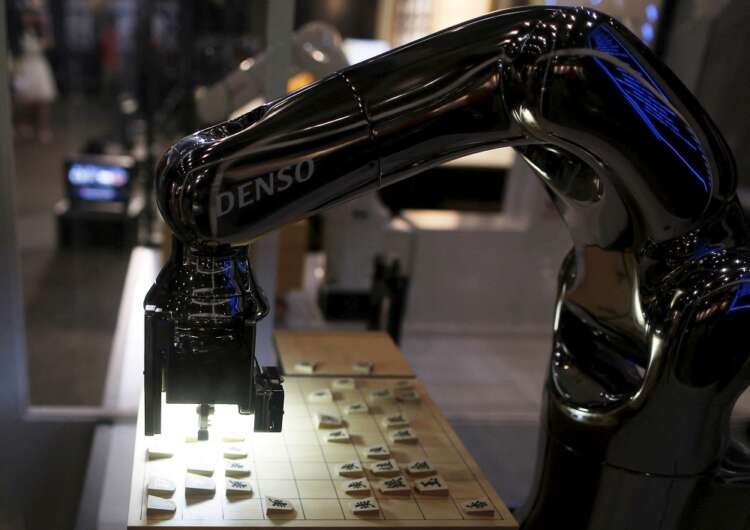

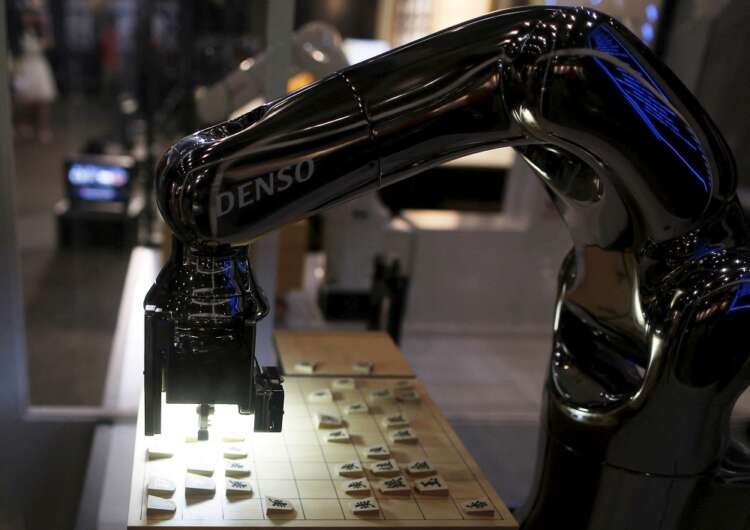

Denso bullish on business prospects as it tackles chip shortages

TOKYO (Reuters) – Denso Corp, Japan’s largest auto supplier, was bullish about its prospects in a

TOKYO (Reuters) – Denso Corp, Japan’s largest auto supplier, was bullish about its prospects in a business presentation on Wednesday as demand for automotive chips expands and it tackles semiconductor shortages that have frustrated Toyota Motor Corp, its biggest shareholder and customer.

Chief Technology Officer Yoshifumi Kato said Denso expects demand for auto chips to be around a third higher by 2025 than it was in 2020, as the key component is increasingly used in fossil-fuel cars, electric vehicles and autonomous drive technology.

That growing demand has combined with COVID-19 pandemic supply-chain disruptions and increased competition for chips from consumer electronic makers to cause persistent shortages that have forced Toyota and other major carmakers to curb output even as car demand grows.

Toyota said last week that global production in April was 9.1% lower than a year earlier.

Denso, which specialises in vehicle air conditioning, power trains and automated driving systems, has responded to chip shortages with partnership deals aimed at securing access to key components.

In February it agreed to buy a 10% stake in a chip plant being built in Japan by Taiwan Semiconductor Manufacturing Co (TSMC) with Sony Group that will be producing 55,000 12-inch wafers a month from 2024.

That deal, Denso says, will help it procure microcontroller chips.

The plant on Kyushu island, which Japan’s government is helping build as part of a strategy to avoid component shortages that could hurt economic growth, will also make chips for a nearby Sony image sensor factory.

In April, Denso also said it would collaborate with United Microelectronics Corp to produce semiconductor wafers in Japan in order to bolster production of power and analog chips.

Denso forecast on Wednesday that sales of those in-house semiconductors would grow by a fifth to 500 billion yen ($3.9 billion) in 2025.

($1 = 129.2300 yen)

(Reporting by Tim Kelly; Editing by Jacqueline Wong)

Automotive chip demand refers to the need for semiconductor components used in vehicles, which are critical for various functions, including engine control, safety systems, and infotainment.

Supply chain disruption occurs when there is a significant interruption in the flow of goods or services, affecting production and delivery. This can be caused by various factors, including natural disasters or pandemics.

A microcontroller chip is a compact integrated circuit designed to govern a specific operation in an embedded system. They are commonly used in automotive applications for controlling various functions.

A partnership in business is a formal arrangement where two or more parties agree to manage and operate a business together, sharing profits, losses, and responsibilities.

Explore more articles in the Top Stories category