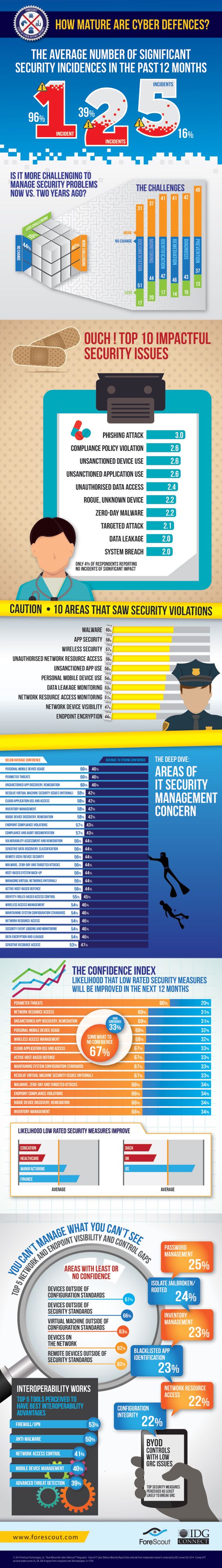

CYBER SECURITY CONFIDENCE UNDERMINED BY CONTRADICTING INVESTMENTS AS 39 PERCENT OF IT ORGANISATIONS EXPERIENCED MORE THAN TWO SIGNIFICANT SECURITY INCIDENTS

Published by Gbaf News

Posted on July 18, 2014

5 min readLast updated: January 22, 2026

Published by Gbaf News

Posted on July 18, 2014

5 min readLast updated: January 22, 2026

ForeScout Technologies has announced the publication of its 2014 Cyber Defence Maturity Report, which is currently available for download at www.forescout.com/stateofdefense. Independent research for the report was conducted by IDG Connect, and offers key insights into the nature of security issues impacting organisations; the perceived maturity of process, controls and tools applied to preempt and contain exposures; the state of confidence in security operations; and the most likely areas for future improvement and investment. Survey respondents included 1600 IT information security decision makers in organisations of more than 500 employees, and spanning five industries in the U.S. and Europe.

Key findings of the report revealed that more than 96 percent of organisations experienced a significant IT security incident in the past year. The majority of IT organisations are aware that some of their security measures are immature or ineffective, but only 33 percent have high confidence that their organisations will improve their less mature security controls. Also evident in the results, increasing operational complexity and threat landscape have affected security capacity as more than 43 percent perceive problem prevention, identification, diagnosis and remediation are more challenging than two years ago. On aggregate, one in six organisations had five or more significant security incidents in the past 12 months. While confidence in IT security management appears optimistic, overall findings showed a contradiction in efficacy and likely investment compared to where incidents have been most impactful.

The full report and infographic can be downloaded at www.forescout.com/stateofdefense. Further regional and industry comparative differences will also be made available. Join IDG Connect and ForeScout on 31st July at 4:00 PM BST as they share research findings in a live webcast entitled “IT Cyber Defence – Progress and Denial” at www.forescout.com/sodwebcast.

Finding Highlights

The need to improve security management is evidenced by the growing number of industry and regulatory compliance frameworks specifying security measures and how sensitive information is protected both on and off-premise. Network complexity, exposure diversity and threat velocity are challenging security operations. But organisations don’t know where they stand and where they are going without a baseline. The survey, conducted and compiled by IDG Connect during May and June of 2014, illustrates the nature of security threats and the extent of defence maturity arrayed against organisations with more than 500 employees in the finance, manufacturing, healthcare, retail and education sectors in the U.S., U.K, Germany, Austria and Switzerland.

While the complete 2014 Cyber Defence Maturity Report offers more extensive data, analysis and inference, survey highlight results are:

Industry and Regional Highlights

“We are pleased to sponsor the 2014 Cyber Defence Maturity Report conducted by IDG Connect. The findings provide a useful snapshot of the state of exposures, controls and investment across global regions and industries,” said Scott Gordon, chief marketing officer at ForeScout. “The independent research clearly validates the need for continuous monitoring, intelligence and mitigation capabilities which are exemplified in ForeScout’s pervasive networks security solutions.”

Explore more articles in the Technology category