Central banks start turning off the cash taps

Published by Jessica Weisman-Pitts

Posted on January 13, 2022

4 min readLast updated: January 28, 2026

Published by Jessica Weisman-Pitts

Posted on January 13, 2022

4 min readLast updated: January 28, 2026

Central banks are signaling a shift from pandemic stimulus, with potential quantitative tightening and interest rate hikes impacting global markets.

By Tommy Wilkes

LONDON (Reuters) – As speculation grows about when the Federal Reserve will begin reducing the size of its balance sheet, some analysts say the era of “quantitative tightening” has already started.

Central bank balance sheets ballooned after the pandemic struck in 2020, but with economies rebounding and inflation soaring above target, central bankers are preparing markets for a reversal to their bond-buying stimulus.

Below are a series of graphics laying out the scale of central bank stimulus and what might happen next.

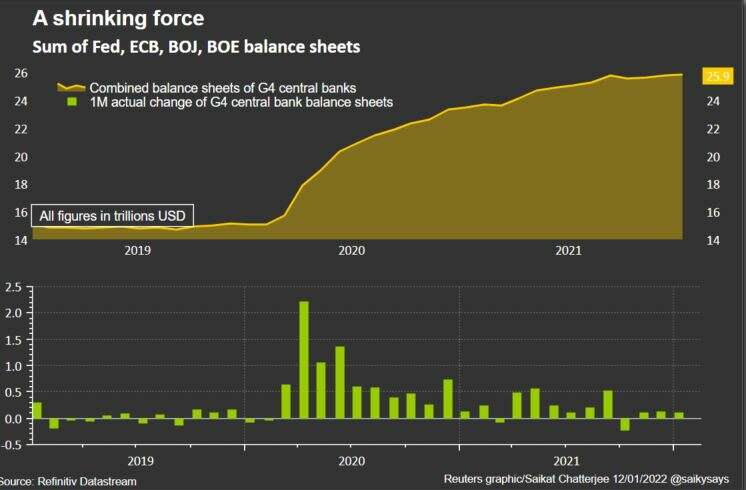

SLOWING, THEN SHRINKING

Markets tumbled this month at the prospect of the Fed hiking interest rates as early as March with quantitative tightening — a shrinking of its $8.8 trillion balance sheet after it doubled in size during the pandemic — following afterwards.

Still, other central banks such as the European Central Bank are likely to keep adding to global liquidity this year, offsetting some of that tightening.

That means that while the rate of expansion in the overall central bank liquidity pool has been slowing since mid-2021, an outright reduction of balance sheets is not expected until late-2022 or even 2023.

(Graphic: Global central bank stimulus – https://fingfx.thomsonreuters.com/gfx/mkt/gdpzykbekvw/cbank%20sheet.JPG)

BofA strategists expect major central bank balance sheets to stabilise rather than shrink in 2022, although as a percentage of GDP they estimate the major central banks will see a decline versus 2021 levels.

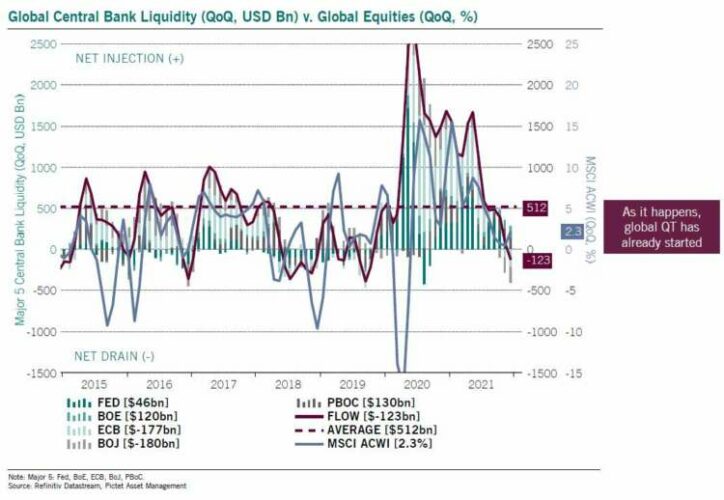

Steve Donzé, senior macro strategist at Pictet Asset Management, estimates the Fed, ECB-POLICY-KAZIMIR-00b06d9b-4b99-46ce-a2aa-458d8eb2d993>ECB-POLICY-CENTENO-a52f21b9-8975-4dc5-9a21-8c5e8267aa43>ECB-POLICY-KAZIMIR-00b06d9b-4b99-46ce-a2aa-458d8eb2d993>ECB-POLICY-3fdc7763-f2c0-4c30-b494-8614852eaf43>ECB-POLICY-KAZIMIR-00b06d9b-4b99-46ce-a2aa-458d8eb2d993>ECB-POLICY-CENTENO-a52f21b9-8975-4dc5-9a21-8c5e8267aa43>ECB-POLICY-KAZIMIR-00b06d9b-4b99-46ce-a2aa-458d8eb2d993>ECB, Bank of Japan, Bank of England, People’s Bank of China and the Swiss National Bank will collectively expand their balance sheets by $600 billion in 2022 — far below the post-financial crisis average of $1.8 trillion and 2021’s $2.6 trillion, but still a net addition.

However, he says that the $600 billion forecast could turn negative if the Fed tightens faster than anticipated today.

And a stronger dollar meant that for global investors, the five biggest central banks actually withdrew more stimulus in the three months to the end of December than they injected versus the preceding three months — the first quarter-on-quarter reduction since before the pandemic, according to his calculations.

(Graphic: Central bank liquidity flows-https://fingfx.thomsonreuters.com/gfx/mkt/klvykqbawvg/pictet%20global%20liquidity.PNG)

Donzé reckons Fed tightening, driven by the end of quantitative easing, rate hikes and then QT, will result in a 4.7 percentage point rise in a U.S. “shadow” real policy rate to -1.8% by the end of 2022.

This shadow rate rose 6 percentage points during the last tightening cycle, but that was over five years, between 2014 and 2019.

FLOWS NOT LEVELS

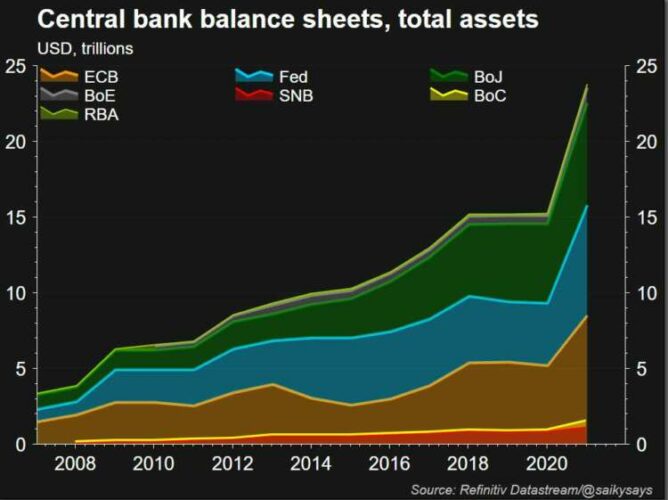

With central bank balance sheets towering above a huge $25 trillion, many observers say that even after some tightening liquidity will remain plentiful and rates historically low.

(Graphic: Central bank balance sheets, total assets – https://fingfx.thomsonreuters.com/gfx/mkt/akvezexqwpr/cenbank%20balance%20sheets.PNG)

Yet it’s the direction of travel that matters for markets pumped up on cheap cash.

Negative inflation-adjusted bond yields suggest the party will continue but as Citi’s Matt King notes central bank stimulus flows are falling fast and “markets follow flows, not levels”.

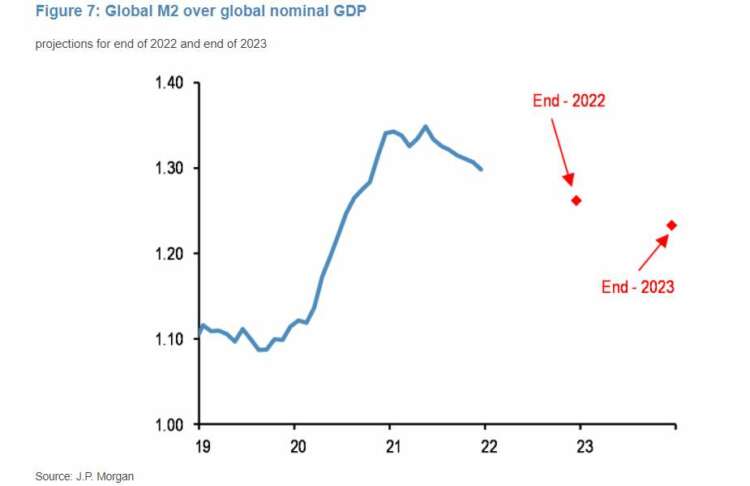

JP Morgan strategists point out that excess money supply — the balance of gross money supply versus money demand — has been falling since May by one measure, and the decline in “excess liquidity” is set to accelerate this year.

(Graphic: Excess money supply – https://fingfx.thomsonreuters.com/gfx/mkt/jnpwejbmlpw/jpm%20money%20supply%20chart.PNG)

They also calculate that money supply growth will decline from a $7.5 trillion per annum pace in 2021 to $4.5 trillion in 2022 and $3 trillion in 2023 — a level last seen in 2010.

(Editing by Saikat Chatterjee and Hugh Lawson)

The article discusses central banks beginning to reverse pandemic-era stimulus through quantitative tightening and interest rate hikes.

The reduction in liquidity and potential interest rate hikes could lead to market volatility and impact global financial conditions.

While balance sheet expansion is slowing, outright reductions are not expected until late 2022 or 2023, with some stabilization in 2022.

Explore more articles in the Banking category