Business Intelligence and the banks of tomorrow

Published by Gbaf News

Posted on February 12, 2013

3 min readLast updated: January 22, 2026

Published by Gbaf News

Posted on February 12, 2013

3 min readLast updated: January 22, 2026

Francois Ajenstat, director of product management at Tableau Software, explains how Business Intelligence tools could give banks the power to boost customer retention.

According to the results of a recent survey from Which?, the UK’s biggest banks remain among the worst for customer satisfaction and service. Despite the vast amounts of customer data stored by these institutions increasing exponentially, they are failing to use it to their advantage. It’s clear that a change is needed and a new generation of Business Intelligence (BI) tools could be an answer.

Now, more than ever, it’s important that banks of all sizes recognise the value of the customer data at their fingertips. New data sources from online banking, ATMs and ecommerce applications has asked a number of questions for these institutions about how they can get value from them. Historically, turning this information into a format that is easy to see and understand has been the toughest part of the puzzle. After all, existing methods of data analysis are not only slow and cumbersome for employees to use, but are also rarely flexible enough to cope with the demands placed on it.

However, by using today’s software, employees at every level in the bank can free themselves from the restraints of these out-dated processes and gain tangible value from their data. BI tools can also allow staff to be more effective by helping them to analyse and explore their data. They can also help banks can provide a more accurate view into their customers and their banking needs, and can guide new products and services.

It’s important to remember that the benefits BI tools can bring banks aren’t just restricted to improving internal operations. By allowing analysis of data, banks can also enhance their competitive edge by improving their ability to make decisions quickly and effectively. Customers and their needs are constantly changing, and so it’s vital that banks are able to respond to opportunities as quickly as they arise. By making data-driven decisions that are based on analysis of a flow of data as it happens in real-time, customers are likely to be more satisfied, and as a result, could significantly impact on the bottom line of any retail bank.

Similarly, intelligence about ATM deployment and management could help banks to identify areas of the country where customers are increasingly struggling with personal finance management. As a result, they can be far prepared to react quickly and place financial helpers in the appropriate branches to provide customers with the support and guidance that they need.

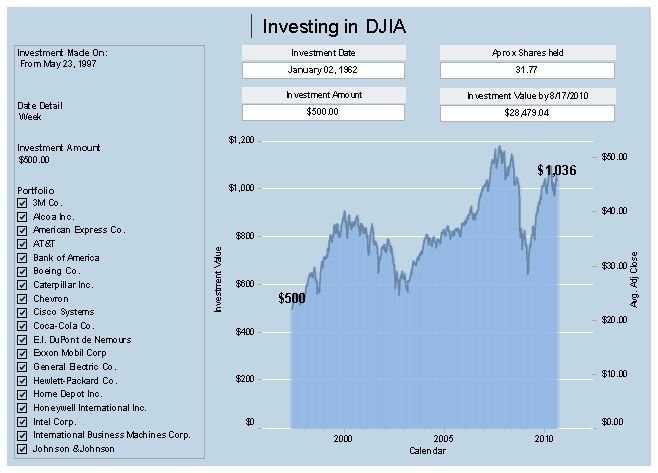

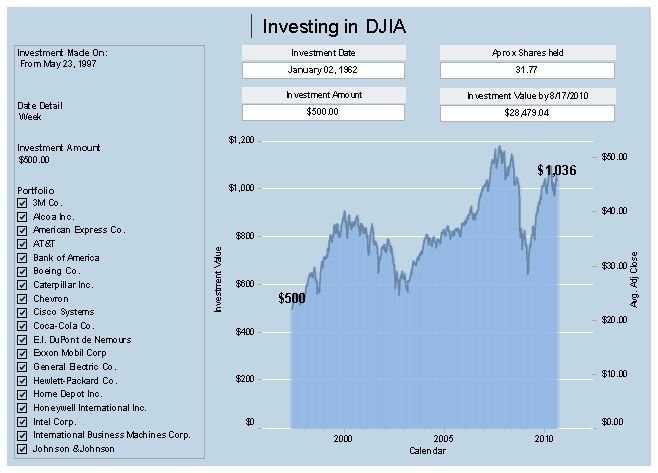

These business intelligence tools can provide sophisticated, highly visual and graphical online interactive data dashboards to gather real-time customer data on specific issues in a more engaging way. This makes it easier for employees to analyse data and spot important trends or any anomalies. These dashboards enable information to be shared securely with other employees or departments across the bank. This enables anyone with permissions to view and interact with each other’s dashboards to answer their own questions.

The banks of the future may find that shaking off their conservative image and embracing today’s fast, easy business intelligence is the key to staying ahead of the competition. They have an opportunity to offer a more relevant banking experience to customers by anticipating their needs, and there’s no doubt that data could provide the perfect solution!

Explore more articles in the Banking category