BANKING IS A RELATIONSHIP BUSINESS

Published by Gbaf News

Posted on July 12, 2014

4 min readLast updated: January 22, 2026

Published by Gbaf News

Posted on July 12, 2014

4 min readLast updated: January 22, 2026

The advance of digital and mobile banking has depersonalized the banking industry. But 50% of customers still visit the bank instead of or in addition to using banking software. Why? Linqto’s focus group research with banking customers reveals the primary reason for visiting the bank is trust in their bankers. It is not about the software. Banking is a relationship business.

Many bankers have 30 years of banking experience. No dropdown menu can include the knowledge of a banker who has been in the business for that long. Instead of closing physical branches why don’t we find a better use for them? A modern digital savvy one, for instance?

A REAL HUMAN, please!

A REAL HUMAN, please!

We can find house listings online today in any market we choose. Still, according to the National Association of Realtors, “From 1991 to 2011 the share of home sellers who used a real estate agent or broker to sell their home increased from 77 percent to 87 percent.”When our finances are invloved, we want the help of an expert.

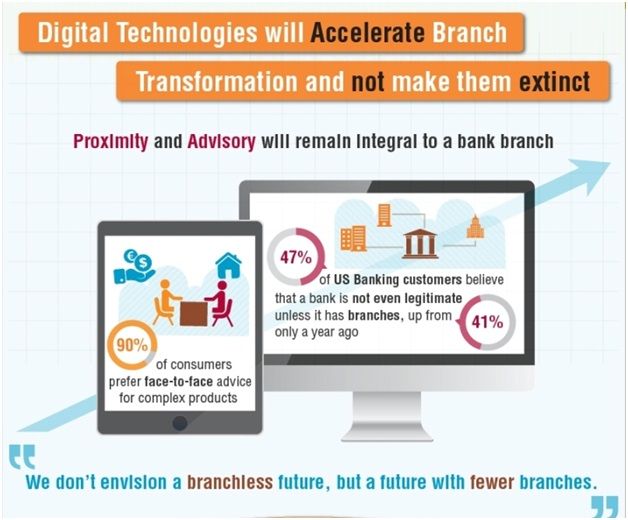

In the same way, banking digitally only addresses the transaction side of the industry. We still need the advice of our banker when making important financial decisions. There are two key facts to consider:

Source: Capgemini Consulting, The Future of Bank Branches

Source: Capgemini Consulting, The Future of Bank Branches

What do customers want?

Studies released by EFMA, McKinsey&Company and Capgemini Consulting reveal that:

So there is a spark between the branches and the customers that transcends spreadsheet analysis.

The future is face-to-face!

According to a recent American Banker article, a Sanford C. Bernstein report recommends regional and midsize banks close a significant number of branches throughout US.

This one-size-fits-all solution to cutting costs could be replaced by a more strategic approach, such as joining digital and brick-and-mortar into a new integrated banking strategy.

Bank employees shouldn’t see fast adoption of digital banking as a threat. The Internet is a new channel that gets them in touch with their customers. Branches and bank tellers are still valuable, even for high frequency banking activities, such as:

Bank employees shouldn’t see fast adoption of digital banking as a threat. The Internet is a new channel that gets them in touch with their customers. Branches and bank tellers are still valuable, even for high frequency banking activities, such as:

A bank teller’s education and experience cannot be erased. It should be refocused and re-channeled on other purposes, for instance advisory services.

Instead of closing branches, bankers can now capitalize on digital technology and use bank representatives’ knowledge, making it accessible for their clients. Utilizing the latest tools in digital banking, under-utilized personnel in remote locations can interact directly with customers in higher density locations.

Linqto’s Personal Banker is a software application that does just this by introducing a real-time video conversation with an actual, on-duty, banker into the financial transaction.

Whenever you use mobile or online banking and need the assistance of a bank representative, simply click the “My Banker” button available on your bank’s website or mobile app.

Linqto Personal Banker:

Read more about the Linqto Personal Banker.

ABOUT THE AUTHOR

Bill Sarris, CEO and Co-Founder of Linqto, Inc.

Bill Sarris, CEO and Co-Founder of Linqto, Inc.

Bill Sarris is a recognized expert in the field of streaming and collaborative technology and the inventor of Linqto technology. Bill has delivered major enterprise software applications for Microsoft, Intuit, Digital Insight, NCR, Google, Stanford and other clients. With over a decade of experience in financial services applications, digital and mobile banking, Bill’s work has received the Forrester Groundswell Award and he holds numerous software certifications.

Explore more articles in the Banking category