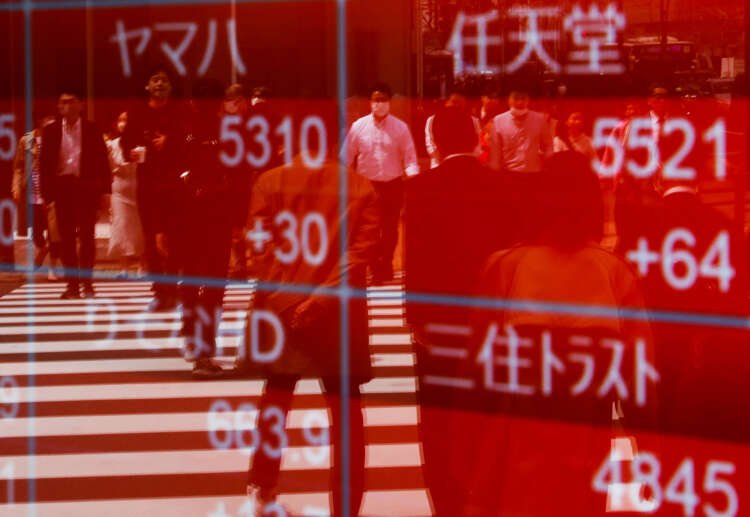

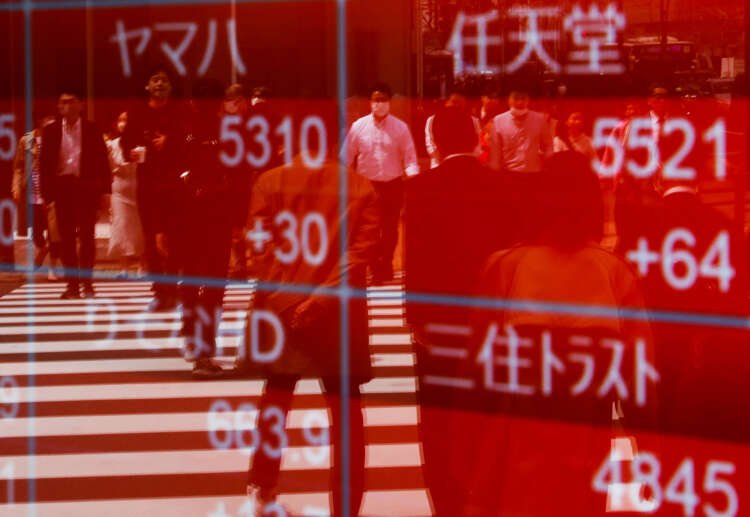

Asian stocks hit 9-month lows on worries over China, US rates

By Ankur Banerjee

SINGAPORE (Reuters) – Asian shares sank to nine-month lows on Thursday, while the dollar was at a two-month peak as fears over China’s sluggish economic recovery and concerns that the Federal Reserve may still raise interest rates rattled investors.

MSCI’s broadest index of Asia-Pacific shares outside Japan slid to 495.03, its lowest since Nov. 29, before clawing back some of its losses to trade 0.49% lower at 500.43. The index down about 8% for August and set for its worst monthly performance since September.

The dark mood is set to continue in Europe with Eurostoxx 50 futures down 0.51%, German DAX futures down 0.55% and FTSE futures 0.35% lower.

The pan-European STOXX 600 hit a fresh one-month low on Thursday, weighed down by luxury companies that are exposed to Chinese consumer demand.

China stocks have been in the doldrums in the past few weeks as a series of economic data has laid bare the stuttering post-pandemic recovery, with investors so far unimpressed with moves from policymakers and clamouring for more stimulus.

On Thursday, China’s blue-chip CSI 300 Index was flat, while Hong Kong’s Hang Seng Index was 0.12% lower after hitting a near nine-month low earlier in the session.

“I still think that there will be more action coming from policymakers,” Herald van der Linde, chief Asia equity strategist at HSBC, told the Reuters Global Markets Forum. “It just takes a bit of time.”

Van der Linde said the appetite to invest in China is very low. “And that appetite has to do with confidence, and that won’t change too quickly. It would be good if we would get some stimulus for consumers.”

Adding to the worrying landscape for the world’s second biggest economy is the deepening property sector crisis. Zhongzhi Enterprise Group on Thursday told investors it is facing a liquidity crisis and will conduct a debt restructuring, according to video footage of a meeting.

The move comes after Zhongrong International Trust Co, a leading trust company controlled by Zhongzhi, missed payments on dozens of investment products since the end of July, according to investor sources.

Overnight, Wall Street ended lower after minutes from the Fed’s July meeting showed officials were divided over the need for more interest rate hikes. [.N]

“Some participants” cited the risks to the economy of pushing rates too far even as “most” policymakers continued to prioritise the battle against inflation, the minutes showed.

The U.S. central bank hiked rates by 25 basis points at the July meeting after standing pat in June.

The commentary from officials, including the hawks suggest a willingness to pause again in September, but to leave the door ajar for a further hike at either November of December meetings, ING economists said in a note.

“We think the Fed will indeed leave interest rates unchanged in September, but we don’t think it will carry through with that final forecast hike,” they said, pointing out that further rate hikes could heighten the chances of recession.

Markets are pricing in an 86% chance of the Fed standing pat next month, CME FedWatch tool showed, with a 36% chance of it hiking in its November meeting.

Data showed U.S. single-family homebuilding surged in July and permits for future construction rose amid a shortage of previously owned houses in another sign of a resilient economy that has led economists to temper forecasts of a recession.

Fed staff, who present their own independently developed views of the economy to policymakers, dropped their projection for a recession later this year.

The cloudy outlook for interest rates helped lift Treasury yields. Benchmark 10-year yields reached 4.298% in Asian hours, the highest since Oct. 21, with a 16-year peak of 4.338% in sight. [US/]

The dollar index, which measures the U.S. currency against six rivals, scaled a two-month peak of 103.58 as investors sought safe assets. [FRX/]

The Japanese yen was at 146.40 per dollar after touching a fresh nine-month low of 146.57 earlier in the session, with traders keeping a vigil on possible intervention chatter from Japanese officials.

Finance Minister Shunichi Suzuki said on Tuesday authorities were not targeting absolute currency levels for intervention.

In commodities, oil prices dropped for the fourth straight session. U.S. crude fell 0.21% to $79.21 per barrel and Brent was at $83.37, down 0.1% on the day. [O/R]

The spike in rates has weighed on non-yielding gold, which touched a five-month low on Thursday. The metal was last $1,892.30 an ounce, having dropped to its weakest level since March 15 at $1,888.30. [GOL/]

(Reporting by Ankur Banerjee, additional reporting by Anosha Sircar in Bengaluru; Editing by Muralikumar Anantharaman and Sonali Paul)

Economic growth refers to the increase in the production of goods and services in an economy over a period of time, typically measured by the rise in Gross Domestic Product (GDP).

Interest rates are the cost of borrowing money or the return on savings, expressed as a percentage of the principal amount. They are influenced by central banks and economic conditions.

The stock market is a collection of markets where shares of publicly traded companies are bought and sold. It serves as a platform for companies to raise capital and for investors to buy ownership in companies.

Currency is a system of money in general use in a particular country or economic region, serving as a medium of exchange for goods and services.

A financial market is a marketplace where buyers and sellers engage in the trade of assets such as stocks, bonds, currencies, and derivatives.

Explore more articles in the Top Stories category