Asian shares muted as investors fret over China reopening

By Ankur Banerjee

SINGAPORE (Reuters) – Asian equities swung between losses and gains in choppy trading on Wednesday as investors looked for direction after China took further steps towards reopening its COVID-battered economy, with worries over an economic slowdown weighing on sentiment.

MSCI’s broadest index of Asia-Pacific shares outside Japan was up 0.12%, having slid as much as 0.5%. After having the best monthly performance in nearly 30 years in November, the index is flat for December with two days of trading left.

European stock futures indicated the stocks were set to fall, with the Eurostoxx 50 futures down 0.13%, German DAX futures down 0.05% and FTSE futures 0.24% higher.

China stocks were little changed, while the Hong Kong stock market rose 2%, encouraged by China’s announcement on Monday it would stop requiring inbound travellers to go into quarantine starting from Jan. 8.

A faster than anticipated peak of infection has stoked expectations that a quick economic recovery is on the cards but surging cases that are straining resources and putting hospitals under pressure has put a lid on investor enthusiasm.

Wall Street ended lower overnight as U.S. Treasury yields pressured interest-rate-sensitive growth shares.

Investors have been trying to gauge how high the Federal Reserve will need to raise rates as it tightens policy in its continuing battle against inflation while also trying to avoid tilting the economy into recession.

The yield on 10-year Treasury notes was down 1.1 basis points to 3.847%, hovering around the five-week high of 3.862% it touched in the previous session.

The yield on the 30-year Treasury bond was down 2.9 basis points to 3.914%, while the two-year U.S. Treasury yield, which typically moves in step with interest rate expectations, was down 1.7 basis points at 4.351%.

Meanwhile, Bank of Japan (BOJ) policymakers discussed growing prospects that higher wages could finally eradicate the risk of a return to deflation, a summary of opinions at their December meeting showed on Wednesday.

At the Dec. 19-20 meeting, the BOJ kept its ultra-easy policy but stunned markets with a tweak to its bond yield control policy, allowing long-term interest rates to rise more.

While markets have had growing expectations that the Japanese central bank is likely to change its policy, investor focus will likely zero in on who will lead the BOJ when Governor Haruhiko Kuroda steps down in April.

“We think once the new governor is appointed, then the policy review will follow in the second quarter of 2023,” ING economist Min Joo Kang said. Another tweak in the yield curve control policy was possible in the first half of 2023, and ING expected a rate hike in late 2023 or early 2024, she said.

“The spring salary negotiation next year is the most important to watch for further meaningful policy change for the Bank of Japan.”

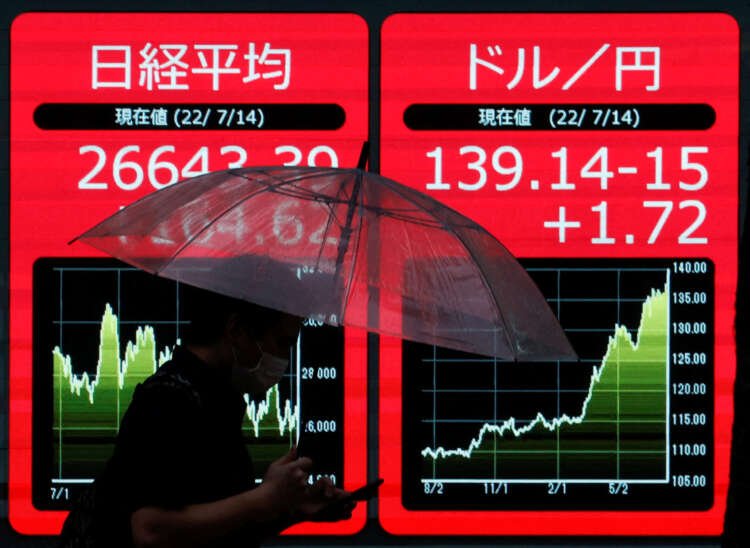

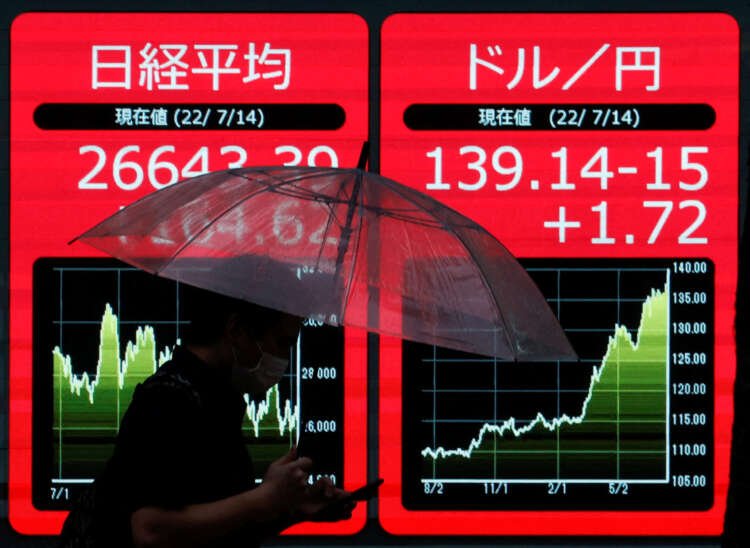

Australia’s S&P/ASX 200 index lost 0.45%, while Japan’s Nikkei slipped 0.6%.

In the currency market, the Japanese yen weakened 0.39% versus the greenback at 134.00 per dollar, with the euro rose 0.01% to $1.0639.

The dollar index, which measures the safe-haven greenback against six major currencies, rose 0.038%.

U.S. crude rose 0.1% to $79.61 per barrel and Brent was at $84.42, up 0.11% on the day.

(Reporting by Ankur Banerjee; Editing by Bradley Perrett)

Equity refers to the ownership interest in a company, represented by shares of stock. It signifies the value of an owner's stake in the business after all liabilities have been deducted.

Interest rates are the cost of borrowing money or the return on savings, expressed as a percentage of the principal amount. They influence economic activity and financial markets.

Economic growth is the increase in the production of goods and services in an economy over time, typically measured by the rise in Gross Domestic Product (GDP).

A trading platform is software used by traders to buy and sell financial instruments such as stocks, bonds, and currencies. It provides tools for analysis and execution of trades.

Explore more articles in the Top Stories category