Ant International’s Antom Launches AI‑Powered MSME App for Finance and Business Operations

The EPOS360 App integrates POS system, payments, banking, lending, and growth support into one platform to help MSMEs start, grow, and scale efficiently.

Singapore, 12 November 2025 - Antom, a leading provider of merchant payment and digitisation services under Ant International, today announced EPOS360, an app that brings point-of-sale (POS) system, payments, banking, lending, and growth support together to help micro, small and medium‑sized enterprises (MSMEs) move from setup to scale efficiently.

EPOS is the all-in-one SME transformation platform of Antom, one of Ant International’s major business pillars. In the first ten months of 2025, Antom recorded strong business momentum, with acquiring TPV for non-Alipay users growing over 70% year-on-year. With the launch of the new app, Antom is set to serve more MSMEs alongside enterprise customers.

In Singapore, about 99% of enterprises are SMEs. In ASEAN, MSMEs account for 97.2% – 99.9% of total establishments in ASEAN Member States. Regionally, the MSMEs contribute 44.8% to GDP. While access to finance has improved, many MSMEs still face challenges in navigating fragmented digital ecosystem, getting market insights, experiencing slow response to market volatilities, and insufficient funding channels, etc.

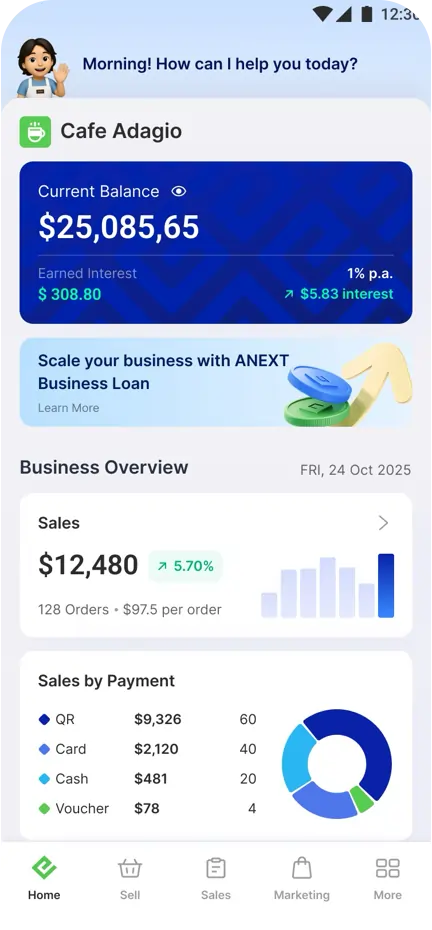

To tackle these pain points, the AI-powered EPOS360 app consolidates POS system, payments, banking, lending, digitisation, marketing and other growth-enabling services. Available on iOS and Android in early 2026, the app allows MSMEs to access all these services, provided by Antom, Alipay+ and ANEXT Bank under Ant International, within five minutes.

The AI-powered EPOS360 provides POS system, payments, banking, lending and other growth-enabling services, offering customised support to help MSMEs operate more efficiently (Image for illustrative purposes only).

The app will help MSMEs engage more customers. It enables merchants to set up online stores across Google Maps, partnering e-wallets, and other digital channels within minutes, making it easier for consumers to find them and place orders. Merchants can also manage daily operations, inventory, and seasonal promotions, as well as get financing support from MAS-regulated ANEXT Bank without any collaterals, all at their fingertips.

In phase one, EPOS360 serves Singapore MSMEs, particularly those in retail and food & beverage, and will expand to cover Malaysia as a mini app within Touch 'n Go in early 2026. It will roll out to more markets later. The app will be available in English, Chinese, Bahasa Malaysia, Thai, and Japanese, with more languages to be added in the future.

Born with AI embedded, the app features a built-in Antom Copilot that helps merchants quickly create online stores, boost sales with omnichannel marketing, and monitor cash flow. It can suggest inventory adjustments, explain weekly performance shifts, or address payment issues. It also analyses competition and marketing campaign results to guide smarter decisions. In addition, the MSME-facing AI copilot identifies holidays, weather changes, competitors, and bundling opportunities to recommend timely promotions, generate content, and publish it across multiple digital channels.

Supported by ANEXT Bank, EPOS360 integrates banking and financing so businesses can manage funds and access credit with ease. Merchants can open a free business account, with no minimum balance or transaction fees, and earn a competitive per annum daily interest rate on eligible balances. The platform also supports expansion, allowing merchants to hold multiple currencies.

Backed by ANEXT Bank, eligible merchants may receive instant approval for a loan up to S$5,000 at sign-up to address short-term needs, with higher limits available and revenue-based financing options available as they grow.

For payments, EPOS360, supported by Antom's payment processing service provider, helps merchants accept cards and alternative payment methods for online and in‑store transactions, with same‑day settlement available for certain payment methods. As businesses grow, the payments setup scales with them, such as activating Alipay+ cross‑border partner wallets for foreign visitors.

The app also allows merchants to pair and configure their EPOS360 Bluetap, a smart over-the-counter terminal that accepts both QR and card payments. Its QR code-based tap-to-pay feature is powered by Ant's proprietary technology.

Ian Cheong, CEO of EPOS, said: “Singapore has shown how a pro-MSME digital agenda can translate into strong economic vitality. To support MSMEs realise their full potential, we are packaging a wide range of merchant services into one AI-powered app that removes complexity and transforms everyday operations into new opportunities for growth. With EPOS360, even a neighbourhood food & beverage stall can launch an online menu, access an instant small loan, and set up a weekend promotion in minutes.”

Gary Liu, General Manager of Antom, Ant International, said: “We aim to make advanced technologies and high-quality services accessible to businesses of all sizes. Tailored-made merchant services have long felt beyond the reach of MSMEs, and EPOS360 lowers that barrier. While continuing to support cross-border merchants, we are deepening our focus on empowering local MSMEs with the same level of innovation and capability to drive sustainable growth.”

EPOS serves over 6,000 merchants in Singapore and is expanding to other markets. The platform helps businesses improve efficiency and customer engagement with intelligent sales systems, AI‑driven CRM and analytics, and hardware solutions such as Soundbox and self‑ordering kiosks.

To recognise outstanding MSMEs that excel in innovation, digitisation, customer experience and workplace culture, Ant International and EPOS have launched the inaugural Emerging Champions Awards in Singapore. Winners include Ai Muay Management Pte. Ltd., which won the Grand Prize in Digital Transformation for its digital transformation strategy for the six wet markets it manages, and Big Spring Day Seafood Trading Pte. Ltd., a local surimi seafood manufacturer named The Most Innovative SME for its proprietary blast-freezing technology and business model. Each winner will receive up to S$10,000 in Family Credits that can be redeemed for EPOS services to accelerate their digitisation journey.

EPOS360 allows merchants to pair and configure EPOS360 Bluetap, a smart over-the-counter terminal that accepts both QR and card payments.

###

About Antom

Ant International's Antom is the leading payment and digitisation services provider for merchants around the world. It offers unified, vertical-specific digital payment solutions to serve businesses of all sizes. Antom supports merchants to integrate over 300 payment methods, enabling them to connect with consumers in more than 200 markets, with the flexibility to accept payments in more than 100 currencies. Beyond payments, it provides digital marketing solutions and merchant digitisation services to help merchant streamline operations and enhance customer engagement. To learn more, please visit https://www.antom.com/.

About EPOS

EPOSis a leading Point-of-Sale (POS) digital solutions provider based in Singapore. Supporting Ant International's mission to empower SMEs, EPOS leverages Antom’s digital capabilities as the organisation’s central hub to serve regional small and medium-sized businesses with integrated O2O digital, payment and banking solutions. For more information about EPOS360, please visit https://www.epos.com.sg/epos360/.

Media Contact:

Ant International PR

pr@ant-intl.com

MSME stands for Micro, Small, and Medium Enterprises, which are businesses with limited resources and workforce, often playing a crucial role in economic growth and employment.

A POS (Point of Sale) system is a combination of hardware and software that allows businesses to complete sales transactions, manage inventory, and track customer data.

Digital banking refers to the digitization of all traditional banking activities, allowing customers to conduct financial transactions online or through mobile applications.

AI in banking involves the use of artificial intelligence technologies to enhance customer service, streamline operations, and provide personalized financial advice.

Lending support for MSMEs includes financial services and products designed to help small and medium enterprises access credit and manage their financing needs.

Explore more articles in the Top Stories category