Analysis-Inflows into unloved European telecoms signal brighter future

By Danilo Masoni and Lucy Raitano

MILAN/LONDON (Reuters) – Investors have poured money back into unloved European telecoms stocks on expectations that costly investments have peaked and that a resurgence in mergers and acquisitions could lead to fatter returns.

The return of inflows could signal a turning point for a sector that as recently as February logged its worst underperformance against the market in more than three decades.

Telecoms’ high debt levels are one factor that deter many fund managers. But growing cash flows and a potential softening in the European Union’s historically tough stance on mergers in the sector means prospects for these shares look brighter.

“Some of the historical headwinds are fading away,” said Luca Finà, head of equity at Generali Insurance Asset Management, which is now selectively overweight in telecoms, having been underweight in 2021 and neutral last year.

“The capex cycle is mostly behind us, leading to an improved free cash flow generation, inflation is leading to price increases and (there’s) an apparent more favourable stance from regulators on consolidation,” he added.

So far in 2023, telecom sector funds have seen $1.8 billion worth of net inflows, recovering more than 80% of last year’s outflows, data from fund tracker EPFR showed.

Finland, Italy, Norway, Austria, Germany and France rank among the top 10 countries for the biggest rises in telecoms inflows this year.

Since February’s record low relative to the broader market, the sector has staged a recovery and the STOXX Telecoms index is up 11% year-to-date, having risen as much as 17%. That compares to a 10.7% peak gain for the region-wide STOXX Europe 600.

Investors are also eagerly waiting to hear whether the European Commission will approve the 18.6 billion-euro ($20.47 billion) merger between Orange and MasMovil in Spain. The ruling, expected in September, is seen as a test case that may even prompt sceptics to rethink their negative view on the industry.

“We don’t see much value in the sector. The only opportunity would be market consolidation,” said Ludovic Labal, portfolio manager of Eric Sturdza Investments’ Strategic Europe Quality Fund.

His fund does not invest in telecoms because of concerns about high leverage and slow growth.

Others are already becoming more positive, including the equity research team at Amundi, Europe’s largest asset manager, which has recommended an overweight allocation since the second half of 2022.

Luca Corona, Amundi senior telco analyst, said price increases for telecoms services do not appear to have been followed by smaller players taking the opportunity to undercut their larger rivals, as has been seen in the past.

He also noted that France and Italy are two other markets that would both benefit from consolidation.

At an enterprise value of 5.8 times core earnings, European telecoms trade at a 21% discount to their 30-year average valuation, according to Refinitiv Datastream. Relative to the market, they trade at a 31% discount on the same metric.

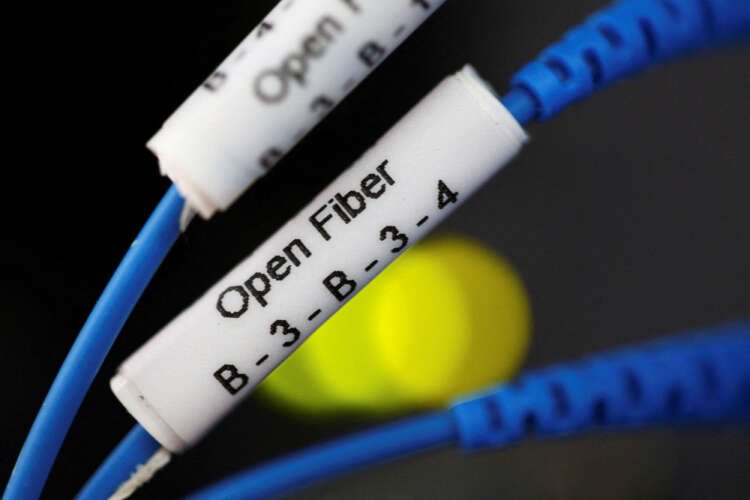

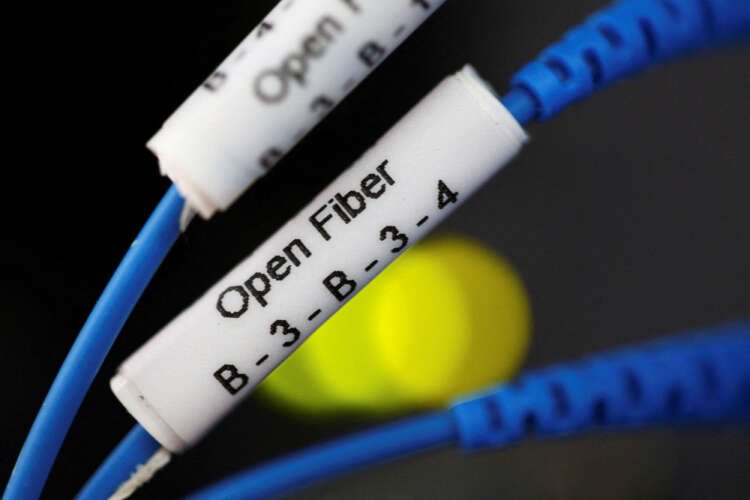

Telecoms is a highly fragmented industry, with four players competing in many domestic markets. Price wars have squeezed margins over the years, just as fixed and mobile networks needed huge investment to meet booming demand for data.

But the investment cycle is turning. France’s Orange has completed more than 90% of its fibre rollout and is reducing capital expenditure. Spain’s Telefonica and Norway’s Telenor have said they are past, or near, peak capex.

That is supporting margins, along with price hikes put in place in the face of soaring inflation, which could help gradually change the downbeat narrative.

“The sector is no more perceived as a ‘no pricing power’ one,” said Olivier Baduel, director of European equity management at Ofi Invest Asset Management.

Also on the horizon is a potential windfall from a European Commission consultation, launched in February, on who should foot the bill for billions of euros of investments in Europe’s telecoms network. Operators have lobbied for decades for leading technology companies to contribute to 5G and broadband roll-out.

UBS analyst Polo Tang estimates that could raise up to 4 billion euros or ease pressure on capex by optimising network traffic.

($1 = 0.9084 euros)

(Reporting by Danilo Masoni in Milan and Lucy Raitano in London; Editing by Sharon Singleton)

A merger is a business combination where two companies join to form a single entity, often to increase market share, reduce competition, or achieve economies of scale.

Capital expenditure (capex) refers to funds used by a company to acquire, upgrade, and maintain physical assets such as property, buildings, or equipment.

Free cash flow is the cash generated by a company after accounting for capital expenditures. It is used to pay dividends, reduce debt, or reinvest in the business.

Inflation is the rate at which the general level of prices for goods and services rises, eroding purchasing power. It is typically measured by the Consumer Price Index (CPI).

A telecommunications index is a financial index that tracks the performance of companies within the telecommunications sector, providing insights into market trends and investment opportunities.

Explore more articles in the Top Stories category