Why the software industry is highly-valued despite a risk-averse pandemic economy

Published by linker 5

Posted on September 14, 2020

5 min readLast updated: January 21, 2026

Published by linker 5

Posted on September 14, 2020

5 min readLast updated: January 21, 2026

Achieving a successful M&A as the world becomes reliant on technology

By Dr. John Bates, CEO of Eggplant

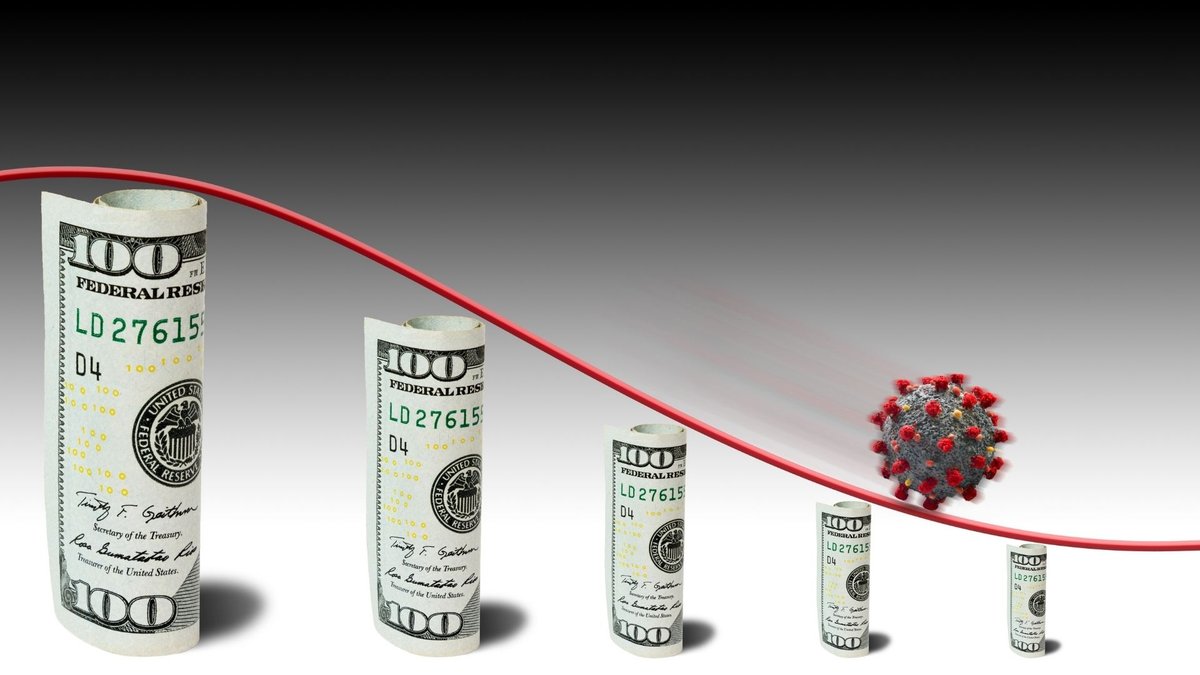

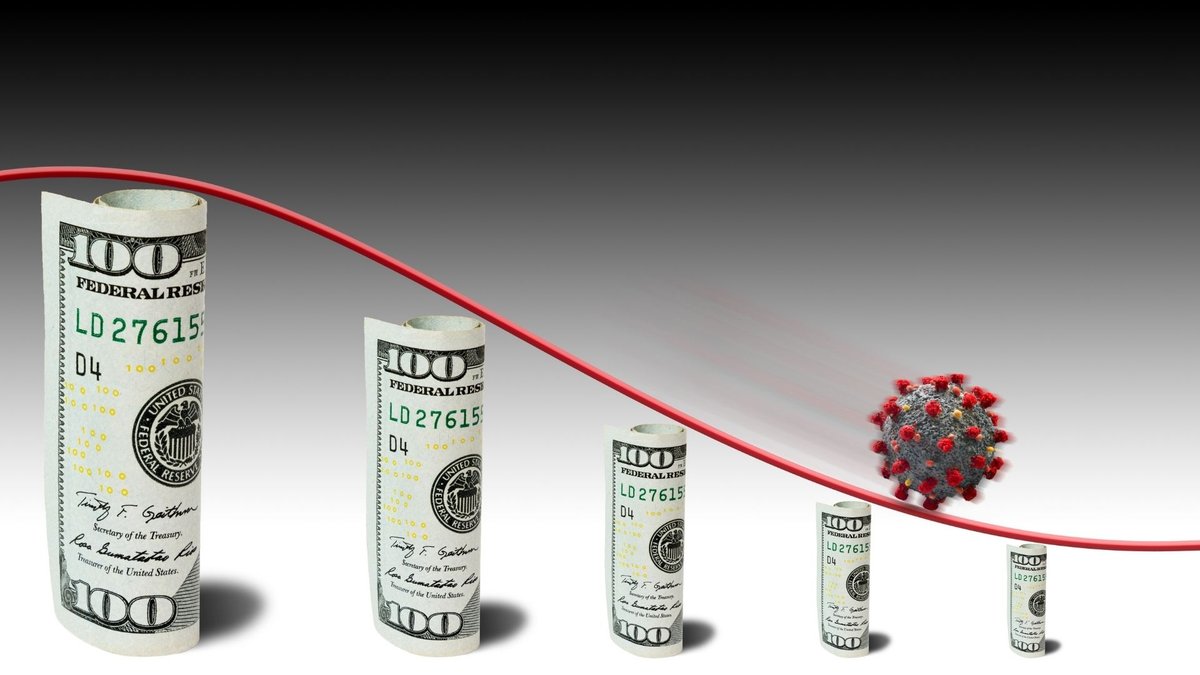

The coronavirus pandemic had – and is continuing to have – a global impact on mergers and acquisitions (M&A). In a very short period of time, and on a very large scale, organisations around the world have had to adapt to an unprecedented disruption. It’s unsurprising that in this time of economic downturn deals have started to dry up and it seems likely for mergers, acquisitions and other activities of the sort to drop-off. This reflects the pattern seen in past financial crises, such as the burst of the dot-com bubble that disrupted the M&A market.

Understandably, economic uncertainty causes hesitation for investors in shelling out large amounts of capital, as well as other negative impacts that create uncertainty in the M&A market, e.g. the stock market to decline and shareholders to worry. Since deal volumes and values work in tandem with the economy, if there is an economic downturn, there will likely be a decline in M&A.

COVID-19 and the consequential UK recession has resurfaced these concerns. Many businesses have delayed or cut back on their acquisition plans, forcing buyers to focus instead on the health of their own company, and with travel restrictions, deal negotiations in the traditional manner are unable to happen. In fact, during the first quarter of the year, deal volumes dropped to a seven year low, with the deal value being reduced by a third compared to the year before.

This isn’t quite the case for all industries however. Despite its rarity, PwC analysis suggests that businesses able to leverage capital to make deals early in a decline could see better returns than those in different industries – about 7% of companies that pursued acquisitions during the 2001 US recession found higher shareholder returns than industry peers twelve months after. Certain industries largely affected by the pandemic may see an increase in M&A activity this year, as buyers see it as a good time to snatch up businesses that fit future strategies for bargain prices, especially in hospitality and transportation. However, one area in which company values have been maintained – and even increased – is software, which has proven itself to be the engine to keep the business world turning.

A different mentality is required when approaching M&A during economic turmoil. Instead of giving into temptation to cut overheads and reduce losses, innovative and fast-moving businesses should be considering the opportunity in front of them. The leaders that grasp the opportunity to expand and create critical new relationships, building a unique marketing offering, will be the ones best placed to dominate the market during COVID-19, as well as throughout the economic recovery.

Technology is driving our future of distancing

For businesses, the focus should be on the solution being offered. It’s not about what the product is, but instead what problems it can solve.

Though the world took a turn for the worst due to the pandemic, it wasn’t all negative for businesses. In fact, some industries – technology especially – have flourished. What we’ve seen is businesses previously hindered by lack of buy-in, technical complexities and budget, now forced to find a work around roadblocks and implement a comprehensive and complex digital strategy out of necessity. Unlike previously carefully mapped out plans for transformation, these digital takeovers have occurred within weeks – not months or years.

Companies in the telecommunications and software industries have kept the world running by connecting people virtually, though separated physically. Critical operations including the release of new products, scaling businesses, product maintenance, among others have therefore continued to be unhindered for many.

As the world pivots to digital and increases the reliance on technology, networked software has now become as important to life as water and electricity. Without it, we are no longer able to function. It has allowed businesses to run, have food delivered, virtually connect family and colleagues, and keep us informed about what’s happening in the world.

Social distance measurements have accelerated digitisation to the point where we are all virtual. We now want to meet virtually, avoid public transportation and distance ourselves from others outside of the home, which is causing a high demand for faster, better internet to stay connected. Technology is already playing a key part in creating a new normal – from contact tracing apps to fever detection tools. But it is obvious that our new world will consist of wanting to live in our own bubble, as distancing and demand for privacy increase.

A business should see this as an opportunity to strategically use M&A to accelerate its digitisation roadmap to increase flexibility and planning in cost structures. Strategic investments of this kind can make a profit centre rather than a compliance function.

With crisis, comes opportunity

Digital transformation has been accelerated by COVID-19, and digital business communities have adapted faster than other industries and governments. The world now is one in which digital products run businesses internally and externally. Success is all about digital products and to measure that success, it’s imperative to provide a customer experience that helps to meet desired business outcomes, i.e. revenue or acquiring new customers.

Opportunities can arise out of a crisis. High-quality deals, that are a win for both buyer and seller, are possible to achieve in this uncertain environment. Choosing the right partners that create new companies to serve the greater needs of the moment, such as enabling virtual services during the pandemic, will result in an improved solution with an expanded offering for customers moving forward.

Explore more articles in the Technology category