The wary canary and the LIBOR OIS spread

Published by Gbaf News

Posted on April 12, 2018

16 min readLast updated: January 21, 2026

Published by Gbaf News

Posted on April 12, 2018

16 min readLast updated: January 21, 2026

By Phil Milburn, co-manager on the Global Fixed Income team at Liontrust Asset Management

In financial markets, some dislocations occur where the causality is not entirely clear. Rather than trying to retrofit an exact explanation, I find it helpful to examine each potential factor in turn to reach a conclusion: Sir Arthur Conan Doyle’s fictional detective would be very proud.

I will follow this methodology to ascertain whether the first quarter’s widening in the US 3-month LIBOR OIS (Overnight Indexed Swap) spread is a sign of something amiss or whether the proverbial canary is returning safely from the coal mine.

The canary is worried about the money market plumbing

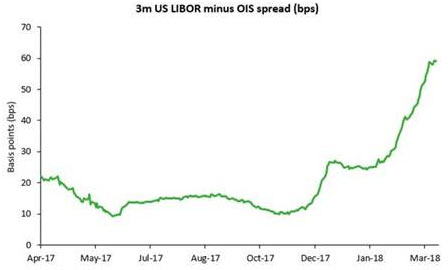

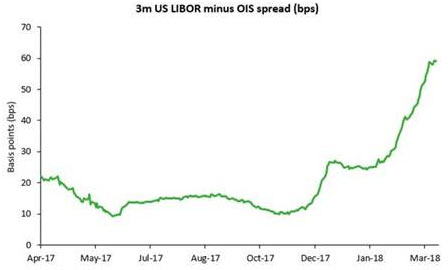

In the first quarter of 2018, the financial market’s view of the path of US interest rates increased with the 3- month OIS moving from 1.44% to 1.72% over the period. However, the movement in US 3-month LIBOR has been more pronounced: it closed the quarter at 2.31%, over 60 basis points higher than the start of the year.

This divergence means there has been a rapid and dramatic widening in the LIBOR minus OIS spread, a frequently followed barometer of market stress. For those long in the tooth, this is very similar to the TED spread (between Treasuries and Eurodollar futures), except with the OIS replacing 3-month treasury bills in the equation.

Source: Liontrust, Bloomberg April 2018

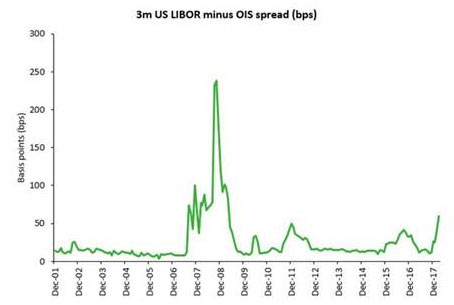

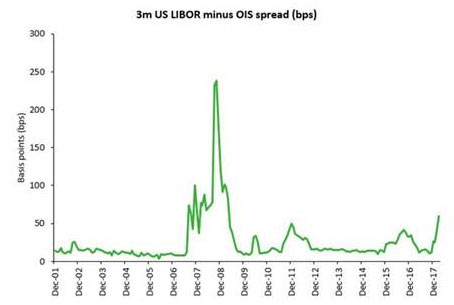

Is this a sign of stress in the market for the wholesale liability financing of US banks? It clearly was during the credit crunch of 2007-2009 and the longer-term perspective in the chart below helps to frame the relative lack of size of the recent moves.

Source: Liontrust, Bloomberg April 2018

However, outside of the US and Australia, we are not witnessing such pressures in the Euro, Yen or Swiss Franc funding markets and only the slightest rise in Sterling (see the chart below). Furthermore, many of the other indicators that scare the canaries are also notable by their absence: volatility measures, such as the VIX, have increased but this is mostly correlated to fluctuations in the FAANGs (Facebook, Apple, Amazon, Netflix, and Google) stocks and President Trump’s tariff talks.

Source: Liontrust, Bloomberg April 2018

Therefore, it looks like the only mine the canary does not want to go into is the US LIBOR one. But going back to my previous point on causality, what is the issue here? There is a danger of over-extrapolating as US LIBOR is not the cleanest signal of bank funding conditions (note that I am assuming LIBOR is not being manipulated after the myriad fines that banks have endured for their past misdemeanours).

Actual 3-month bank funding is a relatively small market at an approximate volume of $1bn a day, and thus US LIBOR submissions look to other inputs such as repo, forwards and swaps to help triangulate the daily fixes. These other inputs are impacted by many factors outside of the demand and supply of unsecured bank funding. Let’s look at the three suggested causes of the widening.

There was a tsunami of Treasury bill issuance from early February until the end of March, which followed directly from the ending of the latest debt ceiling impasse. It is a relatively rare event for the US Treasury to issue a net $325bn of bills over a two-month period, with the last occurrence being targeted to accommodate the money market fund reforms in 2016.

Treasury repo closely tracks bills, and thus repo rates have increased over the period. But there is little direct causality between the two as suppliers of bank funding and buyers of bills see little overlap. It is more likely to have gone through a market-based transmission mechanism, with marginal lenders such as commercial paper managers demanding higher rates with bills as an alternative. Effectively, this is a classic economic crowding out of the funding markets represented by higher prices paid for the marginal borrower.

The second explanation posited for the spread widening is connected to the anticipated repatriation of overseas earnings by large US corporations. With the reduced tax rate, post the fiscal reforms, the formerly “trapped” overseas earnings are expected to flow back into the US. Analysis of the flows is subject to idiosyncratic risk as they can be driven by a few key decision makers, with 40% of the overseas cash stock held by just 10 firms.

The repatriations themselves are not the key driving factor here, rather it is the realised tax liability that they crystallise. Although these can be amortised over an eight-year period, some companies may opt for accelerated tax payments in order to enact special dividends or massive share buybacks.

There has been an increase in non-financial commercial paper issuance and some have suggested this is to pre-fund the tax liabilities; I view this as plausible but only likely to have a small marginal impact. The companies involved in the repatriations are sitting on vast swathes of cash, maybe money market funds are scared of redemptions? It sounds like a good story but the collective evidence simply does not fit here.

The most likely scenario is that the companies which are facing an impending tax liability have been providing some of the financing for banks. Post the 2016 money market fund reforms, banks were pushed into seeking short-term wholesale funds elsewhere and a cash rich treasury part of a large corporation must have been a great hunting ground. However, the reduction in demand from this source is realistically unlikely to have contributed more than a handful of basis points of LIBOR OIS spread widening.

The reduction in reinvestment of the coupon and maturities from the stock of bonds purchased during the Federal Reserve’s quantitative easing (QE) programme is shrinking its balance sheet. As the Fed’s assets reduce, there must, by definition, be a reduction in liabilities within the financial system. Ultimately, as the Fed’s balance sheet shrinks, commercial banks’ reserves decline and excess liquidity reduces. Furthermore, the US Treasury’s cash reserves, built up during the bill issuance, are kept at the Fed, which has a draining impact on the financial system. With US banks being deposit rich and lending conditions pretty sanguine, I believe it is too soon for this to be having a large impact on bank funding rates, but clearly its influence will increase as the excess systemic liquidity is mopped up.

Is it safe for the canary to go back into the mine in the second quarter?

In my opinion, the short answer is yes. Bill issuance is set to slow through the rest of the year as the US Treasury approaches its target cash reserve. In addition, seasonally US tax receipts pick up in April with the 15th representing the deadline for 2017 tax returns.

Examining the evidence, I believe that bill issuance has been the biggest driver of the LIBOR OIS spread widening. The confluence of this with the fears around tax on repatriation flows and the reduction of the Fed’s balance sheet has magnified the movements.

I suggest most of the impact of the latter two factors has been market-fear related, with relevant constituencies repricing their lending rates just in case. I anticipate a reversal of some of the widening in the second quarter and would estimate the spread to settle into a 30 to 40 basis points range. If this part reversal does not happen, I would start to become concerned that I had missed a fourth explanation and then listen to what the canary had to say for itself.

On a multi-year view, the oscillations in Treasury bill issuance are likely to be transitory in nature. The repatriation, and corresponding tax crystallisation, is likely to redistribute the stock of excess asset liquidity from shorter dated credit instruments into equities via share buybacks. However, this has no long-term impact on the stock of liabilities, it just will reduce marginal demand and therefore slightly increase the price of bank funding. The largest long-term driver is likely to be the continued reversal of QE and at some stage the Fed’s balance sheet will have shrunk far enough that banks’ liquidity and funding conditions become tight.

How to seek to make money out of this in a bond fund

Even though we are bond fund managers and not money market fund managers, we can still seek to make some money for clients from this. The Liontrust GF Strategic Bond Fund, which is launching on 13 April, will have a mid-single digit weighting in US floating rate notes. These are unlikely to provide significant capital upside but some extra yield never goes amiss.

Additionally, some shorter dated credit spreads have been under pressure and this has created some opportunities to source cheap 4 to 5 year maturity corporate debt. Finally, the yield benefit one receives from hedging other currencies into US dollars has increased; but clearly the converse applies if one is a non-USD investor.

By Phil Milburn, co-manager on the Global Fixed Income team at Liontrust Asset Management

In financial markets, some dislocations occur where the causality is not entirely clear. Rather than trying to retrofit an exact explanation, I find it helpful to examine each potential factor in turn to reach a conclusion: Sir Arthur Conan Doyle’s fictional detective would be very proud.

I will follow this methodology to ascertain whether the first quarter’s widening in the US 3-month LIBOR OIS (Overnight Indexed Swap) spread is a sign of something amiss or whether the proverbial canary is returning safely from the coal mine.

The canary is worried about the money market plumbing

In the first quarter of 2018, the financial market’s view of the path of US interest rates increased with the 3- month OIS moving from 1.44% to 1.72% over the period. However, the movement in US 3-month LIBOR has been more pronounced: it closed the quarter at 2.31%, over 60 basis points higher than the start of the year.

This divergence means there has been a rapid and dramatic widening in the LIBOR minus OIS spread, a frequently followed barometer of market stress. For those long in the tooth, this is very similar to the TED spread (between Treasuries and Eurodollar futures), except with the OIS replacing 3-month treasury bills in the equation.

Source: Liontrust, Bloomberg April 2018

Is this a sign of stress in the market for the wholesale liability financing of US banks? It clearly was during the credit crunch of 2007-2009 and the longer-term perspective in the chart below helps to frame the relative lack of size of the recent moves.

Source: Liontrust, Bloomberg April 2018

However, outside of the US and Australia, we are not witnessing such pressures in the Euro, Yen or Swiss Franc funding markets and only the slightest rise in Sterling (see the chart below). Furthermore, many of the other indicators that scare the canaries are also notable by their absence: volatility measures, such as the VIX, have increased but this is mostly correlated to fluctuations in the FAANGs (Facebook, Apple, Amazon, Netflix, and Google) stocks and President Trump’s tariff talks.

Source: Liontrust, Bloomberg April 2018

Therefore, it looks like the only mine the canary does not want to go into is the US LIBOR one. But going back to my previous point on causality, what is the issue here? There is a danger of over-extrapolating as US LIBOR is not the cleanest signal of bank funding conditions (note that I am assuming LIBOR is not being manipulated after the myriad fines that banks have endured for their past misdemeanours).

Actual 3-month bank funding is a relatively small market at an approximate volume of $1bn a day, and thus US LIBOR submissions look to other inputs such as repo, forwards and swaps to help triangulate the daily fixes. These other inputs are impacted by many factors outside of the demand and supply of unsecured bank funding. Let’s look at the three suggested causes of the widening.

There was a tsunami of Treasury bill issuance from early February until the end of March, which followed directly from the ending of the latest debt ceiling impasse. It is a relatively rare event for the US Treasury to issue a net $325bn of bills over a two-month period, with the last occurrence being targeted to accommodate the money market fund reforms in 2016.

Treasury repo closely tracks bills, and thus repo rates have increased over the period. But there is little direct causality between the two as suppliers of bank funding and buyers of bills see little overlap. It is more likely to have gone through a market-based transmission mechanism, with marginal lenders such as commercial paper managers demanding higher rates with bills as an alternative. Effectively, this is a classic economic crowding out of the funding markets represented by higher prices paid for the marginal borrower.

The second explanation posited for the spread widening is connected to the anticipated repatriation of overseas earnings by large US corporations. With the reduced tax rate, post the fiscal reforms, the formerly “trapped” overseas earnings are expected to flow back into the US. Analysis of the flows is subject to idiosyncratic risk as they can be driven by a few key decision makers, with 40% of the overseas cash stock held by just 10 firms.

The repatriations themselves are not the key driving factor here, rather it is the realised tax liability that they crystallise. Although these can be amortised over an eight-year period, some companies may opt for accelerated tax payments in order to enact special dividends or massive share buybacks.

There has been an increase in non-financial commercial paper issuance and some have suggested this is to pre-fund the tax liabilities; I view this as plausible but only likely to have a small marginal impact. The companies involved in the repatriations are sitting on vast swathes of cash, maybe money market funds are scared of redemptions? It sounds like a good story but the collective evidence simply does not fit here.

The most likely scenario is that the companies which are facing an impending tax liability have been providing some of the financing for banks. Post the 2016 money market fund reforms, banks were pushed into seeking short-term wholesale funds elsewhere and a cash rich treasury part of a large corporation must have been a great hunting ground. However, the reduction in demand from this source is realistically unlikely to have contributed more than a handful of basis points of LIBOR OIS spread widening.

The reduction in reinvestment of the coupon and maturities from the stock of bonds purchased during the Federal Reserve’s quantitative easing (QE) programme is shrinking its balance sheet. As the Fed’s assets reduce, there must, by definition, be a reduction in liabilities within the financial system. Ultimately, as the Fed’s balance sheet shrinks, commercial banks’ reserves decline and excess liquidity reduces. Furthermore, the US Treasury’s cash reserves, built up during the bill issuance, are kept at the Fed, which has a draining impact on the financial system. With US banks being deposit rich and lending conditions pretty sanguine, I believe it is too soon for this to be having a large impact on bank funding rates, but clearly its influence will increase as the excess systemic liquidity is mopped up.

Is it safe for the canary to go back into the mine in the second quarter?

In my opinion, the short answer is yes. Bill issuance is set to slow through the rest of the year as the US Treasury approaches its target cash reserve. In addition, seasonally US tax receipts pick up in April with the 15th representing the deadline for 2017 tax returns.

Examining the evidence, I believe that bill issuance has been the biggest driver of the LIBOR OIS spread widening. The confluence of this with the fears around tax on repatriation flows and the reduction of the Fed’s balance sheet has magnified the movements.

I suggest most of the impact of the latter two factors has been market-fear related, with relevant constituencies repricing their lending rates just in case. I anticipate a reversal of some of the widening in the second quarter and would estimate the spread to settle into a 30 to 40 basis points range. If this part reversal does not happen, I would start to become concerned that I had missed a fourth explanation and then listen to what the canary had to say for itself.

On a multi-year view, the oscillations in Treasury bill issuance are likely to be transitory in nature. The repatriation, and corresponding tax crystallisation, is likely to redistribute the stock of excess asset liquidity from shorter dated credit instruments into equities via share buybacks. However, this has no long-term impact on the stock of liabilities, it just will reduce marginal demand and therefore slightly increase the price of bank funding. The largest long-term driver is likely to be the continued reversal of QE and at some stage the Fed’s balance sheet will have shrunk far enough that banks’ liquidity and funding conditions become tight.

How to seek to make money out of this in a bond fund

Even though we are bond fund managers and not money market fund managers, we can still seek to make some money for clients from this. The Liontrust GF Strategic Bond Fund, which is launching on 13 April, will have a mid-single digit weighting in US floating rate notes. These are unlikely to provide significant capital upside but some extra yield never goes amiss.

Additionally, some shorter dated credit spreads have been under pressure and this has created some opportunities to source cheap 4 to 5 year maturity corporate debt. Finally, the yield benefit one receives from hedging other currencies into US dollars has increased; but clearly the converse applies if one is a non-USD investor.

Explore more articles in the Finance category