The number of monetary financial institutions in the euro area and in the EU decreased further in 2011

Published by Gbaf News

Posted on January 27, 2012

16 min readLast updated: January 22, 2026

Published by Gbaf News

Posted on January 27, 2012

16 min readLast updated: January 22, 2026

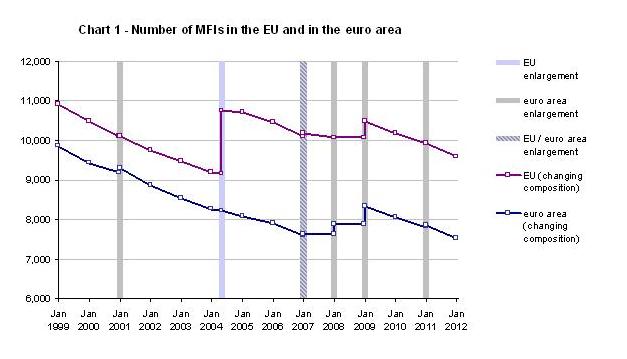

On 1 January 2012 the total number of monetary financial institutions (MFIs) [1] in the euro area stood at 7,533. This is a net decrease of 332 units (4%) in comparison with the situation a year ago. With a few minor exceptions, the decline was spread across the whole of the euro area. There were 9,587 MFIs in the European Union (EU) as a whole, a net decrease of 334 units.

Number of MFIs

Note: The reduction in the number of MFIs during 2011 largely resulted from the introduction of a common definition for European money market funds (Guideline ECB-POLICY-3fdc7763-f2c0-4c30-b494-8614852eaf43>ECB-POLICY-SOURCES-e4bab80d-7aeb-4e49-a29a-ce14e1595c6d>ECB-POLICY-3fdc7763-f2c0-4c30-b494-8614852eaf43>ECB/2011/13), which led to the reclassification of certain funds formerly recognised as money market funds.

Structure of the MFI population

Country breakdown on 1 January 2012

Foreign branches

|

Table 1 – Number of MFIs, by country, and percentage changes in recent periods |

|||||||||

|

Country |

Number |

Percentage |

|||||||

|

1 Jan. 1999 |

1 Jan. 2001 |

1 May 2004 |

1 Jan. 2010 |

1 Jan. 2011 |

1 Jan. 2012 |

1 Jan. 1999 to 1 Jan. 2012 |

1 May 2004 to 1 Jan. 2012 |

1 Jan. |

|

|

ECB-POLICY-3fdc7763-f2c0-4c30-b494-8614852eaf43>ECB-POLICY-SOURCES-e4bab80d-7aeb-4e49-a29a-ce14e1595c6d>ECB-POLICY-3fdc7763-f2c0-4c30-b494-8614852eaf43>ECB |

1 |

1 |

1 |

1 |

1 |

1 |

– |

– |

– |

|

EIB* |

– |

– |

– |

1 |

1 |

1 |

– |

– |

– |

|

BE |

153 |

142 |

126 |

121 |

123 |

122 |

-20.3 |

-3.2 |

0.8 |

|

DE |

3,280 |

2,782 |

2,268 |

2,018 |

1,999 |

1,956 |

-40.4 |

-13.8 |

-2.2 |

|

EE |

– |

– |

25 |

38 |

37 |

37 |

– |

48.0 |

– |

|

GR |

102 |

105 |

100 |

89 |

83 |

79 |

-22.5 |

-21.0 |

-4.8 |

|

IE |

96 |

211 |

294 |

727 |

696 |

590 |

514.6 |

100.7 |

-15.2 |

|

ES |

608 |

571 |

512 |

427 |

413 |

415 |

-31.7 |

-18.9 |

0.5 |

|

FR |

1,938 |

1,764 |

1,577 |

1,298 |

1,206 |

1,147 |

-40.8 |

-27.3 |

-4.9 |

|

IT |

944 |

884 |

854 |

833 |

808 |

785 |

-16.8 |

-8.1 |

-2.8 |

|

CY |

– |

– |

409 |

156 |

153 |

143 |

– |

-65.0 |

-6.5 |

|

LU |

676 |

662 |

586 |

630 |

602 |

554 |

-18.0 |

-5.5 |

-8.0 |

|

MT |

– |

– |

17 |

29 |

32 |

33 |

– |

94.1 |

3.1 |

|

NL |

668 |

620 |

484 |

305 |

300 |

297 |

-55.5 |

-38.6 |

-1.0 |

|

AT |

910 |

866 |

827 |

821 |

806 |

783 |

-14.0 |

-5.3 |

-2.9 |

|

PT |

228 |

223 |

205 |

169 |

164 |

159 |

-30.3 |

-22.4 |

-3.0 |

|

SI |

– |

– |

27 |

28 |

28 |

29 |

– |

7.4 |

3.6 |

|

SK |

– |

– |

28 |

40 |

43 |

44 |

– |

57.1 |

2.3 |

|

FI |

354 |

362 |

396 |

383 |

370 |

358 |

1.1 |

-9.6 |

-3.2 |

|

Euro area** |

9,856 |

9,193 |

8,230 |

8,076 |

7,865 |

7,533 |

-23.6 |

-8.5 |

-4.2 |

|

BG |

– |

– |

36 |

36 |

37 |

– |

– |

2.8 |

|

|

CZ |

– |

– |

79 |

68 |

67 |

67 |

– |

-15.2 |

– |

|

DK |

216 |

213 |

206 |

167 |

164 |

164 |

-24.1 |

-20.4 |

– |

|

LV |

– |

– |

52 |

74 |

76 |

72 |

– |

38.5 |

-5.3 |

|

LT |

– |

– |

74 |

88 |

90 |

95 |

– |

28.4 |

5.6 |

|

HU |

– |

– |

238 |

246 |

246 |

251 |

– |

5.5 |

2.0 |

|

PL |

– |

– |

659 |

714 |

710 |

703 |

– |

6.7 |

-1.0 |

|

RO |

– |

– |

51 |

55 |

55 |

– |

– |

– |

|

|

SE |

179 |

177 |

255 |

212 |

205 |

205 |

14.5 |

-19.6 |

– |

|

UK |

556 |

541 |

457 |

422 |

407 |

405 |

-27.2 |

-11.4 |

-0.5 |

|

EU** |

10,909 |

10,124 |

10,756 |

10,192 |

9,921 |

9,587 |

-12.1 |

-10.9 |

-3.4 |

* For the purposes of the ECB-POLICY-3fdc7763-f2c0-4c30-b494-8614852eaf43>ECB-POLICY-SOURCES-e4bab80d-7aeb-4e49-a29a-ce14e1595c6d>ECB-POLICY-3fdc7763-f2c0-4c30-b494-8614852eaf43>ECB’s monetary and other euro area statistics, the European Investment Bank (EIB) continues to be treated as an institution that is resident outside the euro area.

** Changing composition

Notes:

The number of MFIs has been derived from the ECB-POLICY-3fdc7763-f2c0-4c30-b494-8614852eaf43>ECB-POLICY-SOURCES-e4bab80d-7aeb-4e49-a29a-ce14e1595c6d>ECB-POLICY-3fdc7763-f2c0-4c30-b494-8614852eaf43>ECB’s “List of monetary financial institutions”, which is updated daily on the ECB-POLICY-3fdc7763-f2c0-4c30-b494-8614852eaf43>ECB-POLICY-SOURCES-e4bab80d-7aeb-4e49-a29a-ce14e1595c6d>ECB-POLICY-3fdc7763-f2c0-4c30-b494-8614852eaf43>ECB’s website and is compiled in such a way as to ensure its completeness, accuracy and homogeneity across countries. Its objectives are twofold, namely (i) to serve as the reference reporting population for the compilation of comprehensive and consistent monetary statistics for the euro area and (ii) to serve as a register and a reliable sampling frame for other data collections and for statistical and economic analyses.

Information on MFIs and other financial institutions, including the list of monetary financial institutions and institutions subject to minimum reserves, can be found on the ECB-POLICY-3fdc7763-f2c0-4c30-b494-8614852eaf43>ECB-POLICY-SOURCES-e4bab80d-7aeb-4e49-a29a-ce14e1595c6d>ECB-POLICY-3fdc7763-f2c0-4c30-b494-8614852eaf43>ECB’s website.

________________________________________

[1]“Monetary financial institutions” (MFIs) are central banks, resident credit institutions as defined in Community law, and other resident financial institutions whose business is to receive deposits and/or close substitutes for deposits from entities other than MFIs and, for their own account (at least in economic terms), to grant credits and/or make investments in securities. Money market funds are also classified as MFIs.

[2]The overall increase includes 419 units which resulted from the reclassification of Irish credit unions as credit institutions as of 1 January 2009.

Copyright © for the entire content of this webpage: European Central Bank, Frankfurt am Main, Germany.

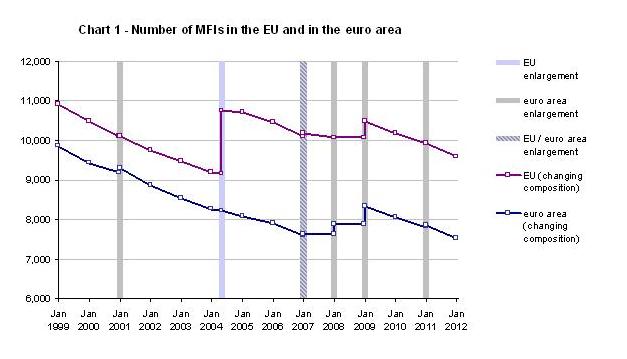

On 1 January 2012 the total number of monetary financial institutions (MFIs) [1] in the euro area stood at 7,533. This is a net decrease of 332 units (4%) in comparison with the situation a year ago. With a few minor exceptions, the decline was spread across the whole of the euro area. There were 9,587 MFIs in the European Union (EU) as a whole, a net decrease of 334 units.

Number of MFIs

Note: The reduction in the number of MFIs during 2011 largely resulted from the introduction of a common definition for European money market funds (Guideline ECB-POLICY-3fdc7763-f2c0-4c30-b494-8614852eaf43>ECB-POLICY-SOURCES-e4bab80d-7aeb-4e49-a29a-ce14e1595c6d>ECB-POLICY-3fdc7763-f2c0-4c30-b494-8614852eaf43>ECB/2011/13), which led to the reclassification of certain funds formerly recognised as money market funds.

Structure of the MFI population

Country breakdown on 1 January 2012

Foreign branches

Table 1 – Number of MFIs, by country, and percentage changes in recent periods | |||||||||

Country | Number | Percentage | |||||||

1 Jan. 1999 | 1 Jan. 2001 | 1 May 2004 | 1 Jan. 2010 | 1 Jan. 2011 | 1 Jan. 2012 | 1 Jan. 1999 to 1 Jan. 2012 | 1 May 2004 to 1 Jan. 2012 | 1 Jan. | |

ECB-POLICY-3fdc7763-f2c0-4c30-b494-8614852eaf43>ECB-POLICY-SOURCES-e4bab80d-7aeb-4e49-a29a-ce14e1595c6d>ECB-POLICY-3fdc7763-f2c0-4c30-b494-8614852eaf43>ECB | 1 | 1 | 1 | 1 | 1 | 1 | – | – | – |

EIB* | – | – | – | 1 | 1 | 1 | – | – | – |

BE | 153 | 142 | 126 | 121 | 123 | 122 | -20.3 | -3.2 | 0.8 |

DE | 3,280 | 2,782 | 2,268 | 2,018 | 1,999 | 1,956 | -40.4 | -13.8 | -2.2 |

EE | – | – | 25 | 38 | 37 | 37 | – | 48.0 | – |

GR | 102 | 105 | 100 | 89 | 83 | 79 | -22.5 | -21.0 | -4.8 |

IE | 96 | 211 | 294 | 727 | 696 | 590 | 514.6 | 100.7 | -15.2 |

ES | 608 | 571 | 512 | 427 | 413 | 415 | -31.7 | -18.9 | 0.5 |

FR | 1,938 | 1,764 | 1,577 | 1,298 | 1,206 | 1,147 | -40.8 | -27.3 | -4.9 |

IT | 944 | 884 | 854 | 833 | 808 | 785 | -16.8 | -8.1 | -2.8 |

CY | – | – | 409 | 156 | 153 | 143 | – | -65.0 | -6.5 |

LU | 676 | 662 | 586 | 630 | 602 | 554 | -18.0 | -5.5 | -8.0 |

MT | – | – | 17 | 29 | 32 | 33 | – | 94.1 | 3.1 |

NL | 668 | 620 | 484 | 305 | 300 | 297 | -55.5 | -38.6 | -1.0 |

AT | 910 | 866 | 827 | 821 | 806 | 783 | -14.0 | -5.3 | -2.9 |

PT | 228 | 223 | 205 | 169 | 164 | 159 | -30.3 | -22.4 | -3.0 |

SI | – | – | 27 | 28 | 28 | 29 | – | 7.4 | 3.6 |

SK | – | – | 28 | 40 | 43 | 44 | – | 57.1 | 2.3 |

FI | 354 | 362 | 396 | 383 | 370 | 358 | 1.1 | -9.6 | -3.2 |

Euro area** | 9,856 | 9,193 | 8,230 | 8,076 | 7,865 | 7,533 | -23.6 | -8.5 | -4.2 |

BG | – | – | 36 | 36 | 37 | – | – | 2.8 | |

CZ | – | – | 79 | 68 | 67 | 67 | – | -15.2 | – |

DK | 216 | 213 | 206 | 167 | 164 | 164 | -24.1 | -20.4 | – |

LV | – | – | 52 | 74 | 76 | 72 | – | 38.5 | -5.3 |

LT | – | – | 74 | 88 | 90 | 95 | – | 28.4 | 5.6 |

HU | – | – | 238 | 246 | 246 | 251 | – | 5.5 | 2.0 |

PL | – | – | 659 | 714 | 710 | 703 | – | 6.7 | -1.0 |

RO | – | – | 51 | 55 | 55 | – | – | – | |

SE | 179 | 177 | 255 | 212 | 205 | 205 | 14.5 | -19.6 | – |

UK | 556 | 541 | 457 | 422 | 407 | 405 | -27.2 | -11.4 | -0.5 |

EU** | 10,909 | 10,124 | 10,756 | 10,192 | 9,921 | 9,587 | -12.1 | -10.9 | -3.4 |

* For the purposes of the ECB-POLICY-3fdc7763-f2c0-4c30-b494-8614852eaf43>ECB-POLICY-SOURCES-e4bab80d-7aeb-4e49-a29a-ce14e1595c6d>ECB-POLICY-3fdc7763-f2c0-4c30-b494-8614852eaf43>ECB’s monetary and other euro area statistics, the European Investment Bank (EIB) continues to be treated as an institution that is resident outside the euro area.

** Changing composition

Notes:

The number of MFIs has been derived from the ECB-POLICY-3fdc7763-f2c0-4c30-b494-8614852eaf43>ECB-POLICY-SOURCES-e4bab80d-7aeb-4e49-a29a-ce14e1595c6d>ECB-POLICY-3fdc7763-f2c0-4c30-b494-8614852eaf43>ECB’s “List of monetary financial institutions”, which is updated daily on the ECB-POLICY-3fdc7763-f2c0-4c30-b494-8614852eaf43>ECB-POLICY-SOURCES-e4bab80d-7aeb-4e49-a29a-ce14e1595c6d>ECB-POLICY-3fdc7763-f2c0-4c30-b494-8614852eaf43>ECB’s website and is compiled in such a way as to ensure its completeness, accuracy and homogeneity across countries. Its objectives are twofold, namely (i) to serve as the reference reporting population for the compilation of comprehensive and consistent monetary statistics for the euro area and (ii) to serve as a register and a reliable sampling frame for other data collections and for statistical and economic analyses.

Information on MFIs and other financial institutions, including the list of monetary financial institutions and institutions subject to minimum reserves, can be found on the ECB-POLICY-3fdc7763-f2c0-4c30-b494-8614852eaf43>ECB-POLICY-SOURCES-e4bab80d-7aeb-4e49-a29a-ce14e1595c6d>ECB-POLICY-3fdc7763-f2c0-4c30-b494-8614852eaf43>ECB’s website.

________________________________________

[1]“Monetary financial institutions” (MFIs) are central banks, resident credit institutions as defined in Community law, and other resident financial institutions whose business is to receive deposits and/or close substitutes for deposits from entities other than MFIs and, for their own account (at least in economic terms), to grant credits and/or make investments in securities. Money market funds are also classified as MFIs.

[2]The overall increase includes 419 units which resulted from the reclassification of Irish credit unions as credit institutions as of 1 January 2009.

Copyright © for the entire content of this webpage: European Central Bank, Frankfurt am Main, Germany.

Explore more articles in the Finance category