Stocks hold firm even as U.S. yields hit multi-year highs

By Elizabeth Howcroft

LONDON (Reuters) -European stock indexes rose Tuesday and U.S. and European government bond yields extended the previous session’s gains as investors adjusted their expectations for rate hikes following hawkish comments from the U.S. Federal Reserve.

Fed Chair Jerome Powell said the central bank could move “more aggressively” to raise rates to fight inflation, possibly by more than 25 basis points at once.

Markets were recalibrating the higher possibility of a 50 bps hike. On Tuesday morning, money markets were pricing in a 80% chance of a 50 bps hike in May, although this dipped down to 70% around midday.

At 1224 GMT, the U.S. 10-year Treasury yield was at 2.3478%, having hit its highest since 2019.

RBC Capital Markets’ chief U.S. economist, Tom Porcelli, wrote in a note to clients that during the speech “it was easy to wonder if a 75bps hike or even going intra-meeting is possible.”

“Both outcomes seem incredibly extreme but when we hear Powell talk about inflation he comes off as incredibly anxious to us.”

Euro zone government bond yields also rose, with Germany’s benchmark 10-year yield hitting a new 2018 high of 0.526%.

Although Wall Street had closed lower after Powell’s comments, stock markets in Europe rose. The MSCI world equity index, which tracks shares in 50 countries, was up 0.2% on the day.

The STOXX 600 was up 0.4%, having climbed high in recent sessions to reach a one-month high. London’s FTSE 100 was up 0.4%.

Wall Street futures edged higher.

Matthias Scheiber, global head of portfolio management at Allspring Global Investments, said the pickup in stocks could be a case of investors buying the dip, but that growth stocks would struggle if the U.S. 10-year yield moves closer to 2.5%.

“We saw the sharp rise in yields yesterday and we see that continuing today on the long end so that’s likely to put pressure on equities… it will be hard for equities to have a positive performance.”

But JPMorgan said that 80% of its clients plan to increase equity exposure, which is a record high.

“With positioning light, sentiment weak and geopolitical risks likely to ease over time, we believe risks are skewed to the upside,” wrote JPMorgan strategists in a note to clients.

“We believe investors should add risk in areas that overshot on the downside such as innovation, tech, biotech, EM/China, and small caps. These segments are pricing in a severe global recession, which will not materialize, in our view.”

The conflict in Ukraine continued to weigh on sentiment. U.S. President Joe Biden issue one of his strongest warnings yet that Russia is considering using chemical weapons.

Oil prices extended their gains following news that some European Union members were considering imposing sanctions on Russian oil – although Germany said that the bloc was too dependent on Russian oil and gas to be able to cut itself off.

The U.S. dollar index was steady at 98.44 , while the euro was up 0.2% at $1.10325.

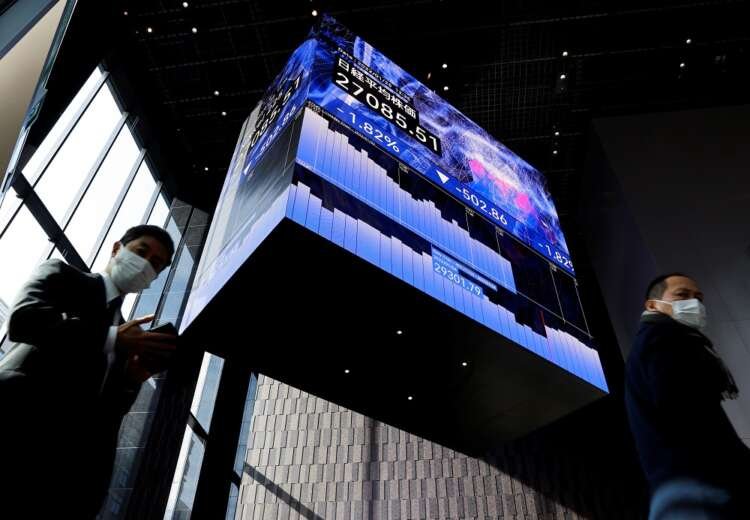

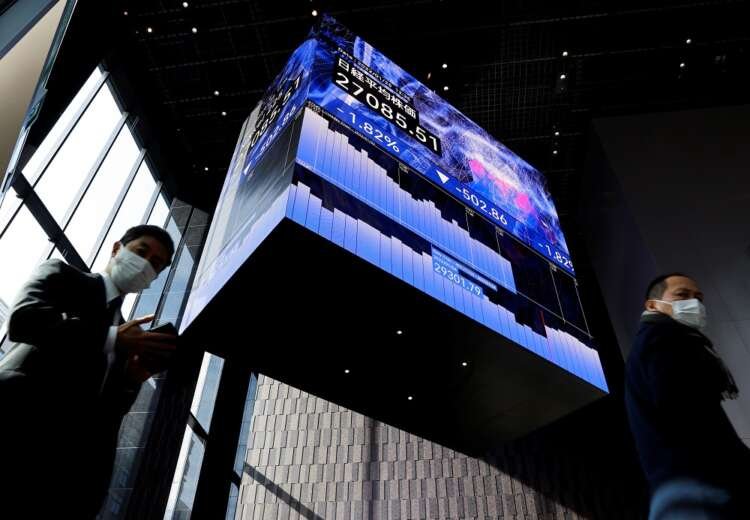

The Japanese yen plunged past the 120 level versus the dollar, hurt by the divergent rate-hike expectations for the United States and Japan.

“The perception that the JPY may become a funding currency rather than a safe-haven unit after the BoJ made it clear that they do not want to hike rates at present has further helped USD-JPY break above the key 120 threshold,” UniCredit said in a client note.

In cryptocurrencies, bitcoin was up 4.4% at around $42,865 .

(Reporting by Elizabeth Howcroft, Editing by William Maclean and Angus MacSwan)

Explore more articles in the Investing category