NEW BEHAVIOURAL FINANCE SOFTWARE LAUNCHED

Published by Gbaf News

Posted on March 13, 2014

4 min readLast updated: January 22, 2026

Published by Gbaf News

Posted on March 13, 2014

4 min readLast updated: January 22, 2026

Clare Flynn Levy

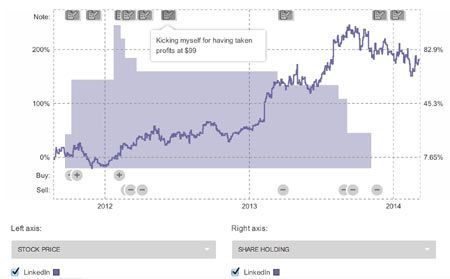

A software program that aims to help fund managers improve their performance by identifying how their own behavioural biases affect trading decisions launched yesterday at the Soho Hotel in London. Essentia Analytics’ decision support software enables fund managers to capture rich data about their own behaviour (from the patterns in the investment decisions they make, to the lifestyle factors such as diet and exercise that may be affecting their performance), and then use that data to improve the productivity and reference ability of their investment processes.

Essentia Analytics was founded by ex-fund manager Clare Flynn Levy, and is based on the principle that a more accurate picture of the past enables better conscious decisions in the future.

Clare Flynn Levy comments:

“We take data that clients are already capturing through their trading systems and enrich it with data about the market context in which those decisions were made, to come up with intelligent insights about how a given fund manager performs over time. We act like a digital mirror for fund managers to understand why they did what they did, empowering them to change or repeat that behaviour going forward. We also enable our users to add data on their physical and emotional states into the mix, to shed even more light on how they can maximise their investment skill. It’s a feedback loop, similar to how an athlete would be constantly looking back on data to improve performance.”

Alongside the software, Essentia Analytics has created a Certified Coaching Partners Programme, working with the world’s top fund manager and trader coaches, to assist fund managers in converting the behavioural insight they glean from the software into behavioural change.

“More and more fund managers and traders are realising that coaching is a competitive advantage, rather than just a remedial measure – after all, in this day and age you don’t find professional athletes who win without the help of coaches. Essentia helps coaches deliver measurable results.”

The software is already being used by portfolio managers at Man Group, the world’s biggest publicly traded hedge fund manager, and Artemis Fund Managers, among others.

Yesterday’s launch, attended by over 50 fund managers, finance professionals, neuroscientists and leading behavioural finance academics, involved a demonstration of the software alongside talks by behavioural finance thought leader Professor Mark Fenton O’Creevy from Open University Business School and Dr. Tara Swart, a neuroscientist and psychiatrist turned leadership coach.

Professor Mark Fenton O’Creevy commented:

“Effective management of emotions is not the same as suppressing or avoiding them. In fact, the best emotion regulators on a trading floor are people who are really aware of what’s going on with their emotions and have the capacity to notice it rather than get caught up in it.

“While people learn these emotional regulation capacities as part of their professional expertise, there’s also a lot of evidence that these kinds of capacities can be trained and supported.”

Dr. Tara Swart commented:

“We need to be more aware of biology – what it’s making us do and how it’s making us think – and then to regulate that, not only on an individual level, but also at a company level. Once you’ve raised awareness of what it is that effects your thinking, it’s about focusing attention on it, looking for opportunities to use the desired behaviour rather than the bad habit, then deliberate practice or repetition of the desired behaviour.”

Clare Flynn Levy concludes:

“All professional investors share a fundamental problem: they are selling skill, but getting paid for performance. Unfortunately, the two are not the same. Performance is not a measure of skill – it’s a measure of outcome.

“Skill is a function of the decisions we make, both consciously and subconsciously. Conscious decisions can be improved by implementing process in a disciplined way. Subconscious decisions are trickier to detect – sometimes they are the secret of our success and sometimes they are our own worst enemy. Maximising investment skill is possible through deliberate practice; Essentia makes deliberate practice simple.

Explore more articles in the Investing category