HOW FINANCIAL SERVICE COMPANIES DEAL WITH INCOMING COMMUNICATIONS

Published by Gbaf News

Posted on March 24, 2014

5 min readLast updated: January 22, 2026

Published by Gbaf News

Posted on March 24, 2014

5 min readLast updated: January 22, 2026

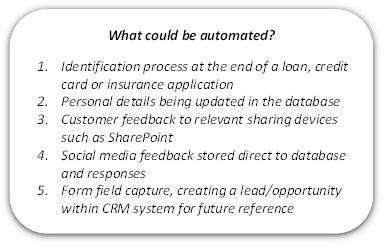

Author: Howard Williams, Marketing Manager, Email2DB

With many financial services brands fighting for customers’ business in loans, mortgages, insurance and credit cards by offering ever lower rates and slicker online application processes – you would expect the backend to be equally slick, yet behind this is an army of personnel manually checking paperwork. Likewise with communications into the firms growing via digital channels – email, social media and web forms – the internal processes are anything but digital, often printed out and put on staff desks to action. It’s a repetitive automation challenge that is often missing or forgotten in the drive for Business Process Automation and great efficiencies in today’s FS sector.

How Fincancial Service Companies Deal With Incoming Communications

Banks, especially, suffer in the application process, they experience a customer drop-off rate post application of up to 30% for credit card and loan applications – worth £billions – where applications are started but never completed (similar to abandoned basket syndrome in the retail/ecommerce sector). This is due to paper bureaucracy, incompetence, items lost in post, simple errors and laziness from the applying person – not to mention the length of time it can take. With one simple error on a credit card application, a customer could have to send ID via post and go through a lengthy, troublesome process. As newer banks are so focused on the online channel you might think they are focussed on the online tech. Not so. With no branches, they encourage customers online towards self-service, rather than the phone. Comms automation coupled with live online chat is a massive missed opportunity here as an efficient customer service and sales conversion channel.

Loan, credit card and mortgage applications all allow online form filling, but behind this is lots of offline manual checking and paperwork which can take weeks and waste time. A simple credit history check against name and addresses and ID confirmation is usually all that is required, and can be achieved digitally without paper. A way to streamline this online-offline process and automate comms process will help banks speed up decisions, while maintaining security, and most importantly in the competitive landscape, improve the customer experience.

For example, a loan application could work in the following way, quickly, simply – and automated. The customer completes the online form, an email is generated to send ID in or upload via online live chat, approved by operator there and then, upload details straight to customer database (no re-keying required), and send to fraud for checking if applicable. Then a text is sent to the customer explaining the process – it’s in progress, someone will be in touch in next 48 hours, after that the money will be in their account within 48 hours. If there are missing ID, or fraud questions, it is marked on the database, generating a text asking the customer to call in for a chat.

Modern banks and FS firms want to engage with customers and encouraging them to get in touch via emails, website and social media – and using a variety of devices – seems quite ‘cool’. Yet systems need to be in place to deal with them. Often they are similar, repetitive questions such as product queries or branch opening hours and standard automated replies here are ideal. Contact centres can be easily resourced to deal with non-standard responses via live chat, calls or online. In addition, when an IT outage or technical issue occurs which prevents cards being used or online banking access – and these seem to happen quite regularly! – All these channels become flooded with customer enquiries and having a scalable response mechanism is an important disaster mitigation process.

The key to automating incoming comms is to use a standardised format – the customer application form must be setup in a way for the system to read and action against the live database. In addition, automating the process of changing customer details frees up staff for other duties and cuts cost. For example, in the insurance sector, once in the customer login area they could upload proof of no-claims bonus and change car details, then any premium adjustment can be automated without the need to speak to an agent. Similarly in online banking customers could login and change address details, which link to the live database and auto-send a confirmation email. Here, if anything suspicious occurs, such as changing addresses too often (rules can be configured to flag this automatically), it can be escalated to the fraud team for checking.

The key to automating incoming comms is to use a standardised format – the customer application form must be setup in a way for the system to read and action against the live database. In addition, automating the process of changing customer details frees up staff for other duties and cuts cost. For example, in the insurance sector, once in the customer login area they could upload proof of no-claims bonus and change car details, then any premium adjustment can be automated without the need to speak to an agent. Similarly in online banking customers could login and change address details, which link to the live database and auto-send a confirmation email. Here, if anything suspicious occurs, such as changing addresses too often (rules can be configured to flag this automatically), it can be escalated to the fraud team for checking.

Why are FS firms not automating their customer applications and comms systems? Well some already are, but there are a number of reasons why lots are not (yet):

In the current climate with the pressure on firms to cut costs and boost efficiencies, it is only a matter of time though. These institutions are certainly more prepared to look at further ways to automate than they have ever been before.

Explore more articles in the Finance category