Efficient Cloud Migrations for Financial Services

By Brian Adler is senior director of cloud market strategy at Flexera and was previously a senior director analyst at Gartner.

Financial service organizations are facing a time of great change and opportunity. They’re moving away from legacy infrastructure and embracing the transformational capabilities of cloud technologies. Their cloud migrations make vast amounts of data available for new tech that will help them maintain their competitive edge, especially as they face growing pressure from challengers and new FinTechs—banks born in the cloud.

Financial service organizations are facing a time of great change and opportunity. They’re moving away from legacy infrastructure and embracing the transformational capabilities of cloud technologies. Their cloud migrations make vast amounts of data available for new tech that will help them maintain their competitive edge, especially as they face growing pressure from challengers and new FinTechs—banks born in the cloud.

As Jamie Dimon, chairman and chief executive officer of JPMorgan Chase, wrote in his 2020 letter to shareholders, refactoring and re-platforming banks’ data “makes data enormously valuable and digitally accessible [for applications such as artificial intelligence and machine learning]. All of this work takes time and money, but it’s absolutely essential that we do it.”

Not only is that work essential, it’s essential that the migration to cloud is done efficiently, with an eye toward cloud cost optimization that helps streamline operations—immediately and in the long-term. But that isn’t always happening. What’s going on and how can financial institutions improve their cloud migration goals?

Trends in Cloud for Financial Services

The trend toward cloud within financial services has been clear in recent years; COVID-19 added momentum. As found in the Tech Spending During COVID-19: The Road to Normalcy in 2021 report from financial services research and advisory firm Celent, one of the key trends impacting banks as a result of the pandemic is “an acceleration of digital transformation and cloud migration timeline by around 2 years.” Many are “reinvesting into digital customer experience” and into improving some of the shortcomings “in digital delivery” that the pandemic highlighted.

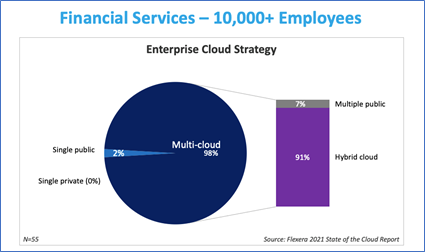

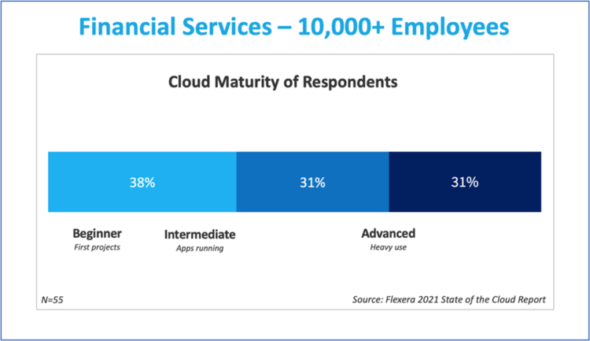

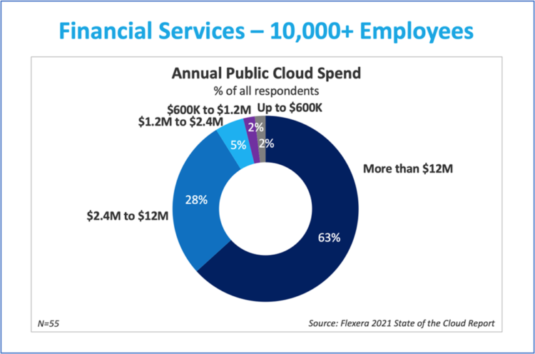

When evaluating financial services organizations against other organizations of comparable size and across industries, noteworthy trends appear. As found in the Flexera 2021 State of the Cloud report, financial services organizations:

Cloud Cost Optimization for Financial Services

Clearly financial services organizations have many good reasons to move to the cloud, including tapping into the power of AI/ML, enhancing customer experiences, improving operational efficiencies, launching innovative initiatives, and more. But having a lot of use cases that are good fits for cloud technology can mean that a lot of data and workloads are thrown there quickly. This can lead to significant waste of cloud expenditures. Today, public cloud spend is over budget by an average of 24% and predicted to increase in the coming year, according to the Flexera 2021 State of the Cloud report.

Consider these guidelines as part of your organization’s cloud initiatives:

Moving to the cloud is a must today for financial services. Struggling to handle cloud initiatives—and expenses—doesn’t need to be part of the equation.

This is a Sponsored Feature

Explore more articles in the Technology category