CHANGING ATTITUDES TO MOBILE WARRANTIES MEANS NEW OPPORTUNITIES FOR BUSINESSES

Published by Gbaf News

Posted on June 18, 2014

4 min readLast updated: January 22, 2026

Published by Gbaf News

Posted on June 18, 2014

4 min readLast updated: January 22, 2026

Inhance Technology CEO, Paul Prendergast, outlines the warranty implications of new research findings for wireless retailers, insurers and carriers.

The explosion in tablets and smartphones is well documented, but new research suggests that warranties offered by many retailers, carriers and insurers have not kept up. Warranties are an important added revenue stream but in the past may have been something of a hard sell for business. That is changing dramatically, but not only because of the cost of today’s sophisticated smartphones and tablets but because of how the lives of today’s consumers are wrapped up in their mobiles.

The main story is that just over one in five (21%) UK mobile users are more worried about being mugged for their smartphone or tablet than they were 12 months ago. This compares to 27% in the US. Over a quarter (26%) of women feel more vulnerable, and 30% of young adults (18-34) are more worried about being mugged for their mobile device than a year ago.

Paul Prendergast, CEO, Inhance Technology. Photo courtesy of Irish Examiner

From a business perspective the body of the research contains interesting data. This reveals not only consumer attitudes to buying wireless warranties but the age group and gender most interested. The study emphasises that these days users are connected to their mobile like an umbilical cord.

Despite the cost of today’s sophisticated smartphones and tablets, almost three quarters (74%) of users believe that the content on their mobile device is as valuable as the phone or tablet itself. Women (78%) value their content more than men (69%), while young adults aged 18-34 (86%) are most likely to recognise the value of content in their mobile device.

There are two implications of this for the industry. First, with the right product retailers and providers are pushing an open door in terms of the added value warranty sale; and second, the days of selling a warranty that covers the device only and not content are numbered.

In many cases the mobile industry is still offering outdated warranties which were relevant to the entry level function phone – not today’s extra smart devices. Basic warranties have not kept pace with technology advances or indeed consumer needs.

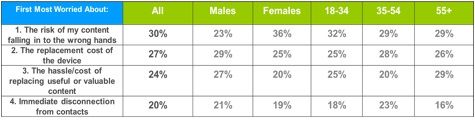

Table A below shows that today’s smart consumers are more worried about content on their mobiles falling in to the wrong hands than they are about replacement cost. Females (36%) are particularly concerned. Almost three quarters have worries other than replacement cost, which reflects the fact that they are carrying their lives in their pocket from sensitive email to contact information and critical ID data.

Table A:

The research finds that almost half (46%) of users are more likely to buy mobile device insurance if it includes an app to protect content. It is significant from an industry perspective that 57% of young adults (18-34) are most likely to buy mobile device insurance if it includes a security app. See Table B.

The research finds that almost half (46%) of users are more likely to buy mobile device insurance if it includes an app to protect content. It is significant from an industry perspective that 57% of young adults (18-34) are most likely to buy mobile device insurance if it includes a security app. See Table B.

Table B:

The survey suggests that users are increasingly open to advanced warranty programs. Next generation warranties provide users with the ability to immediately lock the device (including by sending an SMS from a friend’s phone); locate the device in real-time; capture a picture of the potential thief; sound an alarm to deter a potential thief; wipe important data plus incorporate malware protection and back-up of contacts.

The survey suggests that users are increasingly open to advanced warranty programs. Next generation warranties provide users with the ability to immediately lock the device (including by sending an SMS from a friend’s phone); locate the device in real-time; capture a picture of the potential thief; sound an alarm to deter a potential thief; wipe important data plus incorporate malware protection and back-up of contacts.

There are benefits too for the retailer, insurer and carrier in providing advanced warranty programs. For example, next generation warranties have been shown to boost consumer loyalty and reduce churn. They also include back office facilities that help to combat fraud.

The research is good news for those business providers that can adapt to the wishes of today’s smart consumer.

Explore more articles in the Technology category