Capital One’s Virtual Assistant Eno Now Lets Cardholders Create Virtual Card Numbers in Their Browser

Published by Gbaf News

Posted on November 14, 2018

5 min readLast updated: January 21, 2026

Published by Gbaf News

Posted on November 14, 2018

5 min readLast updated: January 21, 2026

brought to you by Future Digital Finance 2019, WBR Insights

Capital One wants to make the online shopping experience for its customers safer and is turning to its popular virtual assistant Eno to make it happen.

Eno has been available to Capital One customers for well over a year already. A gender-neutral natural-language SMS chatbot, Eno helps Capital One credit card and bank customers quickly access their account balance and recent transactions or even pay off their credit cards simply by sending Eno a text message. Designed to be a financially-savvy text buddy, Eno has many other useful features as well, such as enabling users to check their available credit and credit limit, pay bills, and now – by way of a desktop browser extension – use virtual card numbers for ecommerce purchases.

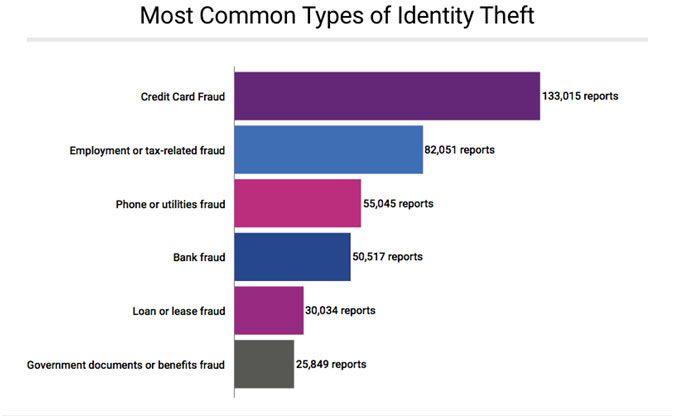

Credit card fraud is the most common type of identity theft in the US, according to recent research by Experian, which notes that there were 133,015 reports of the crime in 2017. It occurs when account information – including credit card numbers – are stolen and used to make fraudulent purchases, usually online.

(Image source: experian.com)

Most (73%) Americans are now concerned about their ability to protect their card information while making purchases online and, as a result, are only shopping on a handful of sites that they know and trust.

As such, Capital One is trying to give its customers greater control and security over their online shopping activities through Eno. The plug-in works with the Google Chrome and Firefox web browsers, and allows Capital One customers to make online purchases from ecommerce sites without using their real credit card numbers.

Once downloaded as a browser extension, Eno automatically detects when a user is visiting an online merchant’s checkout page and is ready to make a purchase. At this point, a popup appears, providing cardholders with a “virtual credit card number”. This number is for temporary use only. It also comes with a virtual expiry date for the card and a virtual security code. These numbers, dates, and codes are then used in place of the customer’s actual card information during purchase.

The idea is that customers can still spend money on their credit cards, but without handing over their actual, sensitive information.

Eno users retain the option of abandoning their purchase, and can even ignore the popup and continue using their plastic card’s real information if they so wish.

And there are other benefits that come with Eno’s virtual credit card numbers, too. For instance, Eno can instantly serve up unique, merchant-specific virtual card numbers which are then saved for ongoing and future payments – saving users time if they regularly buy from the same sites.

It can also help Capital One customers avoid paying for subscriptions that they no longer want. All virtual credit card numbers that are created can be locked and unlocked via an online dashboard, meaning customers can effectively turn down recurring payments. For example, if a customer signed up for a free trial, but had to input a credit card number in order to do so, they can simply use a virtual credit card number during sign-up, and then lock it immediately. This way, they no longer have to remember to cancel the subscription further down the line – instead, when it’s time for the subscription to be paid, it just simply won’t be, as the virtual credit number is now locked.

Using Eno also makes it easier for customers to grant third parties – perhaps a friend, child, or employee – access to their credit card account in a controlled manner. Rather than parting with the actual credit card or the sensitive information associated with it, customers can simply hand over a virtual credit card number and expiration date, which will only work as long as the card owner wants them to. At any point, the cardholder can lock or delete the virtual number with a single click – no need to change the card or call the issuer – and the account is safe from unauthorized charges.

As online shopping becomes a more and more important aspect of consumers’ lives, concerns for the security of our financial accounts are increasing. The challenge for banks and financial institutions is to keep their customers’ money safe without compromising on the convenience offered by online commerce.

Capital One’s Eno seeks to improve both security and convenience with its new browser extension. Even when customers update their actual credit card numbers in the future – either due to the card expiring, a fraud concern, or another account change – all virtual credit card numbers already set up will be automatically mapped to the new account, and customers will still earn rewards whether using their real credit card numbers or virtual ones.

Going forward, Capital One plans to extend support to more browsers beyond Chrome and Firefox. Capital One will also add more features, including the ability to set transaction limits and time limits on specific merchant cards, as well as the ability to create virtual cards for one-time use.

You can hear Joe Whitchurch, Head of CreditWise from Capital One, speak at Future Digital Finance 2019 this coming February at the Omni Amelia Island Plantation Resort, Amelia Island, FL.

Download the Agenda for more information and insights.

Explore more articles in the Finance category