AI-Driven Finance: The CFO Who Replaced Guesswork With Machines

Published by Barnali Pal Sinha

Posted on February 10, 2026

3 min readLast updated: February 10, 2026

Published by Barnali Pal Sinha

Posted on February 10, 2026

3 min readLast updated: February 10, 2026

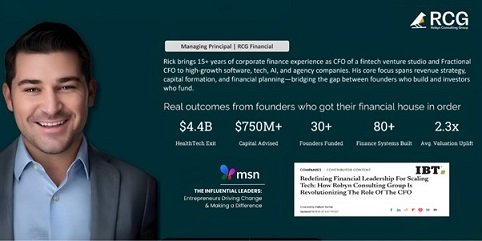

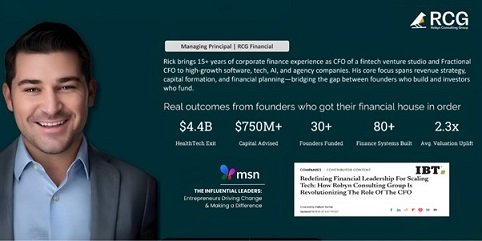

Photo credit: Richard Sanchez

Tech-enabled businesses are entering a moment where finance can no longer sit quietly in the background. Companies move quickly, markets shift fast, and founders need clarity that looks ahead rather than behind them. Predictive finance, strengthened by AI tools, is becoming a practical requirement as 2026 approaches.

Richard Sanchez, Principal and CEO ofRobyn Consulting Group, recognized this change early. His experience with a startup failure led him to rethink the role of finance in guiding young companies. That realization shaped his approach to strategic finance and inspired a model built for founders who need forward-focused insight that keeps pace with real operations.

Historical reports help companies understand what has already happened, but they do little to support decisions in motion. Traditional accounting teams excel at organizing past activity, yet their work offers limited visibility into where the business is heading.

Founders often discover financial concerns only after a negative trend has unfolded. In a competitive environment, this delay can constrain growth or shorten the runway, especially when capital planning and operational strategy must shift in tandem.

The role of the CFO has evolved. Instead of focusing solely on compliance, modern finance leaders operate as strategic partners. They evaluate scenarios, assess risks as they form, and guide product and operational decisions with financial clarity.

This approach defines the work ofRobyn Consulting Group. Their emphasis on live forecasting, practical modeling, and real-time strategic input reflects a shift toward Finance-as-a-Service for high-growth companies that want to move with intention.

AI enables finance teams to model shifting conditions with greater accuracy. Instead of waiting for monthly reports, founders receive continuously updated forecasts, along with cash flow views and unit economics that respond to real-time variables.

Tools that once belonged to Fortune 500 companies now support businesses generating between $2M and $50M in revenue. This access helps leadership teams make more confident decisions about hiring, pricing, capital allocation, and investor preparation while maintaining momentum.

Decision-making speed strongly influences whether a company keeps momentum or stalls. AI-supported finance reduces much of the uncertainty around strategic decisions, helping founders respond more quickly to changing markets or internal challenges.

This is especially important for SaaS, fintech, and digital-first service companies, where small operational shifts can affect key financial indicators and influence long-term valuation.

AI-supported finance is steadily becoming a marker of preparedness. Companies using predictive tools gain clearer visibility, stronger controls, and more effective investor positioning. Richard Sanchez shares this perspective onLinkedIn and continues to highlight how strategic finance can strengthen a company’s long-term direction.

Businesses preparing for 2026 face rising expectations from investors, customers, and competitive markets. Those who rely only on historical reporting are already at a disadvantage. Predictive finance offers founders a practical way to move with more accuracy and confidence as they shape the next stage of growth.

For additional insight into the shift toward modern financial leadership, explore thisIBTimes feature.

If predictive finance helps your competitors move with sharper clarity, the real question becomes how long you can afford to operate without it.

The CFO, or Chief Financial Officer, is responsible for managing a company's financial operations, including financial planning, risk management, record-keeping, and financial reporting.

AI in finance refers to the use of artificial intelligence technologies to analyze data, automate processes, and enhance decision-making in financial services.

Finance-as-a-Service (FaaS) is a model that provides financial services through cloud-based platforms, allowing businesses to access financial tools and resources on demand.

Explore more articles in the Technology category