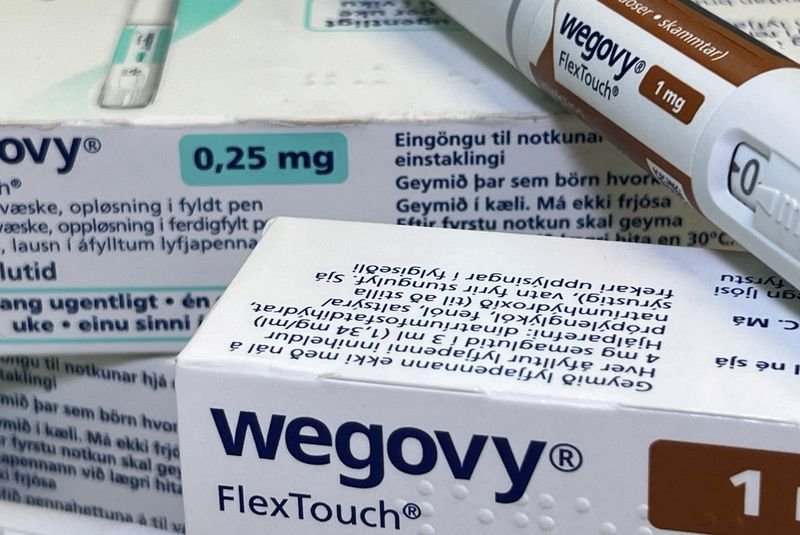

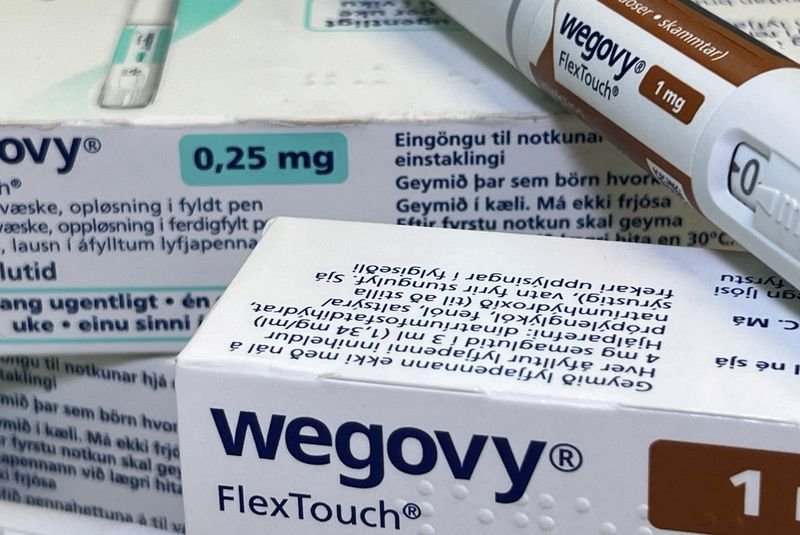

Wegovy maker Novo Nordisk says surging growth driving emissions higher

Published by Global Banking & Finance Review®

Posted on February 5, 2025

2 min readLast updated: January 26, 2026

Published by Global Banking & Finance Review®

Posted on February 5, 2025

2 min readLast updated: January 26, 2026

Novo Nordisk's emissions rose 23% in 2024 due to increased Wegovy production. Despite this, the company aims for net zero by 2045, with interim targets for 2033.

By Maggie Fick and Alison Withers

LONDON/COPENHAGEN (Reuters) - Novo Nordisk emissions grew 23% in 2024, the company said on Wednesday, and will keep rising through the end of the decade as it boosts production of blockbuster obesity drug Wegovy.

The company is spending billions to ramp up its Wegovy output as demand soars.

"Emissions come with growth," said Katrine DiBona, corporate vice president of global public affairs and sustainability at Novo Nordisk, told Reuters in an interview.

The Danish drugmaker said however its expansion plans do not change its commitment to the 2045 net zero emissions goal it set in 2021.

In its annual report published with its fourth-quarter financial results on Wednesday, it also announced an interim target to cut its Scope 3 emissions by 33% by 2033 from a 2024 baseline.

Scope 3 emissions - which include those from all suppliers in a company's supply chain - account for 96% of Novo's overall total.

Novo Nordisk's plans to cut emissions include converting to lower-carbon materials where possible, and setting expectations for suppliers to use green power for deliveries.

DiBona said some levers will not be available for some years, which is why the company expects emissions to keep rising until 2030. "It will be worse before it gets better. And that’s also super important for us to be very transparent on that."

Experts said the company's interim target seemed unrealistic, since it was not decoupling growth from emissions.

"Sounds like a fairy tale," said Sasja Beslik, chief investment strategy officer at asset manager SDG Impact Japan, in response to the targets.

Beslik said companies generally do not suffer reputational risk for setting climate targets and failing to reach them.

"The sustainability angle is not part of the valuation of the stock and has no bearing on financial results, unfortunately."

Novo previously reported a 55% increase in emissions from 2022 to 2023, but revised its emissions accounting to restate the 2023 data.

(Reporting by Maggie Fick in London and Alison Withers in Copenhagen; Editing by Jan Harvey)

The article discusses Novo Nordisk's rising emissions due to increased production of its obesity drug Wegovy.

Scope 3 emissions include all indirect emissions from a company's supply chain, accounting for 96% of Novo Nordisk's total emissions.

Novo Nordisk aims to achieve net zero emissions by 2045 and reduce Scope 3 emissions by 33% by 2033.

Explore more articles in the Headlines category