Analysis-France's latest pensions battle could ignite fresh political crisis

Published by Global Banking & Finance Review®

Posted on February 18, 2025

4 min readLast updated: January 26, 2026

Published by Global Banking & Finance Review®

Posted on February 18, 2025

4 min readLast updated: January 26, 2026

France's pension reform, raising the retirement age to 64, faces renewed scrutiny. An audit may reignite political tensions and impact Macron's government.

By Leigh Thomas

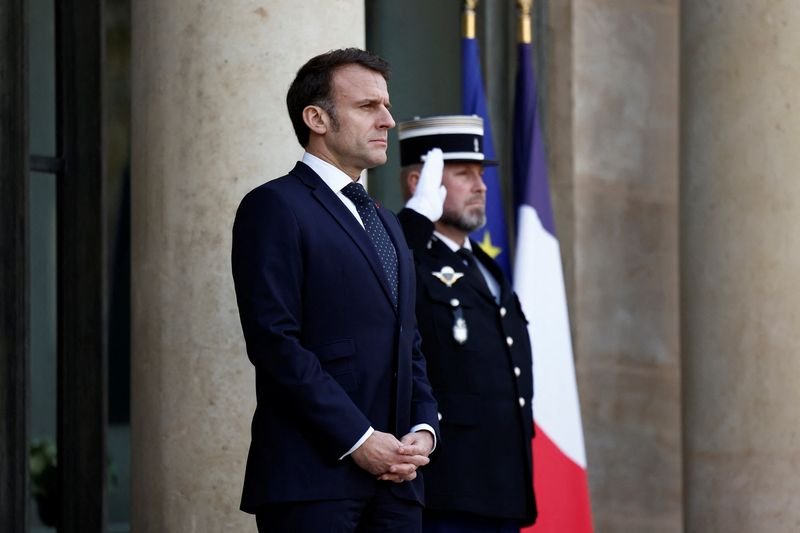

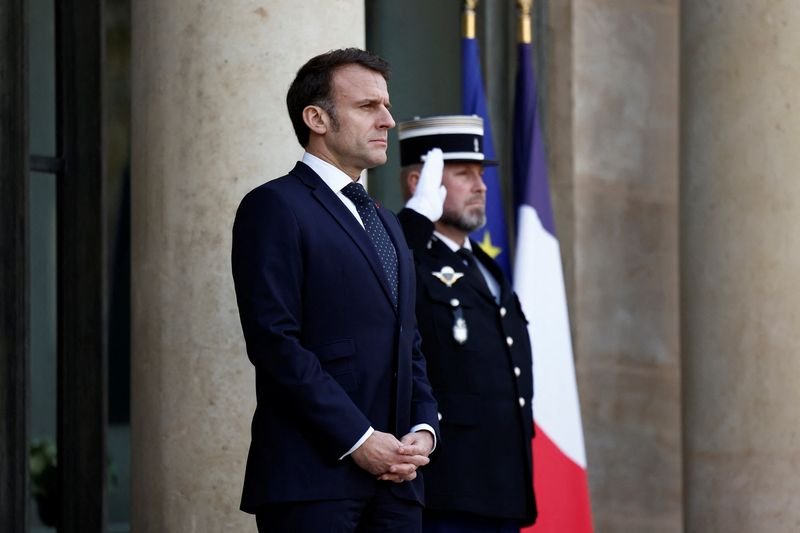

PARIS (Reuters) - President Emmanuel Macron braved strikes and street protests to force through a deeply unpopular reform in 2023 raising France's retirement age by two years to 64, saying it was the only way to keep the generous but costly pension system afloat.

Now an assessment this week by the country's independent public audit office on the size of the pension deficit could rekindle debate about the divisive reform and plunge Macron's fragile, debt-laden government back into crisis.

Francois Bayrou, Macron's latest prime minister, requested the audit office's definitive judgement of the shortfall - estimates of which range from 6 billion to 45 billion euros after he offered to renegotiate the pensions overhaul in exchange for support from Socialist lawmakers.

Unions and opposition parties from the left and far right want Macron's signature reform scrapped.

As part of his offer, Bayrou, a long-time debt hawk, asked employers and unions to form a "conclave" to design a more acceptable reform.

He also weighed in with his own view on the pension shortfall, estimated at 6 billion euros ($6.3 billion) by the independent pension advisory council.

Bayrou said the actual gap between contributions from workers and employers and payouts was as much as 45 billion euros annually, disregarding taxpayer-funded subsidies that are used to narrow the deficit.

If the public audit office concurs on Thursday with Bayrou's estimate of a larger shortfall, it could undermine the left's argument that France can afford to reverse the increase in retirement age and likely reassure investors fretting about the state of France's rickety public finances.

Many economists consider raising the pension age an essential move to adapt the country's public finances to a rapidly ageing population.

However, if the auditor judges the shortfall to be in line with the advisory council's estimates, it will likely embolden those pushing to lower the retirement age, bringing the pensions debate back to the forefront of French politics.

Jean-Daniel Levy, from pollster Harris Interactive, said the pensions issue could plunge France back into chaos.

France's biggest union, the moderate CFDT, has already said it will abandon the talks if they're based on the bigger shortfall.

"We won't be there if it's a fake presentation of the pension system's finances," CFDT head Marylise Leon told France Info radio earlier this month.

Meanwhile, employers' federations are cautious about any changes that would leave them paying more into the pension pot.

HIGH STAKES TALKS

The stakes are high for Bayrou, who has already survived five no-confidence motions. He had to make billions of euros in concessions to get the 2025 budget approved after failure to pass the legislation led to the ouster of his predecessor, Michel Barnier.

Investors, ratings agencies and Paris' European Union partners - wary after France's budget deficit spiralled out of control in the last two years - are closely watching the talks for signs the pension system's finances could come out weaker.

"It's going to be an extremely complicated discussion given the constraints, socially, financially, and politically," Moody's senior credit officer Olivier Chemla told Reuters.

"Any change deteriorating or reducing fiscal sustainability would be credit negative," he added.

Bayrou has said that while all options were on the table for tweaking the 2023 reform, any amendments must not leave the pension system in worse financial shape.

Changes to the pension system are highly sensitive as many are deeply attached to the principle that payroll contributions from workers fund payouts to retirees.

In reality, workers and employers' payroll contributions only cover part of the pension payouts.

"The system is two thirds based on an insurance model and one third subsidised by the state. We can accept that, but it means that our (2023) retirement reform was insufficient," said lawmaker and former finance minister Antoine Armand, calling for a role for private pension funds in the financing.

Some French pensioners doubted talks to rework the reforms would lead to much.

"Company bosses don't want to pay a cent more and it's not the prime minister who is going to look out for small people," retired bank employee and union activist Renee Barbillon, 72, said. "They used to say that when you want to kill off a debate you create a commission."

($1 = 0.9593 euros)

(Reporting by Leigh Thomas; Editing by Gabriel Stargardter and Emelia Sithole-Matarise)

The current retirement age in France has been raised to 64 years as part of a reform implemented in 2023.

Estimates of the pension deficit in France range from 6 billion to 45 billion euros, according to various assessments.

Unions and opposition parties are calling for the scrapping of Macron's pension reform, with the CFDT union stating it will abandon talks if based on the larger shortfall.

The public audit office's assessment could either support the argument for reversing the retirement age increase or embolden those advocating for its retention, impacting the political landscape.

Economists suggest that raising the pension age is essential for adapting France's public finances to an aging population, while any changes that worsen fiscal sustainability could be seen as credit negative.

Explore more articles in the Headlines category