Virtual dollar cards without limits: an overview of the top 3 services in 2025

If you've ever tried paying for subscriptions, online courses, or anything abroad, you've likely faced the frustrating situation of your card not being accepted. Banks block transactions, impose limits, and set restrictions, not to mention the hassle of constantly topping up your balance. Plus, many...

If you've ever tried paying for subscriptions, online courses, or anything abroad, you've likely faced the frustrating situation of your card not being accepted. Banks block transactions, impose limits, and set restrictions, not to mention the hassle of constantly topping up your balance. Plus, many cards don't support dollar payments without extra conversion fees.

Virtual dollar cards are a game-changer. They let you pay for purchases online, use international services, and bypass the restrictions imposed by traditional banks. Most importantly, they’re perfect for anyone who values convenience and flexibility.

But what does "without limits" really mean? It’s not just a phrase. It means no worrying about spending caps, unexpected fees, or payment declines. These cards are ideal for active users who frequently make dollar-based purchases.

The market is full of options, but not all of them meet modern needs. The main priorities are convenience, security, and support for popular payment systems.

Pay attention to factors like ease of top-ups, cryptocurrency support, and regional availability. For example, some services restrict access for users in certain countries.

It’s also essential that the card works with major platforms like marketplaces, advertising platforms, official app stores, and services. If a service offers additional features like expense analytics or multi-currency support, that’s a bonus.

Below, we’ll review three services that provide optimal payment solutions in 2025: PSTNET, LinkPay, and Pyypl.

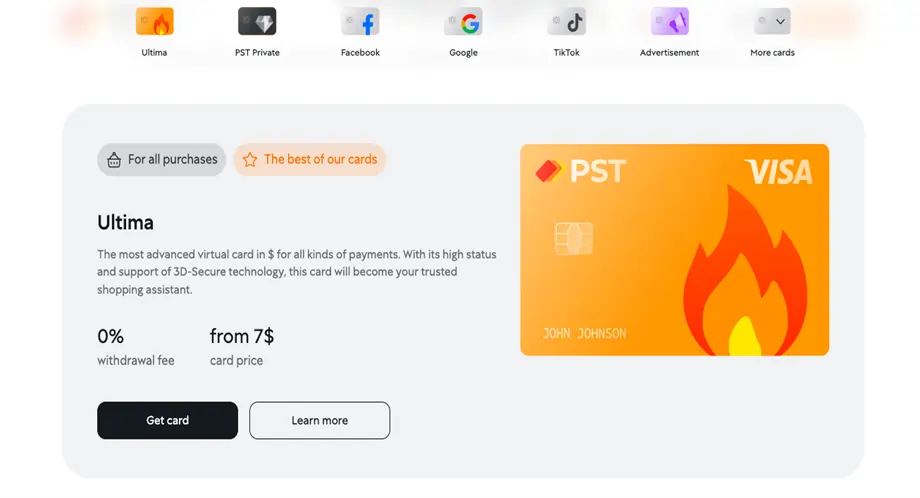

Ultima is a virtual card powered by Visa and Mastercard. Its standout feature is multi-currency functionality, offering accounts in both dollars and euros.

The main highlight of Ultima is its lack of restrictions. You can spend as much as you need, whenever you want. There are also no limits on the number of virtual payment cards you can create on the PSTNET platform. This makes the service an excellent tool for managing finances, such as separating expenses into different categories.

Additionally, Ultima attracts users with minimal fees. Card transactions are fee-free, and topping up costs just 2%. If you need to withdraw funds, you can do so in USDT without any additional charges.

Key benefits:

LinkPay offers virtual cards under the Omni brand. This credit card provides 3% cashback on expenses. The cards are powered by Visa and Mastercard.

The platform’s intuitive interface simplifies payments and makes it easy to use the service. One of its major advantages is the absence of spending limits. However, there is a fee structure. Topping up costs 1% of the amount, and transactions incur a 2% fee. For users with monthly spending over $50,000, these fees are waived, but you’ll need to subscribe to the Ultra plan to unlock these and other perks.

Key benefits:

Pyypl offers virtual prepaid cards accepted at millions of stores worldwide. These Visa-powered cards come with no overall spending limits, making them ideal for long-term use. However, single transactions are capped at $1,000. There’s also a fee structure, with each transaction costing 2.99% of the amount.

Key benefits:

Limits are always inconvenient, especially if you frequently shop or deal with large amounts of money. Unlimited cards let you forget about restrictions and focus on what really matters.

Among the best solutions in 2025 are PSTNET, LinkPay, and Pyypl. These services offer cards with minimal fees, extensive top-up options (including cryptocurrencies), and high security thanks to 3D Secure. Each service has its unique strengths: PSTNET’s lack of limits and zero fees, LinkPay’s cashback, or Pyypl’s app-based card management. All these virtual cards make international payments simple and accessible from anywhere in the world.

Explore more articles in the Finance category