The latest research report from Siemens Financial Services indicates Manufacturers face countdown to gain competitive advantage from Industry 4.0

Published by Gbaf News

Posted on April 23, 2019

5 min readLast updated: January 21, 2026

Published by Gbaf News

Posted on April 23, 2019

5 min readLast updated: January 21, 2026

Siemens Financial Services (SFS) has released a new research paper which estimates the ‘tipping point’ at which half of manufacturers will have substantially migrated to Industry 4.0 production platforms.

Commercial benefits of Industry 4.0 adoption

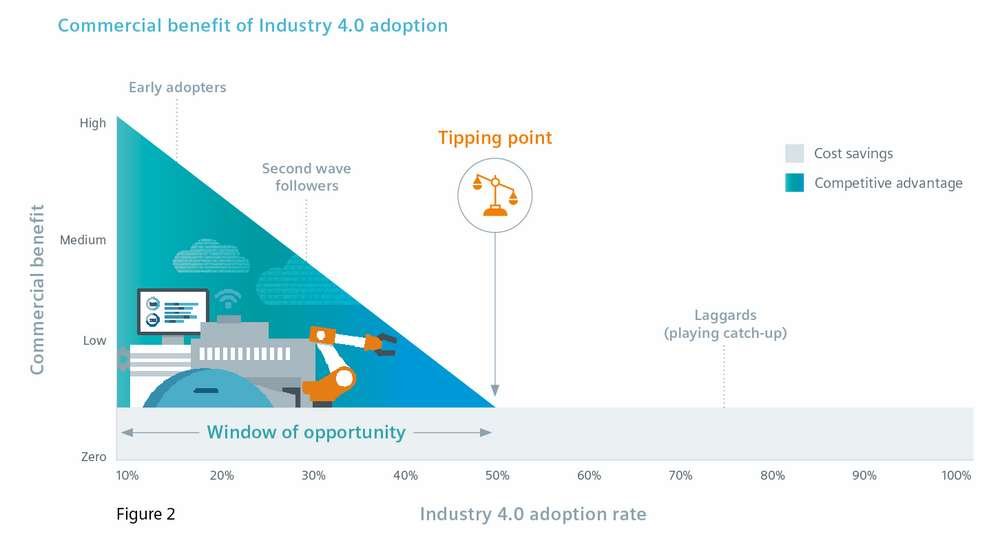

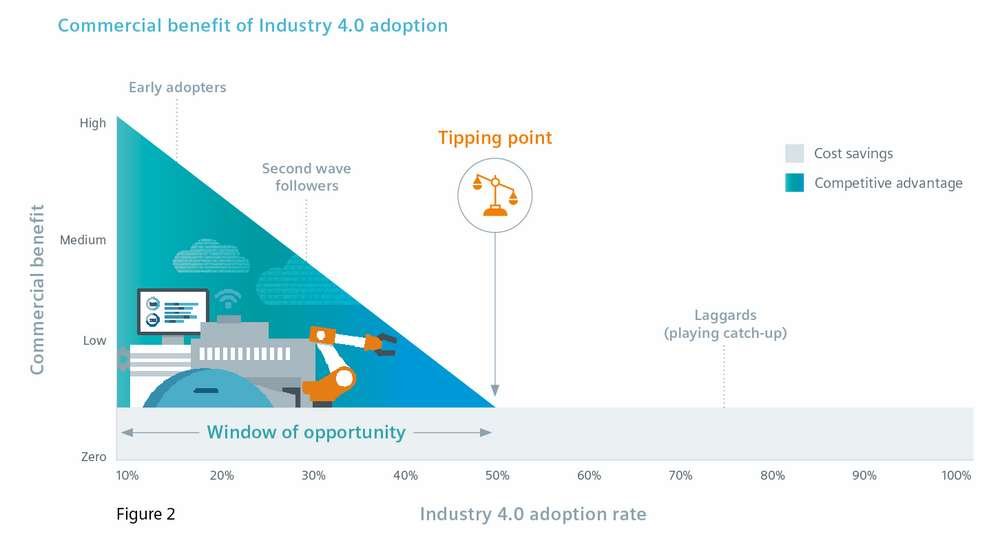

The key question relating to digital transformation in the manufacturing industry has ceased to be one of ‘whether’ to invest in transformation but rather ‘when’. Previous research from SFS has found that the potential financial value of digitalisation is estimated to be between 6.3 percent and 9.8 percent of total annual revenue by 2025 . In most marketplaces, early movers – the first 50% of players to invest in new technologies or business models – are those that will be able to make the most of this competitive advantage, at the expense of competitors that have not adopted. For the ”laggard” half of the market, investment in the new technologies or models is still required, but the possibility to gain competitive advantage has fallen away as the “followers’’ digitalization is simply aligning with the new market norm.

SFS interviewed respondents from across the globe – manufacturers, trade associations, management consultants and academics – to estimate how long it would take for this ‘tipping point’ of 50% deployment amongst manufacturers to be reached. This effectively forecasts the window of opportunity for manufacturers to gain the expected return on investment from their digital transformation initiatives. Larger manufacturers were expected to take between 5-7 years to reach this point; whereas SME manufacturers were expected to take longer – between 9-11 years.

Respondents were also asked about the proportion of manufacturers to have implemented a significant Industry 4.0 pilot. This is an important insight into the current rate of adoption, since many manufacturers start their Industry 4.0 journey by piloting new technology or solutions before embarking on a full roll-out of digital transformation. The research found that 70-80% of large companies have implemented a significant pilot project for Industry 4.0 production solutions, compared to 40-50% of SMEs.

How long until the Industry 4.0 adoption

Manufacturers across the same regions were also interviewed for their views on the role that specialist finance was playing in enabling their digital transformation. Challenges to implement digital transformation tend to pivot around the issue of finance – understanding the commercial benefits of Industry 4.0, knowing that there will be a reliable return-on-investment, and paying for Industry 4.0 technology at a rate that is less than or matches those expected commercial gains, making the investment sustainable and cash-flow friendly. The financing techniques that enable sustainable digital transformation are becoming known as “Finance 4.0”. These techniques cover the full range of requirements, from the acquisition of a single digitalised piece of equipment, to financing a whole new factory, to even acquiring a competitor.

“Debate has moved on from whether to invest in digital transformation to when and how,” says Brian Foster, Head of Industry Finance at Siemens Financial Services in the UK. “Most leading manufacturers, large and small, are looking for sustainable ways to invest in digital transformation so that they gain the competitive benefits of being in that early mover cohort – the first 50% of adopters. But there are a number of challenges, many of which center around the practicalities of investment in the technology and machinery required.”

“Forward-thinking manufacturers are using Finance 4.0 solutions to accelerate their digital transformation to maximise the market advantage and steal a march on their competitors.”

Siemens and Siemens Financial Services will be at Hannover Messe showcasing cutting-edge Industry 4.0 technologies, and the finance solutions to help manufacturers acquire them, at Hannover Messe 2019, 1-5 April 2019 at booth D35, Hall 9.

Methodology

41 respondents were interviewed about their views on current Industry 4.0 pilot project implementation. The same respondents were also asked to estimate the period (in years) by which a majority (50%+) of manufacturers would have deployed digital transformation (Industry 4.0) across their production processes. Respondents included global top 2000 manufacturers, trade associations, expert management consultants, and academics, covering the USA, Europe, and AS-PAC. They were interviewed between September 2018 and January 2019. The study also interviewed 26 manufacturers across these regions to get their views on the role specialist finance was playing to enable Industry 4.0 transformation.

Explore more articles in the Investing category