The inevitable shift to mcommerce in emerging economies

Published by Jessica Weisman-Pitts

Posted on November 16, 2022

5 min readLast updated: February 3, 2026

Published by Jessica Weisman-Pitts

Posted on November 16, 2022

5 min readLast updated: February 3, 2026

By Arunabh Madhur, Regional VP & Head Business EMEA at SHAREit Group

We live in a mobile-first world, where market penetration of smartphones and widespread use of mobile apps are rising exponentially. Reports estimate that the number of global smartphone users will continue to grow rapidly and hit 7.49 billion by 2025.

The global pandemic has only accelerated this trend, spearheading the adoption of mobile technology around the world, including in emerging markets. In turn, in-app purchases spiked worldwide in this time, especially in emerging markets like Southeast Asia, the Sub Indian continent, the Middle East and Sub-Saharan Africa, as consumers spent more of their income online. According to recent data, there are now 13 markets where users are spending more than four hours per day using apps. To name but a few, these include Indonesia, Singapore, Brazil, Australia, Japan and South Korea. This was anticipated, due to social distancing measures and lockdowns globally, most people turned to digital channels to find products and services.

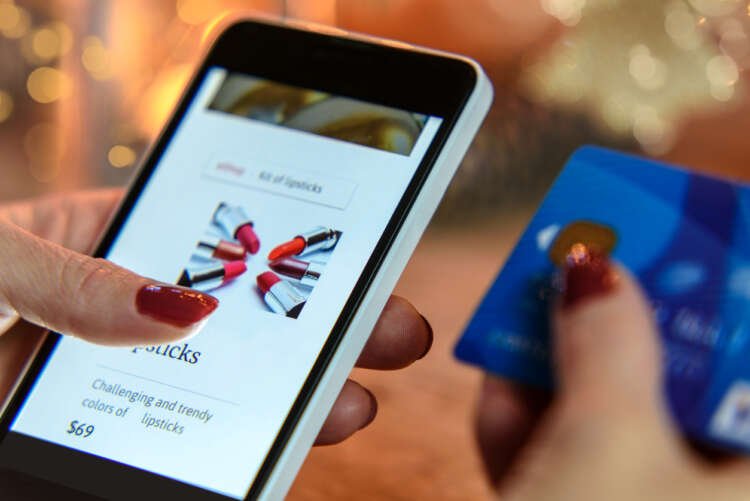

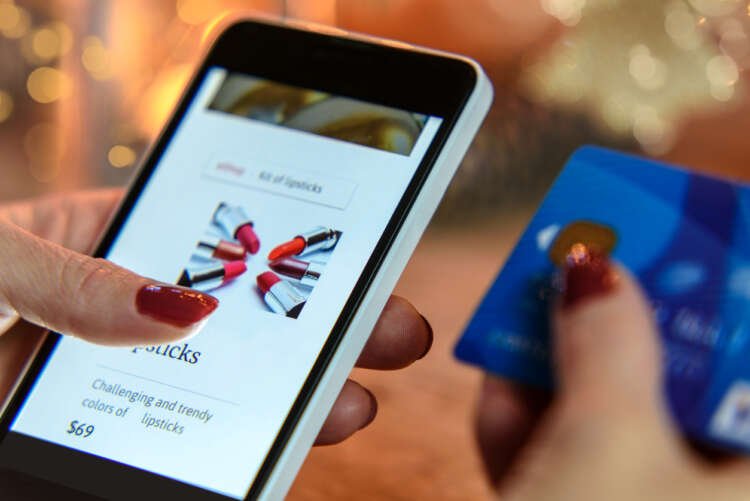

How mobile is redefining shopping experiences

Mobile shopping has already become a huge part of our lifestyle and will soon become so, in many other households. According to eMarketer, mobile commerce remains the most preferred channel among consumers globally. By 2024, global mobile commerce retail sales are expected to reach nearly $4.5 trillion, accounting for 69.9% of total retail e-commerce sales.

The pandemic saw a large set of people moving to mobile transactions largely in the space of e-commerce, medicine buying and food delivery business. These were supported by a very strong mobile commerce and payments which lead digital payments push and the entire conversation around the mobile commerce category.

A by-product of peer-to-peer sharing is digital literacy as friends and family trust and teach each other about how apps work. The unprecedented ability and speed allowing app sharing between family and friends has only brought people closer together. Whether it’s a product recommendation or sharing discount codes with loved ones, digital interactions are built on offline relationships. In fact, ‘social commerce’ is actually highly dependent on trust within a community, the interactions of users, and word of mouth. Peer-to-peer sharing utility helps to create a social ecosystem with people discovering new apps through friends and family. There is no doubt that smartphone continues to rise in the developing world and so does the internet connection. People have migrated from the use case of data saving only, to now mostly data saving and convenience, or fast speed transfer experience.

The value of consumer personalization: how payments can help

It’s also important to not forget the rise of e-payments that has been pushing digital shopping towards wider adoption. Digital payment methods, such as Apple Pay and Google Pay, which enable card payments via smartphones, have not only streamlined the customer journey but also facilitated access to e-commerce, especially to the large unbanked population in emerging markets. With digital wallets becoming a core part of payments and online shopping experiences, mcommerce transactions will continue to grow.

In addition, the rise of micropayments has built a very strong mandate in driving mcommerce internationally and in emerging markets, with digital payments expected to account for 91% of total e-commerce spending by 2025. This is an up-tick from 80% in 2020. Therefore, the key for retailers is to support as many digital payment mechanisms as possible to help meet consumer demands and minimise the rate of transaction abandonment. Merchants and payment providers also need to work together on optimizing websites and payment solutions for smartphones in order to remain competitive and appealing to consumers.

New digital habits and why there is no going back

When looking closely, it is easy to see that digital habits learned during the pandemic have now been fully integrated into people’s daily routine. Improvements in productivity and efficiency brought about by increased adoption of mobile services is benefitting both consumers and brands. As a result of this, mobile is now at the heart of business strategies for consumer brands, which helps when reaching audiences at scale, improve customer shopping experiences while boosting online conversions. This is also a preferred route for people worldwide right now as it provides a convenient channel to shop whenever and wherever. But while the proliferation of smartphones and tablets produces many benefits, millions could be excluded from the benefits of digital payments and e-commerce. Therefore, it is in the interest of sellers and governments to find ways to include those living without access to tech.

Further to these fast-growing mcommerce regions across emerging economies, mcommerce is also experiencing growth across Europe. In the UK specifically, 60% of total retail online sales now come from mobile phones – that’s more than any other county in Europe. In fact, only the US and China are ahead when it comes to the mcommerce market. Mobile phones are now the primary choice when it comes to making online purchases and it is expected to surpass £100 billion by 2024 in the UK. As a result of the rise of mcommerce, SHAREit now works with leading global e-commerce brands, in Southeast Asia, South Africa in Europe and Middle East with a performance ad solution and the retargeting solutions.

The evolved mobile shopper has new expectations and seeks richer experiences from existing brands. For companies with their eyes firmly set on growth in the coming year, brands need to adapt to this change, and create bespoke experiences for their customers in order to thrive.

Mobile commerce, or m-commerce, refers to buying and selling goods and services through mobile devices, such as smartphones and tablets, enabling users to shop online from anywhere.

Consumer personalization involves tailoring products, services, and marketing efforts to meet the individual preferences and behaviors of customers, enhancing their shopping experience.

E-commerce refers to the buying and selling of goods and services over the internet, allowing businesses and consumers to conduct transactions online.

Emerging markets are economies that are in the process of rapid growth and industrialization, often characterized by increasing consumer demand and investment opportunities.

Explore more articles in the Business category