Swing Trading Techniques: The Big News Day Trap

Published by Gbaf News

Posted on September 6, 2011

9 min readLast updated: January 22, 2026

Published by Gbaf News

Posted on September 6, 2011

9 min readLast updated: January 22, 2026

Technical vs Fundamental Trading

Technical or Fundamental? The debate as to which trading methodology to use has been raging for decades.

The pure fundamental trader examines economic data, balance sheets, inter-market correlations, and political developments with a view to determining whether a market is correctly priced. After making a value judgement as to where a given market should be, he or she will aim to take advantage of any discrepancies between the current price and what they deem to be fair value. Fundamental traders are therefore deeply concerned with why a market is moving in a given direction.

The pure technical trader is not as concerned with the underlying fundamentals driving a market, preferring to limit the inputs they look at to data derived mainly from the market price. The pure technician believes that market psychology is the key factor, and that markets trend and reverse in a predictable manner which produces patterns on the charts which can be exploited. The technician has an array of tools relating to trend, momentum, market sentiment, and overbought/oversold status.

While the two approaches to solving the market puzzle may sometimes be at odds and ‘never the twain shall meet’, it would be unwise for proponents of both methodologies to disregard valuable information which could be gleaned from the other camp, i.e. trading in a vacuum. While fundamental traders would be foolish to ignore the powerful trend of a security which doesn’t reflect where they think value ‘should’ be, for example a bear market in stocks which sees prices get cheaper and cheaper, similarly technical traders should also maintain a healthy respect of the fundamentals, particularly those trading over a short timeframe with a correspondingly close stop-loss level. The need for mutual respect on both sides becomes more acute on days when an important piece of news comes out.

Trading on Big News Days

Consider a day trader who trades off of intraday charts and imagine it is just approaching 8.30am Eastern Standard Time on the first Friday of the month when the US Non-Farm Payrolls report is usually released. This piece of economic data often produces an extreme market movement as traders who are typically lightly positioned or flat going into the data release put on new positions based on the number.

If a technical trader gets a buy or sell signal just before the number is released does he or she take the trade and hold the position through the release? It would be very foolish to do so as a number or a revision of a previous number which comes out far from consensus market expectations often sees markets move very sharply from the pre-release price to another level without trading at prices in between. This news-driven ‘gap’ can sometimes see the market suddenly trade significantly above or below one’s stop-loss exit level, creating a much larger loss than allowed for by the trader’s money management rules.

Surely the best strategy here would be to wait until long after the data release before making a trade? The problem with this approach is that one can miss most of the move, buying into a trend when many of the early buyers are selling out. It would be great shame to miss out on what could be one of the best trading opportunities of the month so what should the trader do?

Big moves are often preceded by market ‘traps’

In my opinion, many of the best trading opportunies arise as a result of a false breakout of some kind. Most of the time, this theory applies to the technical approach where for example the breach of a support level fails to see follow through selling and a powerful move unfolds in the opposite direction. I term this set-up as a ‘Bear Trap’. It is these technical traders who have ‘sold the break’ who have become trapped and it their stop-loss buying which ultimately drives the price higher as they exit their losing short positions, heading for the exits at the same time.

In this case however, the traders who have become ‘trapped’ are the fundamental traders who have reacted to the economic data which has just been released. Assume that the Non Farm Payroll number comes out so far away from market expectations that it is implicitly bearish for a particular market and as such generates heavy selling pressure just after the release. However, by the close of the session the news-related decline has been reversed, generating losing open positions for those who sold ‘on the news’. Many times I have witnessed just such a move lead to a very powerful advance which often lasts for several days!

How to profit from big news-related traps

From a trading perspective, I would say that the best way to approach these ‘big news’ days is to wait until after the release of the data rather than taking a position and holding it over the release. What often happens is once the data is released markets often see a knee-jerk reaction as fundamentally-driven traders take a position, particularly if the number is significantly stronger or weaker than the market consensus expectations. However, perversely as it may seem, the markets have a habit of seeing a very powerful movement in the OPPOSITE direction to the initial post-release movement, much to the frustration of those who take a position based on the data. To take advantage of just such a move, I like to follow this three step process.

– Just prior to the release, I record the price of the market I want to trade. This point will be known as the ‘news origin price’ and will be my entry price should the market generate a ‘significant’ movement after the release.

– I then calculate price levels which if hit would constitute a ‘significant’ movement due to the news which would tell me that new money is being committed to the market. I would say that any movement which sees the expansion of the global session range by at least 50% is ‘significant’. I would also consider a smaller expansion of the global session range if it includes the breach of yesterday’s high or low in the process.

– I then wait for the release. If any of the threshold levels outlined above are hit by the close of the session (give or take a few pips) I will look to enter a position in the opposite direction if and only IF the ‘news origin price’ is seen again during the global session. If the market returns to this level having made a ‘significant’ post-release move outlined above, then all of the news-driven traders will suddenly find themselves underwater and it is they who will chase the price higher or lower in stop-loss related buying or selling. If the trade is triggered, I will place a protective stop-loss the other side of the day’s range so far looking to trail it as the trade (hopefully) moves into profit.

As to targets, this naturally depends on one’s timeframe but I would stress that a move of this nature is often good for a 2 to 1 or 3 to 1 reward to risk ratio, if not by the close of the session then certainly over subsequent days. If the trade is triggered I will look to exit at three separate levels (PT1, PT2, and PT3) which I calculate if the trade is triggered. I hold the trade until either the stop level is hit, all of the profit objectives are met, or at 22.00 CET on the third trading day after the entry date. If the trade is triggered on a Friday, I will exit on around the U.S. close on Wednesday.

The U.S. Non Farm Payroll ‘Trap’

Let’s see an example of this trading strategy in action for EUR/USD after the release of U.S. Non Farm Payrolls on 2nd October 2009.

Just before the data release, EUR/USD was trading at 1.4543. The number came out much worse than market expectations (-263,000 vs expectations of -170,000), resulting in a violent knee-jerk sell off which saw a test of the buy set-up level at 1.4480, as can be seen in figure 1 below (green line).

After hitting the buy set-up level at 1.4480, EUR/USD then reversed sharply to trade back at the News Origin price at 1.4543 generating a buy signal with a stop-loss at 1.4479 (just below the session low). Within a few hours the first profit take level (PT 1) was hit at 1.4606 and the stop was moved up from 1.4479 to the breakeven point, thus creating a risk-free trade.

Figure 1

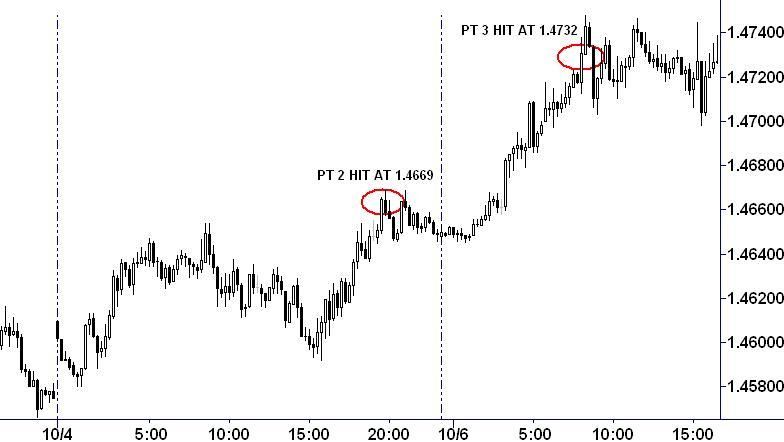

Over the course of the next few days, EUR/USD managed to extend its advance to 1.4763, over 200 pips above the original entry price and at a level which could have generated a profit in excess of 3 times the potential loss.

figure 2

The next time a significant data release such as U.S. Non Farm Payrolls comes around, look to join a post-release reversal which could last for several days.

I wish you all the best in your trading!

About the author

Howard Friend is Chief Market Strategist at MIG BANK in Neuchatel, Switzerland. He has worked as trader and market analyst for over 20 years and has developed some very accurate proprietary trading systems to time the markets. He is a keen student of market price dynamics, has appeared regularly on financial TV and has lectured and been published widely on his specialist subject of trading strategy development. He is a Member of the Market Technicians Association and holds the Chartered Market Technician designation.

Contact details

Howard Friend, Chief Market Strategist, MIG BANK

E-mail : h.friend@migbank.com

Phone: +41 32 722 8454

Website: http://www.migbank.com

Explore more articles in the Trading category