Russian central bank vows financial stability support as rouble tanks

Published by maria gbaf

Posted on February 23, 2022

2 min readLast updated: January 20, 2026

Published by maria gbaf

Posted on February 23, 2022

2 min readLast updated: January 20, 2026

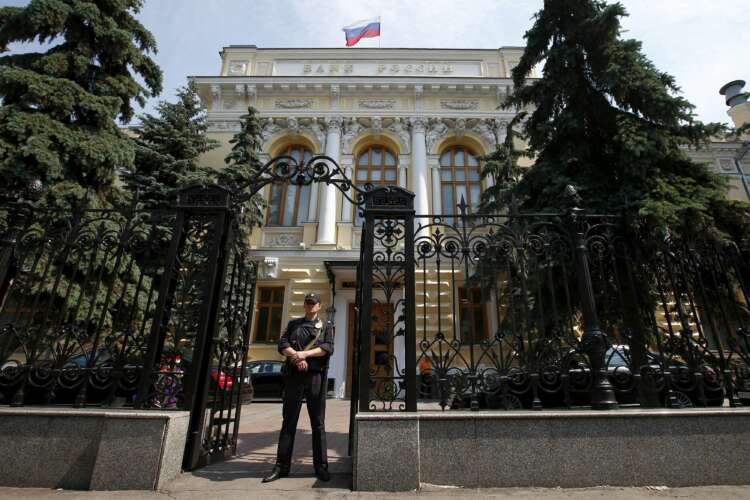

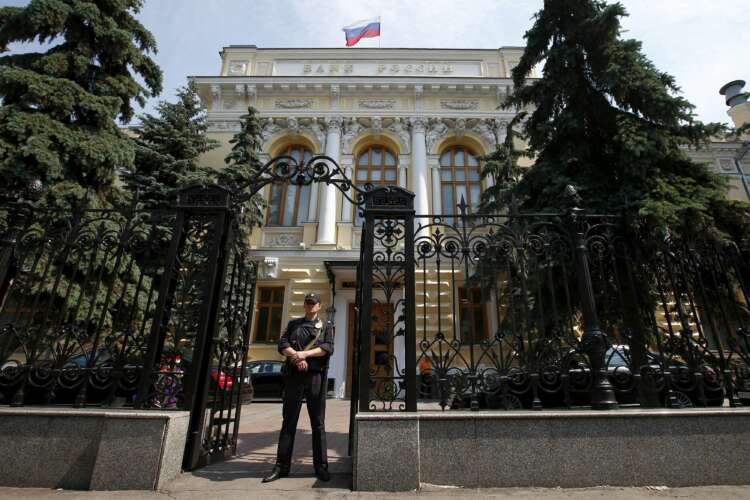

MOSCOW (Reuters) -The Russian central bank on Tuesday said it was ready to take all necessary measures to support financial stability, as Russian assets were hammered after Moscow sent what it called “peacekeeping” forces into eastern Ukraine.

MOSCOW (Reuters) -The Russian central bank on Tuesday said it was ready to take all necessary measures to support financial stability, as Russian assets were hammered after Moscow sent what it called “peacekeeping” forces into eastern Ukraine.

The rouble hit a near two-year low after President Vladimir Putin ordered the deployment of troops to two breakaway regions in eastern Ukraine after recognising them as independent.

The sharp drop in the rouble from levels around 70 to the greenback seen just four months ago is expected to fuel already high inflation, one of the main concerns among Russians, which would dent the country’s already falling living standards.

“The Bank of Russia is keeping the development of the situation on the financial market under control and is ready to take all necessary measures to support financial stability,” the bank said in a statement.

It also announced some easing of requirements for banks, saying lenders would be permitted to use the market value of stocks and bonds in their portfolios as of Feb. 18 in earnings reports until October.

But the central bank, which does not target a particular exchange rate for the free-floating rouble, fell short of saying what other measures it could take as Russia braced for a new round of Western sanctions that could target Russian banks and state debt.

“Volatility would obviously increase in this situation (of new sanctions), and it would be worth the Bank of Russia considering entering the market with interventions at some points,” said Egor Susin, managing director at Gazprombank Private Banking.

“The central bank has the key interest rate and interventions in its arsenal,” said Evgeny Suvorov, an economist at CentroCreditBank.

The central bank has raised rates by a hefty 100 basis points at two board meetings in a row and is expected to hike the rate again from 9.5% on April 29 as inflation stands near 8.8%, far above the 4% target.

The bank, which said on Tuesday it still expects inflation to slow to 4% target in mid-2023, did not reply to a Reuters request for comment on possible FX selling to ease downside pressure on the rouble.

(Reporting by Andrey Ostroukh, Alexander Marrow and Elena Fabrichnaya; Additional reporting by Maxim Rodionov and Anton Kolodyazhnyy; editing by Jason Neely)

Explore more articles in the Finance category