LONDON STANSTED AND BIRMINGHAM AIRPORT FOUND TO BE THE WORST FOR CURRENCY EXCHANGE RATES

Published by Gbaf News

Posted on May 22, 2014

2 min readLast updated: January 22, 2026

Published by Gbaf News

Posted on May 22, 2014

2 min readLast updated: January 22, 2026

Caxton FX, a leading international payment and currency card provider has undertaken major research into the state of the UK’s airport exchange rates.

LONDON STANSTED And BIRMINGHAM Airport Found To Be The Worst For Currency Exchange Rates

Caxton FX enables holidaymakers to avoid the high costs of purchasing foreign currency at airports as well as offering a safe and convenient way to carry cash abroad. With holiday packing and endless last minute jobs, it can be tempting to organise currency at the airport, however poor airport rates and high commission charges can leave holidaymakers out of pocket.

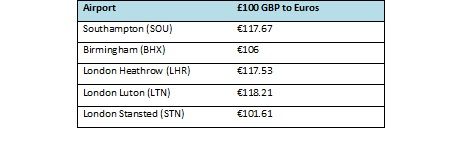

The recent Caxton FX survey across major UK airports, including Birmingham, Southampton, London Heathrow, London Luton and London Stansted, illustrates the high costs and the need for consumers to be mindful of alternative currency options.

London Stansted Airport has been uncovered as offering the worst rate for Euros; £100 will buy just €101.61. Meanwhile at Birmingham £100 will only buy €106 and on top of this, customers will pay a high £4.75 in commission.

With weekend breaks to European cities becoming an increasingly popular holiday option, holidaymakers taking smaller amounts abroad will be penalised by high-commission charges and poor exchange rates.

As against Caxton FX’s current exchange rates, for £100, the consumer will receive €122.48 with absolutely no commission charged. Please see www.caxtonfx.com/currency-cards/ for daily rates.

As against Caxton FX’s current exchange rates, for £100, the consumer will receive €122.48 with absolutely no commission charged. Please see www.caxtonfx.com/currency-cards/ for daily rates.

James Hickman, Managing Director at Caxton FX commented ‘’this confirms what many travellers fear – that leaving currency to the last minute never pays…what is interesting is the disparity between the airports themselves in terms of what rates are available for what should be a standardised approach’’.

Caxton FX offers consumers three types of card; the Euro Traveller, US Dollar Traveller and the Global Traveller Card, all which come with free ATM withdrawals, competitive exchange rates and no additional costs. A key feature of the Euro Traveller and US Dollar Traveller cards is that it allows customers to lock in an exchange rate at the time of purchasing currency allowing holidaymakers to budget accordingly.

*Airport rates based on research conducted on 15thMay 2014.

Explore more articles in the Trading category