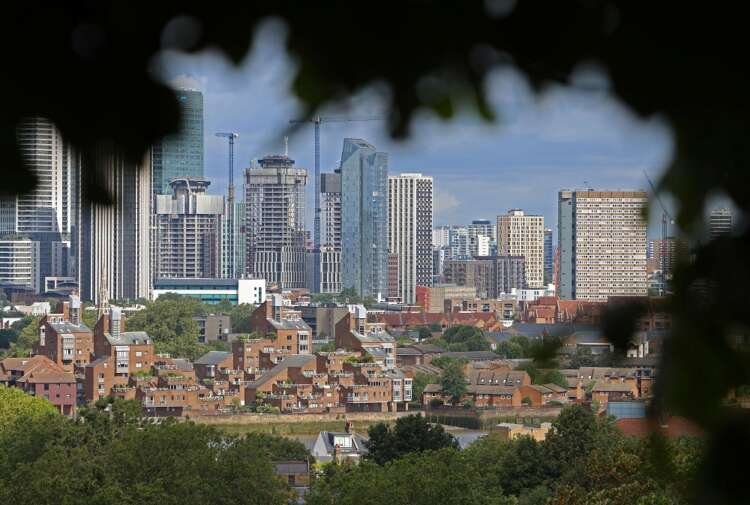

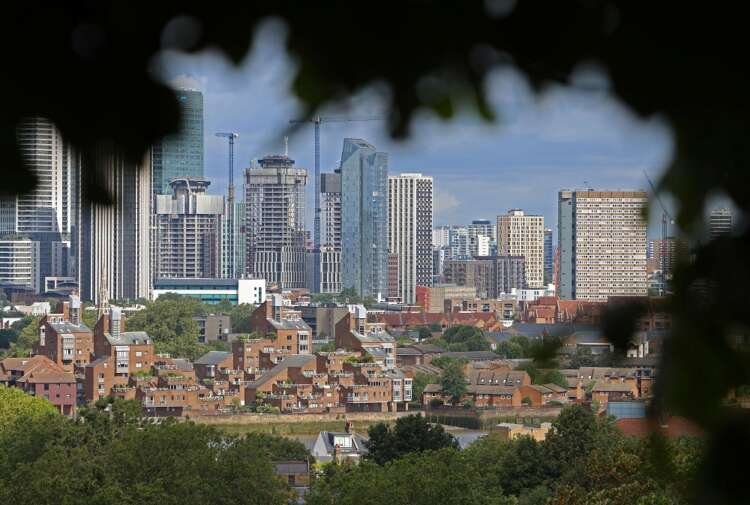

Lack of homes for sale gives UK house prices a surprise boost -Nationwide

By William Schomberg

LONDON (Reuters) – British house prices unexpectedly rose by almost 1% in October but the increase was due more to a lack of homes for sale than a turnaround in the market which has been hit by a jump in borrowing costs, mortgage lender Nationwide said.

Prices increased by 0.9% from September when they had risen by a marginal 0.1%, Nationwide said.

It was the biggest monthly increase since August 2022.

In year-on-year terms, prices in October were down 3.3%, a less sharp fall than September’s 5.3% drop.

Economists polled by Reuters had expected prices to fall by a monthly 0.4% and by 4.8% year on year.

“The uptick in house prices in October most likely reflects the fact that the supply of properties on the market is constrained,” Nationwide Chief Economist Robert Gardner said.

Last month, a monthly survey by the Royal Institution of Chartered Surveyors showed its members expected further falls in sales volumes in the coming months but expectations for sales in 12 months’ time turned positive for the first since May.

Britain’s housing market boomed during the COVID pandemic on surging demand for bigger homes, pushing prices up by about 25%, according to Nationwide’s measure.

But the market has been hit by the Bank of England’s 14 interest rate hikes between December 2021 and August 2023 which pushed mortgage rates to a 15-year high.

The BoE is expected to leave the Bank Rate on hold for a second meeting in a row on Thursday. But investors do not expect any rate cuts until the second half of next year.

Gardner said there was little evidence of forced selling of homes, which would push down prices, in large part because unemployment remains low, helping households to meet their higher mortgage costs, Gardner said.

BoE data for September, published earlier this week, showed the smallest number of mortgage approvals since January.

Imogen Pattison, an economist at consultancy Capital Economics, said the signs of weaker demand and of an increase in homes coming onto the market meant prices were probably only half way through a 10% fall from last year’s peak.

“While some buyers are able to accept higher mortgage payments, helping to prop up house prices, their number is dwindling as shown by the drop in mortgage approvals in September,” Pattison said.

(Writing by William Schomberg; editing by Jason Neely)

A mortgage is a loan specifically used to purchase real estate, where the property itself serves as collateral for the loan.

Mortgage rates are the interest rates charged on a mortgage loan, which can fluctuate based on economic conditions and central bank policies.

The Bank of England is the central bank of the United Kingdom, responsible for issuing currency, maintaining monetary stability, and overseeing the financial system.

House price inflation refers to the increase in the prices of residential properties over time, often influenced by demand, supply, and economic factors.

The housing market encompasses the buying, selling, and renting of residential properties, influenced by factors like interest rates, economic conditions, and consumer demand.

Explore more articles in the Finance category