Hermes: Stay cool as markets run hot

Published by Gbaf News

Posted on August 6, 2018

8 min readLast updated: January 21, 2026

Published by Gbaf News

Posted on August 6, 2018

8 min readLast updated: January 21, 2026

The first half of this year has brought record-high temperatures across many parts of the globe, despite the presence of La Niña, a climate phenomenon usually associated with cooling.

In his latest report, Tommaso Mancuso, Head of Multi-Asset, Hermes Investment Management, asks: are markets at a similar extreme and, if so, how suddenly could wintry temperatures take hold?

End-of-cycle warning signs

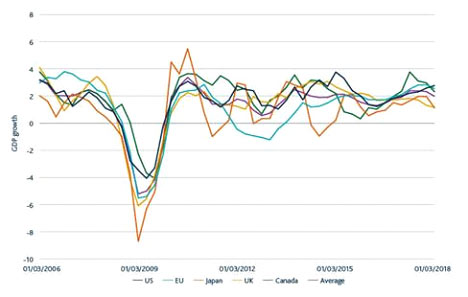

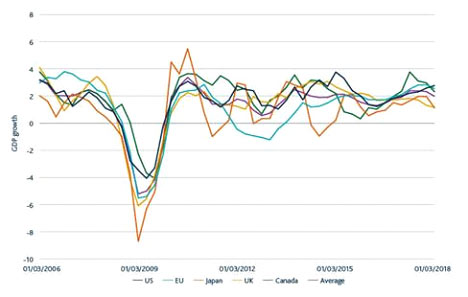

The period from mid-2016 to the end of 2017 saw a synchronised acceleration of global growth. Although still positive, global growth has decelerated somewhat and is no longer in sync. This in turn has amplified the differences in monetary policies carried out by central banks across the major economic blocs with the US firmly on a tightening path, Japan remaining loose and other countries somewhere in between (see figure 1).

Figure 1. After a period of synchronisation, national GDP growth rates are starting to diverge

Source: Reuters Datastream as of 31 March 2018

In 2015, the global economy was on the brink of deflation, yet reflation since then has brought inflation back to pre-crisis levels. We expect this gradual reflationary trend to continue, fuelled, among other things, by tightness in the job markets of several major economies and the escalation of trade disputes. Consequently, monetary policies should continue to tighten globally, albeit gradually. In Q1, the Federal Reserve showed that it is prepared to tighten even in the midst of a meaningful market sell-off. This stance is a major departure from the accommodative measures taken since the financial crisis. In other words, the tide that has fuelled valuations across all assets is gradually turning.

Not all economic slowdowns have been preceded by an inversion of the US yield curve, but historically this has been one of the most reliable indicators of a forthcoming decline of American growth. Today, not only has the curve almost inverted, one could also observe that, in previous cycles, lower policy rate peaks have been associated with shallower levels of inversion (see figure 2), and we continue to believe in the ‘wisdom of crowds’ that is reflected by market pricing.

Figure 2. US yield-curve inversion: still a harbinger of recession?

Source: Bloomberg as of 18 July 2018

Another potential warning signal is the strengthening dollar. While several factors might have contributed to the rally in the greenback since mid-February, we would highlight a few: the diverging growth prospects among countries, monetary-policy normalisation sucking dollars out of the system and the increasing differential in policy rates. This is causing financial conditions to tighten globally and is one of the main causes of the recent sell-off of emerging market (EM) assets. As in previous cycles, the outflow of funds from EM assets tends to flow back into the economy with the brightest outlook, namely the US. If this persists, it will exacerbate the price action.

Finally, we are now firmly in the midst of a trade dispute. Initially, we subscribed to the thesis that Trump’s aggressive rhetoric was largely a negotiating tactic. We now have a different view. While the US President may still be pursuing a quick political gain ahead of the midterm election, it is increasingly apparent that a profound anti-globalisation ideology currently has the upper hand in the administration. Consequently, we think the long-term implications are real. The US mid-term elections are likely to have a meaningful impact on market optimism either way.

In isolation, none of the indicators or events described above are sufficient to cause the cycle to end. Some of them are simply enabling factors. However, we have seen them appear before downturns in the past, and it appears that they are converging again.

Keep cool as the cycle winds down

Despite the increasing number of warning signals and unabated geopolitical uncertainty, equity markets could still record new highs before the year is up. Following the market correction in Q1, momentum has resumed, fuelled by positive fundamentals, stock buy-backs, reassurances from central banks and typical end-of-cycle optimism. Therefore, it is a time to be patient: it is important to remain engaged in the market while gradually reducing risk.

The above is published solely for informational purposes and is not to be construed as a solicitation or an offer to buy or sell any securities or related financial instrument. The views and opinions contained herein are those of the author and may not necessarily represent views expressed or reflected in other Hermes communications, strategies or products.

The first half of this year has brought record-high temperatures across many parts of the globe, despite the presence of La Niña, a climate phenomenon usually associated with cooling.

In his latest report, Tommaso Mancuso, Head of Multi-Asset, Hermes Investment Management, asks: are markets at a similar extreme and, if so, how suddenly could wintry temperatures take hold?

End-of-cycle warning signs

The period from mid-2016 to the end of 2017 saw a synchronised acceleration of global growth. Although still positive, global growth has decelerated somewhat and is no longer in sync. This in turn has amplified the differences in monetary policies carried out by central banks across the major economic blocs with the US firmly on a tightening path, Japan remaining loose and other countries somewhere in between (see figure 1).

Figure 1. After a period of synchronisation, national GDP growth rates are starting to diverge

Source: Reuters Datastream as of 31 March 2018

In 2015, the global economy was on the brink of deflation, yet reflation since then has brought inflation back to pre-crisis levels. We expect this gradual reflationary trend to continue, fuelled, among other things, by tightness in the job markets of several major economies and the escalation of trade disputes. Consequently, monetary policies should continue to tighten globally, albeit gradually. In Q1, the Federal Reserve showed that it is prepared to tighten even in the midst of a meaningful market sell-off. This stance is a major departure from the accommodative measures taken since the financial crisis. In other words, the tide that has fuelled valuations across all assets is gradually turning.

Not all economic slowdowns have been preceded by an inversion of the US yield curve, but historically this has been one of the most reliable indicators of a forthcoming decline of American growth. Today, not only has the curve almost inverted, one could also observe that, in previous cycles, lower policy rate peaks have been associated with shallower levels of inversion (see figure 2), and we continue to believe in the ‘wisdom of crowds’ that is reflected by market pricing.

Figure 2. US yield-curve inversion: still a harbinger of recession?

Source: Bloomberg as of 18 July 2018

Another potential warning signal is the strengthening dollar. While several factors might have contributed to the rally in the greenback since mid-February, we would highlight a few: the diverging growth prospects among countries, monetary-policy normalisation sucking dollars out of the system and the increasing differential in policy rates. This is causing financial conditions to tighten globally and is one of the main causes of the recent sell-off of emerging market (EM) assets. As in previous cycles, the outflow of funds from EM assets tends to flow back into the economy with the brightest outlook, namely the US. If this persists, it will exacerbate the price action.

Finally, we are now firmly in the midst of a trade dispute. Initially, we subscribed to the thesis that Trump’s aggressive rhetoric was largely a negotiating tactic. We now have a different view. While the US President may still be pursuing a quick political gain ahead of the midterm election, it is increasingly apparent that a profound anti-globalisation ideology currently has the upper hand in the administration. Consequently, we think the long-term implications are real. The US mid-term elections are likely to have a meaningful impact on market optimism either way.

In isolation, none of the indicators or events described above are sufficient to cause the cycle to end. Some of them are simply enabling factors. However, we have seen them appear before downturns in the past, and it appears that they are converging again.

Keep cool as the cycle winds down

Despite the increasing number of warning signals and unabated geopolitical uncertainty, equity markets could still record new highs before the year is up. Following the market correction in Q1, momentum has resumed, fuelled by positive fundamentals, stock buy-backs, reassurances from central banks and typical end-of-cycle optimism. Therefore, it is a time to be patient: it is important to remain engaged in the market while gradually reducing risk.

The above is published solely for informational purposes and is not to be construed as a solicitation or an offer to buy or sell any securities or related financial instrument. The views and opinions contained herein are those of the author and may not necessarily represent views expressed or reflected in other Hermes communications, strategies or products.

Explore more articles in the Investing category