FTS’ SMART PAYMENTS ENABLING SOLUTION SELECTED TO SUPPORT GLOBAL E-COMMERCE MERCHANT ACQUIRER

Published by Gbaf News

Posted on May 1, 2014

3 min readLast updated: January 22, 2026

Published by Gbaf News

Posted on May 1, 2014

3 min readLast updated: January 22, 2026

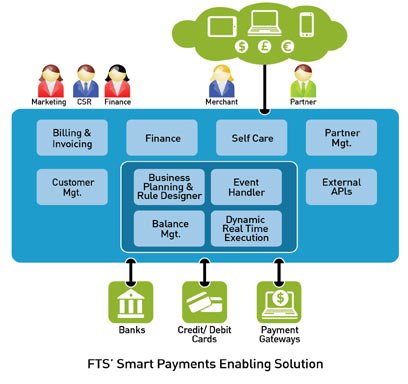

Payments and Billing Platform Enhances Payment Processing, Revenue Sharing and Merchant Acquiring

FTS, a global provider of billing and payments solutions announced that its Smart Payment Enabling™ Solution has been selected by a US-based international acquirer focused on the e-commerce and m-commerce payment processing arena.

FTS’ Smart Payments Enabling Services

The new customer has selected FTS’ Smart Payments Enabling Solution in order to revamp the commissioning and settlements processes at the heart of its payment processing and acquiring platform. Based on its broadly deployed Leap™ Billing technology, FTS’ solution will play a critical role in the customer’s transaction management processes with its PSP partners and associated merchants.

FTS’ Smart Payments Enabling Solution will automate the rating, billing and settlement functionality of the customer’s multi-currency commissioning system which is presently managed through complex procedures. It will support the customer’s dynamic and flexible contracts with its partners and merchants – each with its own business logic – enabling the implementation of a dedicated commissioning model for each case. This will enable the customer in the rapid onboarding of new merchants and partners, whilst substantially reducing operating costs and achieving an unprecedented time to market.

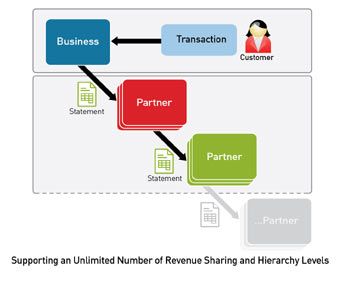

Furthermore, the solution will automatically process each partner’s statement to track the commission charges the customer is paying its partners, thus ensuring a one-to-one marketing approach that emphasizes the personalized interactions between them.

FTS’ Smart Payments Enabling Solution is a feature-rich platform that meets the diverse and expanding requirements of the various players in the payments, e-commerce and m-commerce industry. It provides rapid time to market, flexibility and vendor-independence, all of which are crucial to the effective deployment of settlement and revenue sharing business models. Moreover, the FTS solution is ideal for supporting the unique aspects of digital acquiring interactions, including compound revenue sharing in a world of multiple partners and complex value chains.

Supporting an unlimited number of revenue sharing and hierarchy levels 3…

“FTS has recently entered the realm of card payment processing, digital merchant acquiring and e-commerce,” commented Nir Asulin, FTS’ CEO. “This project proves once again FTS’ versatility in providing solutions that support a range of industries beyond telecom billing: the Smart Payments Enabling Solution is ideal for the broad range of innovative pricing, revenue sharing and business models evolving today. We look forward to continued cooperation with this customer in assisting them in the development of new modules that will meet their precise business requirements in this dynamic industry.”

Explore more articles in the Finance category