Fitch Ratings’ Investor Survey Highlights Escalating Sovereign Concerns

Published by Gbaf News

Posted on May 17, 2012

7 min readLast updated: January 22, 2026

Published by Gbaf News

Posted on May 17, 2012

7 min readLast updated: January 22, 2026

By Monica Klingberg Insoll, Managing Director, Credit Market Research, Fitch Ratings

Fitch Ratings’ quarterly European Senior Fixed-Income Investor Survey, which represents the views of fund managers with combined assets of over USD5.5 trillion, gives an authoritative snapshot of the sector’s views. The latest survey, for Q2 2012, shows overall sentiment turning more negative as the European Central Bank (ECB-POLICY-SOURCES-e4bab80d-7aeb-4e49-a29a-ce14e1595c6d>ECB-POLICY-RATES-82f6314e-6203-420b-bc8b-70a978546822>ECB-POLICY-SOURCES-e4bab80d-7aeb-4e49-a29a-ce14e1595c6d>ECB)-induced relief of the first quarter is wearing thin.

Sovereign Concerns Escalate

Survey respondents expressed a more negative view on fundamental credit conditions for the sovereign sector, with 71% believing these will deteriorate, up from 58% in the previous quarter’s survey.

Investors were also concerned about sovereign refinancing prospects, with 79% voting it the most challenged sector – an all-time-high. This dissatisfaction resulted in 49% of investors electing developed sovereigns as their least favoured investment choice. This is up from 31% in the last quarter – and is a new high, beating the 46% recorded in Q210 during the midst of the Greek crisis.

Investors were also concerned about sovereign refinancing prospects, with 79% voting it the most challenged sector – an all-time-high. This dissatisfaction resulted in 49% of investors electing developed sovereigns as their least favoured investment choice. This is up from 31% in the last quarter – and is a new high, beating the 46% recorded in Q210 during the midst of the Greek crisis.

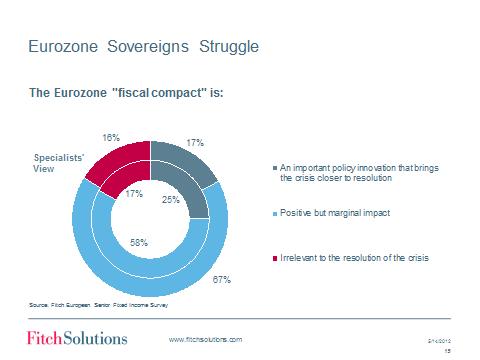

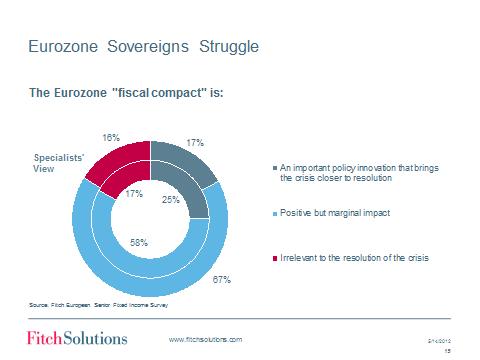

The majority (58%) of investors think the eurozone fiscal compact is positive but marginal in solving the crisis, while only 25% regard it as an important policy innovation bringing crisis resolution closer; 17% view it as an irrelevance.

Banks Fall Out of Favour as Relief Begins to Fade

Banks Fall Out of Favour as Relief Begins to Fade

According to the survey results, the ECB-POLICY-SOURCES-e4bab80d-7aeb-4e49-a29a-ce14e1595c6d>ECB-POLICY-RATES-82f6314e-6203-420b-bc8b-70a978546822>ECB-POLICY-SOURCES-e4bab80d-7aeb-4e49-a29a-ce14e1595c6d>ECB-induced sense of relief still lingers, with only 13% of investors saying they believe the bank segment faces the highest refinancing challenge, down from 22% last quarter and from the high of 49% in Q411 when the sector was ranked higher than sovereigns for the first time.

However, the shot-in-the-arm effect is fading, with only 12% of survey participants ranking banks as their top investment choice, down from 27% in the prior quarter and behind high yield and investment grade corporates and emerging market sovereigns. Respondents also turned less bullish on issuance volumes and more bearish on spread developments for the banking sector over the next 12 months.

The survey indicates that European investors appreciate the ECB-POLICY-SOURCES-e4bab80d-7aeb-4e49-a29a-ce14e1595c6d>ECB-POLICY-RATES-82f6314e-6203-420b-bc8b-70a978546822>ECB-POLICY-SOURCES-e4bab80d-7aeb-4e49-a29a-ce14e1595c6d>ECB’s assistance but are concerned that the banking sector will require ongoing support. Respondents’ views on long-term refinancing operations (LTRO) were mixed, but 38% say the actions will need to be repeated as early as next year.

High Yield Optimism

High yield made a comeback in popularity, overtaking investment grade corporates to become the survey participants’ top investment choice. Nearly one quarter of respondents (24%) voted high yield their favoured sector – the highest proportion since the peak 36% in Q111 and up from 14% in the prior survey.

This resurgence was matched by bullish views on issuance and spreads. 42% of investors expect high yield issuance to increase, up from 30% last quarter. Approximately one third of respondents expect spreads to tighten. This is in line with the last survey and slightly higher than the proportion expecting widening.

Investors’ outlook for high yield credit conditions remains broadly negative according to the survey results. However, fewer respondents expect conditions to deteriorate: 37%, down from 46% in the Q112 survey.

Strong issuance during the first quarter was boosted by solid fund inflows to the sector although Fitch notes that European investor appetite for high yield tends to be fickle, leading to a cycle of stop-start issuance. A worsening of Eurozone economic and financial system risks could easily bring the European high yield market to another temporary halt. Nevertheless, Fitch anticipates higher quality high yield issuers will be able to continue to price bonds.

The Q212 survey was conducted between 27 March and 4 May 2012. Established in 2007, Fitch Rating’s quarterly European Senior Fixed Income Investor Survey is a leading indicator of investor sentiment that provides valuable insight into the opinions of professional asset managers regarding the state of the European credit markets. The full survey results are available on www.fitchratings.com

By Monica Klingberg Insoll, Managing Director, Credit Market Research, Fitch Ratings

Fitch Ratings’ quarterly European Senior Fixed-Income Investor Survey, which represents the views of fund managers with combined assets of over USD5.5 trillion, gives an authoritative snapshot of the sector’s views. The latest survey, for Q2 2012, shows overall sentiment turning more negative as the European Central Bank (ECB-POLICY-SOURCES-e4bab80d-7aeb-4e49-a29a-ce14e1595c6d>ECB-POLICY-RATES-82f6314e-6203-420b-bc8b-70a978546822>ECB-POLICY-SOURCES-e4bab80d-7aeb-4e49-a29a-ce14e1595c6d>ECB)-induced relief of the first quarter is wearing thin.

Sovereign Concerns Escalate

Survey respondents expressed a more negative view on fundamental credit conditions for the sovereign sector, with 71% believing these will deteriorate, up from 58% in the previous quarter’s survey.

Investors were also concerned about sovereign refinancing prospects, with 79% voting it the most challenged sector – an all-time-high. This dissatisfaction resulted in 49% of investors electing developed sovereigns as their least favoured investment choice. This is up from 31% in the last quarter – and is a new high, beating the 46% recorded in Q210 during the midst of the Greek crisis.

Investors were also concerned about sovereign refinancing prospects, with 79% voting it the most challenged sector – an all-time-high. This dissatisfaction resulted in 49% of investors electing developed sovereigns as their least favoured investment choice. This is up from 31% in the last quarter – and is a new high, beating the 46% recorded in Q210 during the midst of the Greek crisis.

The majority (58%) of investors think the eurozone fiscal compact is positive but marginal in solving the crisis, while only 25% regard it as an important policy innovation bringing crisis resolution closer; 17% view it as an irrelevance.

Banks Fall Out of Favour as Relief Begins to Fade

Banks Fall Out of Favour as Relief Begins to Fade

According to the survey results, the ECB-POLICY-SOURCES-e4bab80d-7aeb-4e49-a29a-ce14e1595c6d>ECB-POLICY-RATES-82f6314e-6203-420b-bc8b-70a978546822>ECB-POLICY-SOURCES-e4bab80d-7aeb-4e49-a29a-ce14e1595c6d>ECB-induced sense of relief still lingers, with only 13% of investors saying they believe the bank segment faces the highest refinancing challenge, down from 22% last quarter and from the high of 49% in Q411 when the sector was ranked higher than sovereigns for the first time.

However, the shot-in-the-arm effect is fading, with only 12% of survey participants ranking banks as their top investment choice, down from 27% in the prior quarter and behind high yield and investment grade corporates and emerging market sovereigns. Respondents also turned less bullish on issuance volumes and more bearish on spread developments for the banking sector over the next 12 months.

The survey indicates that European investors appreciate the ECB-POLICY-SOURCES-e4bab80d-7aeb-4e49-a29a-ce14e1595c6d>ECB-POLICY-RATES-82f6314e-6203-420b-bc8b-70a978546822>ECB-POLICY-SOURCES-e4bab80d-7aeb-4e49-a29a-ce14e1595c6d>ECB’s assistance but are concerned that the banking sector will require ongoing support. Respondents’ views on long-term refinancing operations (LTRO) were mixed, but 38% say the actions will need to be repeated as early as next year.

High Yield Optimism

High yield made a comeback in popularity, overtaking investment grade corporates to become the survey participants’ top investment choice. Nearly one quarter of respondents (24%) voted high yield their favoured sector – the highest proportion since the peak 36% in Q111 and up from 14% in the prior survey.

This resurgence was matched by bullish views on issuance and spreads. 42% of investors expect high yield issuance to increase, up from 30% last quarter. Approximately one third of respondents expect spreads to tighten. This is in line with the last survey and slightly higher than the proportion expecting widening.

Investors’ outlook for high yield credit conditions remains broadly negative according to the survey results. However, fewer respondents expect conditions to deteriorate: 37%, down from 46% in the Q112 survey.

Strong issuance during the first quarter was boosted by solid fund inflows to the sector although Fitch notes that European investor appetite for high yield tends to be fickle, leading to a cycle of stop-start issuance. A worsening of Eurozone economic and financial system risks could easily bring the European high yield market to another temporary halt. Nevertheless, Fitch anticipates higher quality high yield issuers will be able to continue to price bonds.

The Q212 survey was conducted between 27 March and 4 May 2012. Established in 2007, Fitch Rating’s quarterly European Senior Fixed Income Investor Survey is a leading indicator of investor sentiment that provides valuable insight into the opinions of professional asset managers regarding the state of the European credit markets. The full survey results are available on www.fitchratings.com

Explore more articles in the Investing category