Digitising transactions opens the door to addressing a $9 trillion liquidity issue.

Published by Gbaf News

Posted on November 21, 2019

4 min readLast updated: January 21, 2026

Published by Gbaf News

Posted on November 21, 2019

4 min readLast updated: January 21, 2026

By Roy Anderson, CPO and digital transformation officer at Tradeshift, the supply chain payments and marketplaces company (and European unicorn tech startup).

Every financial year begins with good intentions. And as the end of each quarter approaches, it’s a good habit for companies to get into reviewing how they are tracking against their goals, the progress that has been made and areas for improvement.

One of the key areas to come under scrutiny is the payments process. Were all bills paid on time? And if not, address what is causing the delay? Was it because of long-lead times rather a late payment? Did payment terms have to be extended? How many complaints were filed about delays in payment from suppliers?

Have these potentially led to capital shortages for suppliers or spurred a change of supplier? How many invoices had to be manually processed in the areas of procurement and / or accounting? How many people are working on these tasks in the back office?

If you’re looking to understand why a payment might have been missed, or perhaps fix a process that’s broken down, then first you have to have a comprehensive view of finance across the entire supply chain.

That’s easier said than done. The way businesses trade together has not really evolved very much in the past 40 years or so. Most of the processes are fairly paper-intensive, and different departments are siloed off from one another.

When you have a lot of paper, and a lot of steps in the process, chances are things are going to be slow, they’re going to be disconnected, and they’re going to go wrong a lot. Most organisations are recognising the fact that digitising the whole process is the way to go. But despite a lot of grand words, just 8% of trade transactions globally are digital.

Digitising accounts payable process makes a lot of sense for big buyers. Consider this, the average paper-based invoice costs around $14.38 to process. Automation can reduce that cost to $2.52. Now look at the time taken to process an invoice. Best-in-class systems that use automated processing take 3.1 days, compared to the average 10.6 days. Now apply that to DHL 10 million invoices a year. Moving even a fraction of those invoices onto an automated e-invoicing platform can make an enormous difference.

That’s all well and good, but now put yourself in the shoes of a small business owner supplying one of these big buyers. How much of an incentive would it be to digitise your processes, just to help your customer save a bit of money?

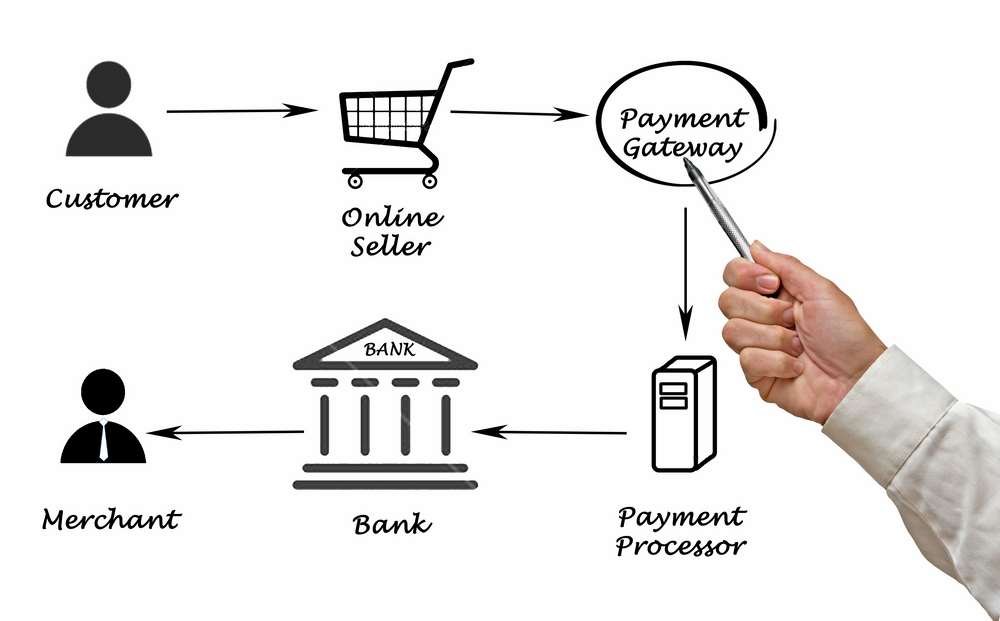

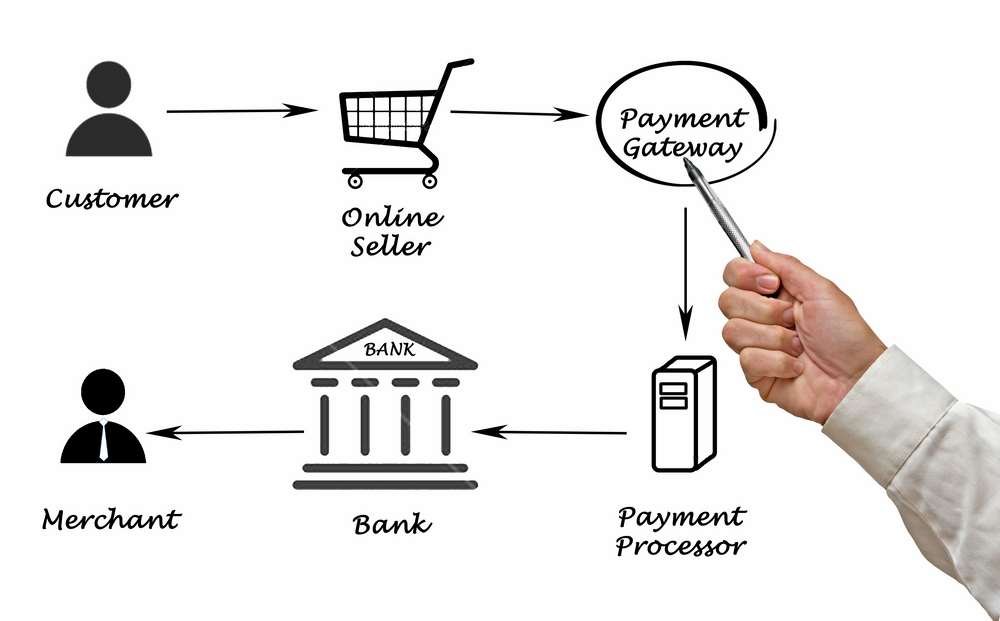

But what if you could get something out of it in return? Most buyers want to delay payments as long as they can to preserve cashflow. Most suppliers want to be paid as soon as possible. Neither party is in the wrong. They’re just trying to do what’s best for their business. Finding a compromise is not always easy. But what if you could start to offer suppliers different financing options in return for switching to a digital platform.

Many suppliers are willing to give 2-3% discount if it means they will get paid quicker. But various factors are preventing many organisations from striking that kind of arrangement. Lack of digitisation is a real stumbling block. Back-end processes on the buyer side are often simply too cumbersome to offer dynamic discounting on a large volume of invoices. And from the supplier side, a lot of small and medium sized businesses are locked out of trade financing arrangements because banks and other financial institutions lack visibility and therefore don’t want to take a risk.

What happens then is that financing remains out of reach for pretty much everyone who could use it, and a liquidity gap forms in its place. We put that liquidity gap at somewhere in the region of $9trillion of cashflow that’s trapped between supplier and buyer.

Digitising eases that liquidity gap on two fronts. First it helps the overall process become much more transparent and efficient, even when a business is processing large amounts of invoices from diverse suppliers.

Second, digitising the transaction layer between buyers and sellers, helps smaller suppliers build up a digital footprint that allows banks a financial institutions to build up a clearer picture of who they’re looking at. The more information they have about suppliers, who their customers are, what deals they have outstanding, whether they deliver on time etc., the more attractive it becomes to finance them.

The relationship between buyer and supplier can also become more dynamic, negotiating terms that are beneficial for all parties. Buyers see the prospect of higher profit margins, and greater efficiencies. Suppliers see the benefits of positive cashflow and more manageable payment terms.

Explore more articles in the Business category