COULD CHINA RIDE THE YEAR OF THE HORSE INTO A GOLDEN SUNSET?

Published by Gbaf News

Posted on April 15, 2014

11 min readLast updated: January 22, 2026

Published by Gbaf News

Posted on April 15, 2014

11 min readLast updated: January 22, 2026

Apparently (according to one broadsheet astrologer anyway) The Chinese Year of the Horse heralds difficult times for those involved in the minerals mining industries. Given that country’s recent focus on gold, I think even the Chinese would dispute that prediction.

At the end of 2013 I wrote in the Black Swan newsletter “Gold has looked weak throughout the year but guess who has been buying: China.

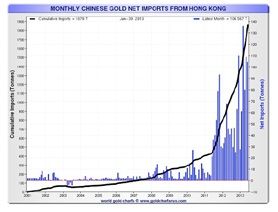

The chart above is China’s imports of gold from Hong Kong. They will also have been buying through Shanghai and other areas but this remains a good proxy for what is happening overall as it is the data least likely to be faked!

The chart above is China’s imports of gold from Hong Kong. They will also have been buying through Shanghai and other areas but this remains a good proxy for what is happening overall as it is the data least likely to be faked!

We can be sure that China has a plan here so it is still a sensible move to have a decent exposure to the yellow metal. Apart from that the markets look very “toppy”. The Swan has an exposure against the Dow which may yet come good but the only sectors looking like strong buys are miners: the China boom has NOT ended.”

I have been puzzling ever since over what China’s plan with gold might be. Today I want to set out one possible scenario but first I want to talk about market rigging and fraud.

The LIBOR Stitch-up

If someone had asked me in 2011 if LIBOR was rigged I would have scoffed and answered “NO!”. I would probably have gone on to say that it would be impossible to have a conspiracy that large amongst so many people. Sooner or later somebody would crack and the whole thing would be blown wide open.

Come June 2012 that “someone” turned out to be Barclays. Clearly realizing that the game was about to be up Barclays “confessed” and in exchange for shopping all the other banks involved paid a reduced $460mil in fines. This looks a bargain against the $1.5bil paid by UBS that December but actually all the fines were pretty meagre.

LIBOR is the starting point for around $350 trillion in derivatives trades and the Financial Times reported that the rigging had been going on since 1991. You do not need many basis points on $350tril over a twenty year period to move your lifestyle well into the comfort zone; or your bank’s profits; or your bank’s balance sheet. So actually those fines look like something of a bargain: particularly as no one has yet been jailed.

There is strong evidence that a similar market manipulation has been happening to gold and that it may be about to come to an end. As we look at this possibility it is important to remember how impossible the rigging of LIBOR once seemed.

Gold as a supporter of currencies

Richard Poulden

Gold has been used as a medium of exchange for thousands of years. Back in Roman or pre-Roman times there were a number of good reasons for this. Firstly it is rare, but not too rare. Secondly, it is simple and easy to mine. At the basic level it is visible in rich veins and these can be mined with simple tools. It can then be smelted at a relatively low temperature to turn it into bars or ingots. Thirdly, it is golden: most of the other elements in the periodic table, which might appear as prospective currencies, are silvery in colour and thus hard to distinguish instantly from each other. Then, lastly, it does not corrode.

For hundreds of years gold circulated as physical currency until the convenience of holding gold in a vault and simply passing on the certificate entitling someone to that gold came to be seen as more convenient. The creation of what is effectively paper money is often erroneously attributed to the London Goldsmiths in the 17th Century. Wrong, it was the Chinese who invented paper money with “Merchant Receipts” circulating in the Tang Dynasty around 700.

Although of course the merchants and goldsmiths quickly worked out that they could issue more certificates than the gold they held (because not everyone would ask for it back at once) the certificates were nonetheless linked to gold and could always be exchanged for it.

| Purchasing power parity on the left scale, currency in circulation on the right

|

Indeed, for most of history, the currency that has circulated in economies has either been itself an item of intrinsic value (gold/silver) or linked to an item of intrinsic value (Bretton Woods and the post World War Two exchange rate mechanism). This automatically prevented governments from simply “printing money”. Then, on August 15th 1971, Richard Nixon severed the final link of the US dollar to gold. In so doing he severed the last link of paper currencies to any item of real value. True, international gold convertibility of most major currencies had gone decades before but in the 1960’s the US dollar could still be exchanged for gold at the rate of $35 per ounce.

We thus entered a period when, for the first time in history ALL world currencies were “Fiat Currencies”[iii]. The last 43 years have thus been fundamentally different from all preceding economic history. We have lived in a period where currencies have not been linked to anything other than a government’s statement of what a currency is worth.

Once governments could issue as much money as they chose the inevitable happened. They could not resist : they “printed” money. There is a whole discussion to be had here, one I’ll address another time, but suffice to say that for the governments the decline in the value of the currencies is actually beneficial.

The return of gold: Back to the Future?

But hold on….governments still have a lot of gold in their central banks right? Well they all say they have and since they are governments it must be true. Or is it all nothing but a game of Liar’s Poker?

2011 was the last time China released data on its gold reserves. According to the World Gold Council the following is the current ranking.

Now the Chinese data here is actually 2011 data and since we know that China purchased in excess of 1,000 metric tonnes of gold last year alone this table is clearly out of date even though it purports to be as of January 2014.

World Gold Holdings over 1,000 Meteric tonnes

|

But it gets more interesting. If we assume gold has been mined at 1,400mt a year for 200 years (which is probably on the high side) then the total gold ever mined is around 280,000mt. Some of this is sitting in jewellery and museums and some has been consumed in industrial uses: the computer on which I am writing this for instance. So I am going to round that to 250,000mt of gold ever mined in the world. Now the top 20 countries on the World Gold Council list hold 27,500mt between them or in other words about 11% of all the gold ever mined!

No one below the top 8 has over 1,000 tonnes so China’s purchase of 1,000 tonnes last year alone is absolutely massive. If as is rumoured, China is about to announce that its holdings of gold are now in excess of 5,000mt the only possible source for this gold is the USA.

So China is in the process of cornering the physical gold market and right now I would say they have probably done it.

Another LIBOR? Could the gold markets also be rigged?

Given what we have seen with LIBOR the obvious answer is “yes” they could be. Conspiracy theories have been around on the gold price for years[iv]. But a recent article by Paul Craig Roberts and Dave Kranzler really caught my attention.[v]

I have stated since the Quantitative Easing program began in 2008 that this would inevitably lead to inflation. It is impossible to inject that amount of money into the system, both in the US and Europe and NOT get inflation.

At the same time as the massive QE programs have been injecting money into the system, Asia, and in particular China, have been buying gold and demanding physical delivery of every ounce they buy (see the graph at the start of this article).

What Roberts and Kranzler clearly explain is the method by which the market has been manipulated. The major bullion banks (at the behest of the Federal Reserve) go short on the Comex[vi] exchange in New York. They do this running naked short positions (a position where they do not have the gold to deliver). If the derivative positions on COMEX are allowed to remain open, and closed only when there is a fall in the gold price, the downward pressure can be relentless.

The same banks are also dumping physical gold on the LBMA[vii] in a way so as to ensure the maximum downward pressure on the price. Although this started as long ago as 2000 the main effort to push down the price has been since the recent high of $1,900 in 2011. Unless this intervention had taken place the price of gold would probably be closer to the $5,000 predicted by Standard & Chartered a couple of years ago.

The objective of the manipulation was to protect the value of the dollar in the face of the massive injections of money into the system and you would have to say that it has by and large worked. However on the other side of most of the physical trades sat the Chinese, each time demanding physical delivery of everything they purchased.

Let’s hear from Roberts and Kranzler: “It became more imperative to drive down the price, but the lower price resulted in higher Asian demand for which scant supplies of gold were available to meet. Having created more paper gold claims than there is gold to satisfy, the Fed has used its dependent bullion banks to loot the gold exchange traded funds (ETFs) of gold in order to avoid default on Asian deliveries. Default would collapse the fractional bullion system that allows the Fed to drive down the gold price and protect the dollar from QE.”[viii]

So is there evidence, as there was with LIBOR, of people heading for the exit? Yes, there is.

Firstly Germany asked for its 1,500mt of gold held in the Federal Reserve to be sent back. Instead of complying the Fed negotiated seven years in which to return 300mt. So pretty obviously they have not got the gold to deliver.

Secondly, Deutsche Bank has withdrawn from gold and silver price fixing. These price “fixes” occur twice daily and there are only 5 banks involved. That number has just been reduced by 20%.

Conclusion:

China is almost certainly the largest holder of physical gold in the world and by a very substantial margin. Much of the physical gold purchased by them over the last few years looks as though it can only have come from the vaults of the Western central banks, particularly the Fed. However long this continues, at some point it will come to an end and at that point China will control the world gold markets and the world monetary system.

What should investors do about it? Well, hold gold obviously but also hold the shares of gold mining companies. I can not do better than quote Louis James, Senior Metals Investment Strategist at Casey Research: “While we’re convinced that buying gold and silver right now will provide handsome rewards, much more money will be made by investing in companies that mine these precious metals. For investors with an appetite for risk, the really big paydays will come from speculating in the best of the best junior miners”. I could not put it better!

Richard Poulden

Chairman

Wishbone Gold Plc

About the Author:

Richard Poulden has founded or co-founded successful companies in healthcare, retail and natural resources and in all these sectors he has executed successful strategies for growth by acquisition.

Mr Poulden is Chairman and CEO of Wishbone Gold Plc, Deputy Chairman of PCG Entertainment Plc and Chairman of Black Swan Plc. In addition to the foregoing, Black Swan is an investor in a range of sectors and companies covering financial services, foreign exchange trading and electricity transmission.

He is a regular interviewee and speaker at events such as the UK Investor Show. He is resident in Dubai, and frequently in the UK, Australia and Asia.

Explore more articles in the Investing category