Higher capital requirements for UBS will raise costs for others, CEO says

Published by Global Banking & Finance Review®

Posted on January 30, 2025

2 min readLast updated: January 26, 2026

Published by Global Banking & Finance Review®

Posted on January 30, 2025

2 min readLast updated: January 26, 2026

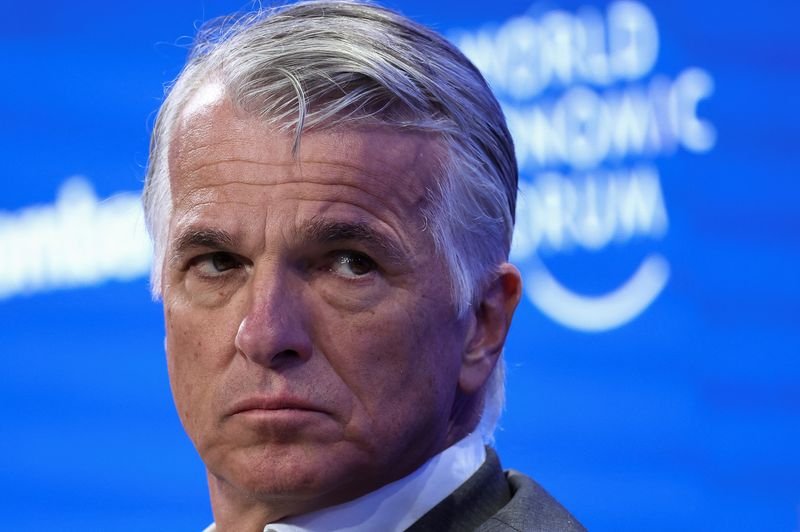

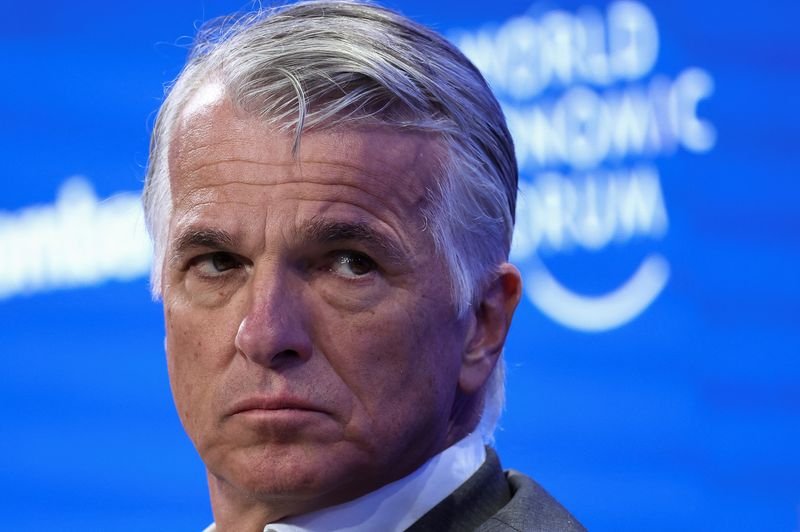

UBS CEO Sergio Ermotti warns that higher capital requirements could lead to increased costs for companies and households, urging a review of Swiss banking regulations.

ZURICH (Reuters) - Imposing higher capital requirements on UBS as a systemically relevant bank will usher in higher costs for companies and households, the Swiss lender's CEO, Sergio Ermotti, said on Thursday.

Ermotti was speaking at an event in Zurich where he urged authorities currently preparing to overhaul Swiss banking rules to stick closely to the current capital requirements.

The Swiss government has vowed to tighten banking regulations in order to make the sector more robust and avoid the risk of another meltdown of the kind Credit Suisse suffered in 2023, which led to its takeover by longtime rival UBS.

"The fact that with today's regulation UBS is able to rescue CS (Credit Suisse) shows that the capital strength and regulation is good enough if it's implemented coherently and also communicated transparently," Ermotti said.

Given Switzerland's swift implementation of the Basel III financial stability requirements, UBS was already adhering to some of the strictest capital requirements worldwide, Ermotti told an audience of banking professionals.

Switzerland's ambition to remain a leading financial centre was incompatible with higher capital requirements for a bank's subsidiaries abroad, Ermotti said, calling for a cost-benefit analysis and asking to be involved in regulatory discussions.

A study published this month by the University of Bern posited that UBS effectively benefits from a state guarantee that has reduced its costs by billions. Ermotti rejected the report, saying that it was based on data that was out of date.

(Reporting by Ariane Luthi and Oliver Hirt; Editing by Dave Graham)

Ermotti stated that imposing higher capital requirements on UBS would lead to increased costs for companies and households.

The Swiss government aims to tighten banking regulations to strengthen the sector and prevent another financial meltdown like that of Credit Suisse in 2023.

Ermotti mentioned that UBS's ability to rescue Credit Suisse demonstrates that current capital regulations are adequate if implemented coherently.

UBS is already following some of the strictest capital requirements globally due to Switzerland's swift implementation of Basel III financial stability requirements.

Ermotti rejected the study's claims that UBS benefits from a state guarantee, arguing that it does not significantly reduce its costs.

Explore more articles in the Finance category