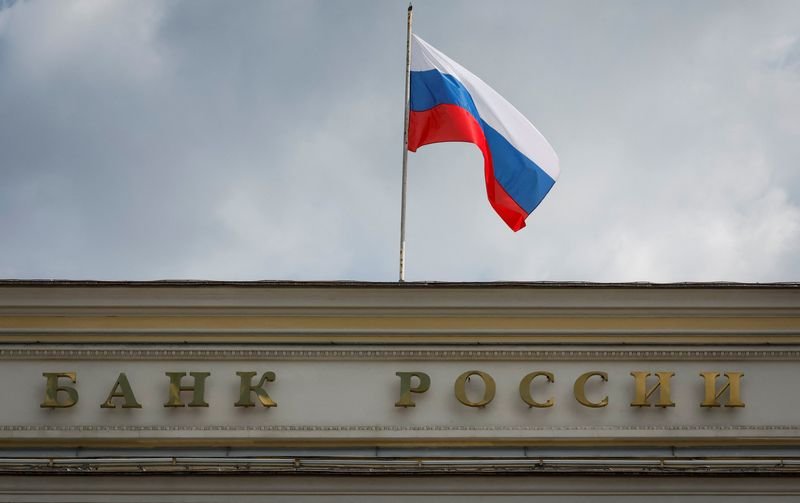

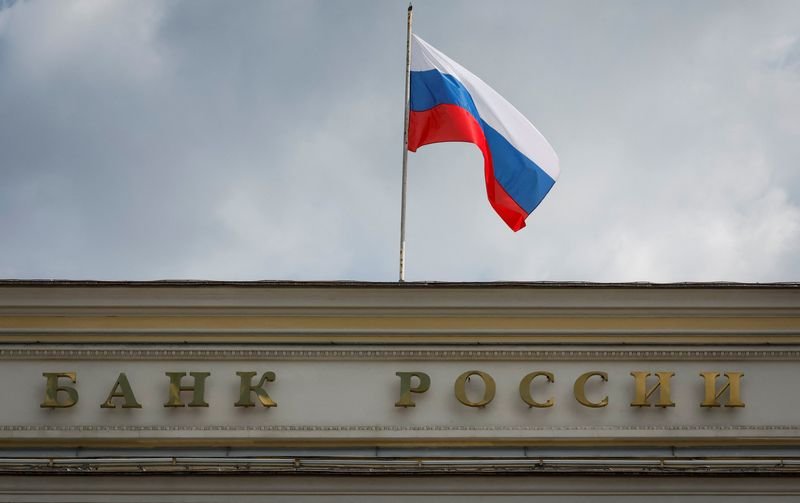

Russian central bank expected to keep benchmark rate on hold on Feb 14: Reuters poll

Published by Global Banking & Finance Review®

Posted on February 10, 2025

3 min readLast updated: January 26, 2026

Published by Global Banking & Finance Review®

Posted on February 10, 2025

3 min readLast updated: January 26, 2026

The Russian central bank is expected to keep its benchmark rate at 21% on Feb 14 due to high inflation, with no rate change anticipated until summer.

By Elena Fabrichnaya

MOSCOW (Reuters) - The Russian central bank is expected to keep its benchmark interest rate on hold at a board meeting on February 14 but is likely to use more hawkish language than previously as inflation is not slowing, a Reuters poll of 24 analysts showed on Monday.

High inflation, which reached 9.5% last year, is the key challenge for the Russian economy in 2025, and it is important to contain it, Prime Minister Mikhail Mishustin told President Vladimir Putin last week.

Reuters reported earlier that Putin is increasingly concerned about the state of the Russian economy, while CEOs at top Russian corporations have publicly criticised the central bank's high interest rate policy.

The regulator surprised markets at its last rate-setting meeting in December by unexpectedly keeping the key rate on hold, after raising it to the highest level since the early 2000s earlier in the year.

Analysts pointed out that slowing lending rates in recent months could be the main argument for the central bank to believe its monetary policy is working and the economy is starting to cool down.

"In November-December, clear trends towards a slowdown in lending have emerged, which will eventually lead to a cooling of aggregate nominal demand and a reduction in price pressure," said VTB's Rodion Latypov.

The rouble, whose weakening contributed to a rise in inflation last year, has strengthened by 14% against the U.S. dollar since the start of 2025, alleviating inflationary pressure, analysts said.

"The rouble continues to strengthen, which restrains future inflationary risks. On the other hand, currently inflation remains significantly above the central bank's target levels," said Sberbank's Igor Rapokhin.

All 24 analysts in the Reuters poll predicted that the key rate will stay at 21%. Mikhail Vasilyev from Sovkombank said the central bank needed to stay hawkish in its statements.

"From the regulator's point of view, it is important to maintain a strict rhetoric now to prevent premature easing of financial conditions," he said.

Inflation, mainly fuelled by state spending to finance what Russia calls its "special military operation" in Ukraine, has reached 9.9% on an annual basis, the latest statistical data showed.

"If the key rate remains at the current level in February, I would not expect it to decrease before the summer, when annual inflation has a chance to fall below 8%," said Dmitry Kulikov from ACRA rating agency.

(Reporting by Elena Fabruchnaya, writing by Gleb Bryanski; Editing by Hugh Lawson)

The article discusses the Russian central bank's expected decision to maintain its benchmark interest rate amid inflation concerns.

The central bank aims to control high inflation, which is a significant challenge for the Russian economy.

The rouble has strengthened by 14% against the U.S. dollar, helping to alleviate inflationary pressures.

Explore more articles in the Finance category