Commission wants one set of rules across EU for innovative firms

Published by Global Banking & Finance Review®

Posted on January 21, 2025

3 min readLast updated: January 27, 2026

Published by Global Banking & Finance Review®

Posted on January 21, 2025

3 min readLast updated: January 27, 2026

The EU proposes a unified rulebook, the 28th regime, to retain innovative firms and simplify operations across its single market, preventing moves to the U.S.

By Jan Strupczewski

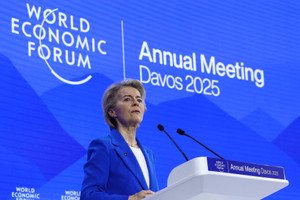

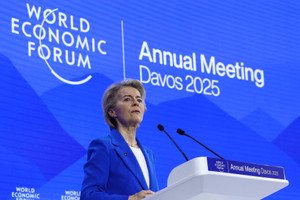

BRUSSELS (Reuters) -The European Commission wants to dissuade innovative start-up firms from moving to the U.S. to grow by creating rules that would allow them to easily operate across the 27-nation European Union, the head of the Commission said on Tuesday.

In a speech at the Davos economic forum in Switzerland, Ursula von der Leyen said a special rulebook, independent of often differing national legislation, would allow companies to take advantage of the full scale of the EU's single market of 450 million consumers.

"Today, the European Single Market still has too many national barriers," von der Leyen said. "Sometimes companies are dealing with 27 national legislations."

"We will offer instead to innovative companies to operate all across our Union under one single set of rules. We call it the 28th regime. Corporate law, insolvency, labour law, taxation – one single and simple framework across our Union," she said.

The initiative is part of the EU's efforts to retain innovative firms so that the bloc can stay in the race for technologies of the future which would allow the European economy to stop emitting CO2 and help prevent climate change.

The United States often holds more attraction to young European companies because raising capital in the U.S. is easier than in Europe and because a product developed in one U.S. state can be sold across the whole U.S. with no extra paperwork.

Using the so-called 28th regime would be legal way of bypassing the need for all 27 EU governments to agree on often complex reforms to harmonise their financial, legal and taxation rules.

The 28th regime method has been discussed in the context of various areas of EU activity since 2010, most recently as way forward in a report on how to improve the EU's single market by former Italian Prime Minister Enrico Letta.

But it requires the consent of governments and the European Parliament to launch. Finishing the legal process could take around two years, if not more, and success is not guaranteed.

"EU governments have blocked such 28th regime proposals many times," one senior EU official said. "But maybe now with the urgency you can propose such an omnibus 28th regime."

The Commission estimates there are around 182,000 innovative small and medium sized companies, who could, on a voluntary basis, become part of the 28th regime to get better access to the whole EU single market.

"This would be a complex endeavour," one EU diplomat said. "At the same time, at some point we will have to start considering difficult issues as well. We can't keep saying we need to address competitiveness but maintain our existing positions."

(Reporting by Jan Strupczewski, editing by Ed Osmond)

The article discusses the EU's proposal for a unified rulebook to simplify operations for innovative firms across its single market.

The 28th regime is a proposed set of unified rules allowing firms to operate across the EU without dealing with 27 different national legislations.

The EU aims to retain innovative firms within Europe and prevent them from moving to the U.S. by simplifying market operations.

Explore more articles in the Finance category