Smaller economies' medium term default risk could have risen

Published by Global Banking & Finance Review®

Posted on January 30, 2025

2 min readLast updated: January 26, 2026

Published by Global Banking & Finance Review®

Posted on January 30, 2025

2 min readLast updated: January 26, 2026

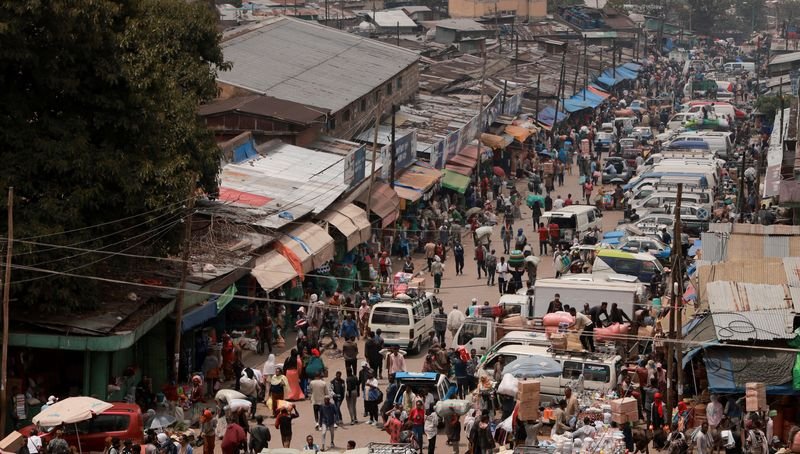

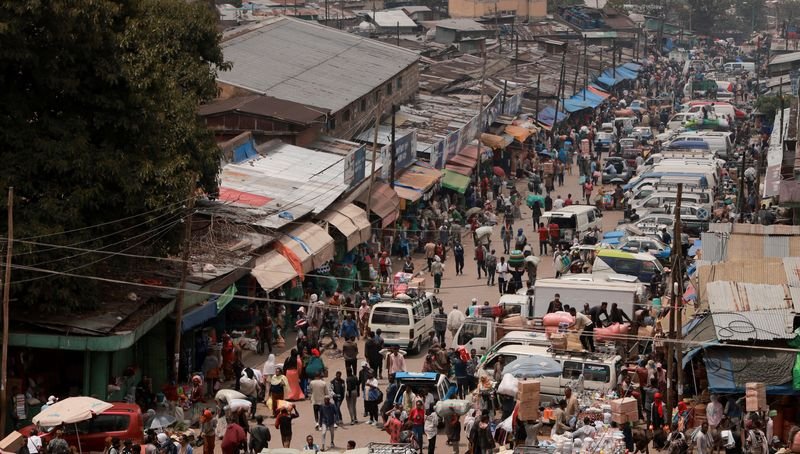

Smaller economies, especially in Africa, face rising default risks due to global factors. The G20 Common Framework may offer debt relief solutions.

By Karin Strohecker

LONDON (Reuters) - Some of the world's smallest economies, especially in Africa, could be at increased risk of being unable to pay their debts in the medium term, even as developing nations have emerged from a series of sovereign defaults, financial adviser Lazard said.

The pandemic, the Ukraine war, and domestic strife have led governments, including Argentina, Ecuador, Ethiopia, Ghana, Sri Lanka and Zambia, to default since 2020.

Investors do not expect more sovereign defaults in 2025, but credit metrics for smaller and riskier countries, known as frontier markets, point to a structural weakening, especially for governments in Africa, Thomas Lambert, of Lazard's sovereign advisory team, said.

The U.S. Federal Reserve decided to hold its benchmark interest rate - the basis for global borrowing rates - on Wednesday. Markets expect it to be steady until June as Donald Trump's second administration has left the policy backdrop extremely uncertain.

Lambert said the refinancing profile for the most fragile nations was modest this year, but that could change between 2026-28 when larger repayments will be due.

"So it is plausible that in these years a new cycle could start again,” Lambert, one of the authors of the Lazard paper published this week on the subject, told Reuters.

High U.S. rates add to the difficulties of refinancing, and the paper said the "distance to default has diminished for many countries".

Emerging market investors have in recent months turned to frontier markets to shelter from the impact of Trump's return to the White House that is expected to heighten trade tensions with Mexico and China - two of the major investment destinations in the asset class.

The reprieve in potential defaults offered an opportunity to revisit the G20 Common Framework, a debt relief initiative launched during the COVID-19 pandemic to help heavily-indebted countries. It has been criticised following slow restructurings.

(Reporting by Karin Strohecker, editing by Barbara Lewis)

The pandemic, the Ukraine war, and domestic strife have caused several governments, including Argentina, Ecuador, Ethiopia, Ghana, Sri Lanka, and Zambia, to default since 2020.

Investors do not expect more sovereign defaults in 2025; however, credit metrics for smaller and riskier countries indicate a structural weakening.

High U.S. rates complicate refinancing efforts, and the distance to default has diminished for many countries, making it harder for them to manage their debts.

The G20 Common Framework is a debt relief initiative launched during the COVID-19 pandemic aimed at assisting heavily-indebted countries.

The refinancing profile for the most fragile nations is modest this year, but it could change between 2026-28 when larger repayments will be due.

Explore more articles in the Finance category