Besi forecasts unexpected sales drop in first quarter

Published by Global Banking & Finance Review®

Posted on February 20, 2025

3 min readLast updated: January 26, 2026

Published by Global Banking & Finance Review®

Posted on February 20, 2025

3 min readLast updated: January 26, 2026

Besi forecasts a 10% sales drop in Q1 2025 due to market weakness, despite positive AI orders. Hybrid bonding solutions show growth potential.

By Nathan Vifflin and Leo Marchandon

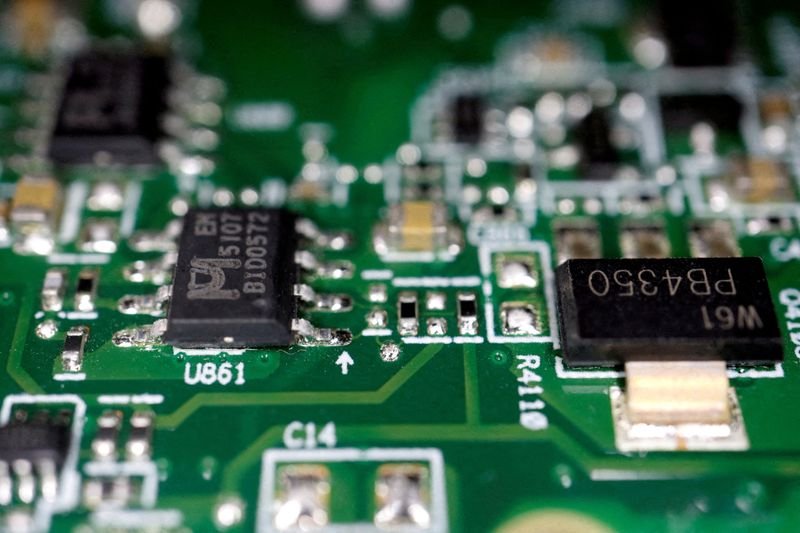

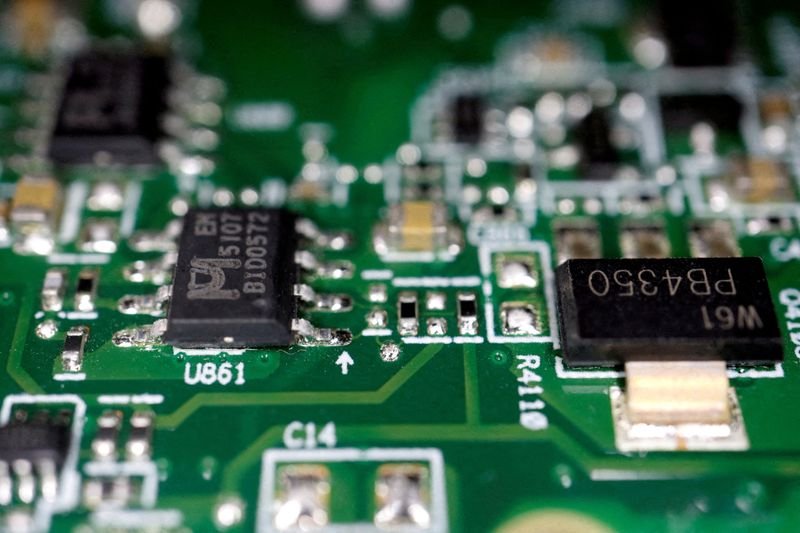

(Reuters) - Dutch chipmaking parts supplier BE Semiconductor Industries forecast an unexpected sales drop for the first quarter on Thursday, as weakness in its traditional markets offsets positive AI-related orders.

Besi's shares fell as much as 10% in early trading. They closed 0.7% higher.

The chip assembly equipment maker expects its first-quarter sales to fall by up to 10% from the 153.4 million euros ($159.9 million) it reported for the final quarter of 2024.

Analysts were expecting revenue to grow to 170.2 million euros in the first quarter, according to LSEG's IBES data.

Degroof Petercam analyst Michael Roeg said the first quarter guidance came in well below market expectations, while fourth-quarter results were a broad miss, with order bookings significantly below estimates.

Bookings, an important gauge for forecasting future growth, were 121.9 million euros in the fourth quarter, against analysts' estimate of 171 million euros in a Visible Alpha consensus.

"We enter the year 2025 with cautious optimism based on strong momentum in our advanced die placement solutions for AI applications partially offset by ongoing weakness in mainstream automotive, smart phone, industrial and Chinese end-user markets," CEO Richard Blickman said in a statement.

Investors are banking on growing orders for Besi's hybrid bonding solutions and the company's first-mover advantage amid a surge in demand for AI-enabling technology.

But its traditional markets - tools destined for the production of chips used in cars and smartphones - are facing a more than two year long downturn, as manufacturers push back orders to manage their excess manufacturing capacity.

Besi said it expects a recovery in the mainstream assembly markets to start only in the second half of 2025, which will also depend on end market trends and the course of global trade restrictions.

CEO Blickman said at the company's results press conference that hybrid bonding was well on track, despite orders fluctuating quarter to quarter. Hybrid bonding connects chips together more directly, resulting in lower power consumption and higher chip density.

Hybrid bonding customers increased to fifteen from nine in the fourth quarter, which included two new major clients, the company said, one Japanese and one Korean.

Besi said it expects broad adoption of hybrid bonding to occur incrementally over the next three years, as existing customer orders are purposed at an early stage for mass production.

($1 = 0.9591 euros)

(Reporting by Nathan Vifflin and Leo Marchandon in Gdansk; Editing by Milla Nissi and Jane Merriman)

Besi expects its first-quarter sales to fall by up to 10% from the 153.4 million euros reported for the final quarter of 2024.

Analysts were surprised by the first quarter guidance, which came in well below market expectations, and noted that fourth-quarter results were a broad miss.

Besi's traditional markets, particularly for chips used in cars and smartphones, are experiencing a downturn lasting over two years, as manufacturers push back orders.

Besi is optimistic about its hybrid bonding solutions, with customer numbers increasing and expectations for broad adoption over the next three years.

Besi expects a recovery in mainstream assembly markets to begin only in the second half of 2025, depending on end market trends and global trade restrictions.

Explore more articles in the Finance category