Apple rises as rosy forecast lifts hopes for iPhone rebound

Published by Global Banking & Finance Review®

Posted on January 31, 2025

2 min readLast updated: January 26, 2026

Published by Global Banking & Finance Review®

Posted on January 31, 2025

2 min readLast updated: January 26, 2026

Apple's positive forecast boosts hopes for an iPhone sales rebound, adding $81 billion to its market value despite AI challenges in China.

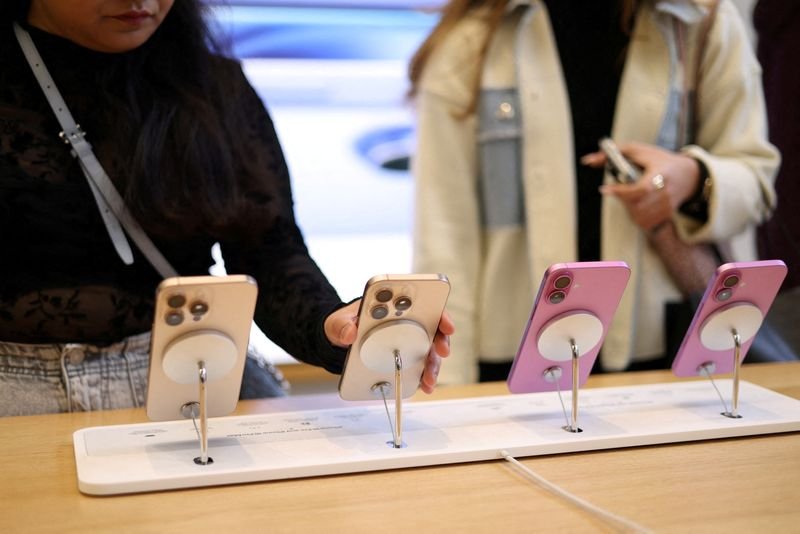

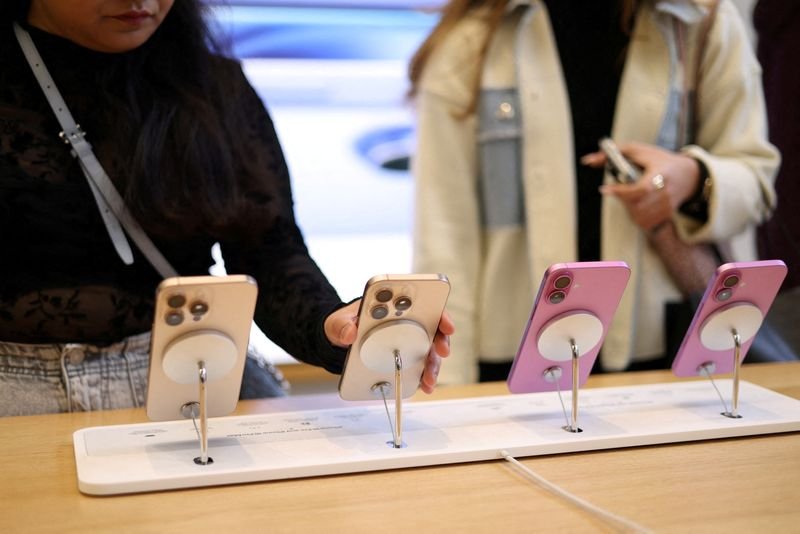

(Reuters) - Apple shares rose 2% on Friday after a rosy forecast fuelled hopes of an iPhone sales rebound, even as tough competition and a lack of AI features weigh on demand in key market China.

Already the world's most valuable company, Apple is set to add more than $81 billion to its market value of $3.573 trillion, if the gains hold.

Apple, which has been grappling with investor worries over iPhone demand due to a slow rollout of its AI-powered Apple Intelligence features, expects revenue to rise in the low- to mid-single digit percentage range in the current quarter.

The forecast suggested demand was picking up for the iPhone 16 series that was launched in September without most of the Apple Intelligence features but updates in recent months added services including ChatGPT integration.

"Fears had mounted (heading into Apple's first-quarter earnings report). But the company flipped them to the mat," said Rosenblatt analyst Barton Crockett.

While Microsoft and Alphabet have poured billions into AI-related investments, Apple has taken a more cautious approach, avoiding hefty capital spending and focusing on leveraging the technology for device sales.

"With investors highly tuned into how AI spend will represent real revenue for big tech, Apple's results have provided ... reassurance," said Susannah Streeter, head of money and markets at Hargreaves Lansdown.

Still, China — Apple's third-largest market — remains a concern.

The company is yet to secure a local partner in China to roll out its AI features, while domestic rivals including a resurgent Huawei have been chipping away at its market share there with more splashy devices.

Apple's sales declined 11% in China in the last three months of 2024, after a marginal decline in the previous quarter.

But government stimulus measures rolled out earlier this month, would help Apple stem the sales decline, J.P. Morgan analysts noted.

At least 12 analysts lifted their price targets on the stock. Apple shares gained about 30% last year. That compares with a more than 65% jump in Meta, the best performer in the Big Tech group, and a 12% rise in laggard Microsoft.

Apple's 12-month forward price-to-earnings ratio is 31.12, compared with Microsoft's 29.2 and Meta's 26.7.

(Reporting by Joel Jose and Siddarth S in Bengaluru; Additional reporting by Samuel Indyk in London; Editing by Amanda Cooper and Shinjini Ganguli)

The article discusses Apple's positive forecast and its impact on iPhone sales and market value.

Apple is cautiously integrating AI features to boost device sales, focusing on updates like ChatGPT integration.

Apple faces tough competition from local rivals like Huawei and struggles to secure a local partner for AI features.

Explore more articles in the Finance category