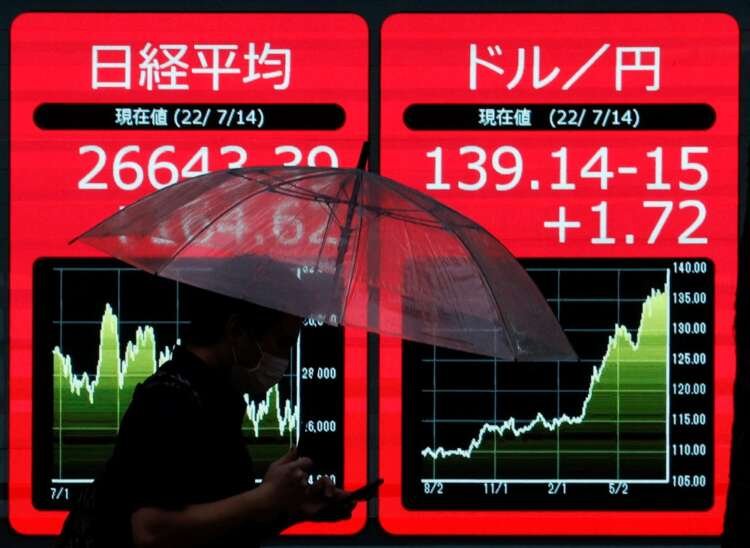

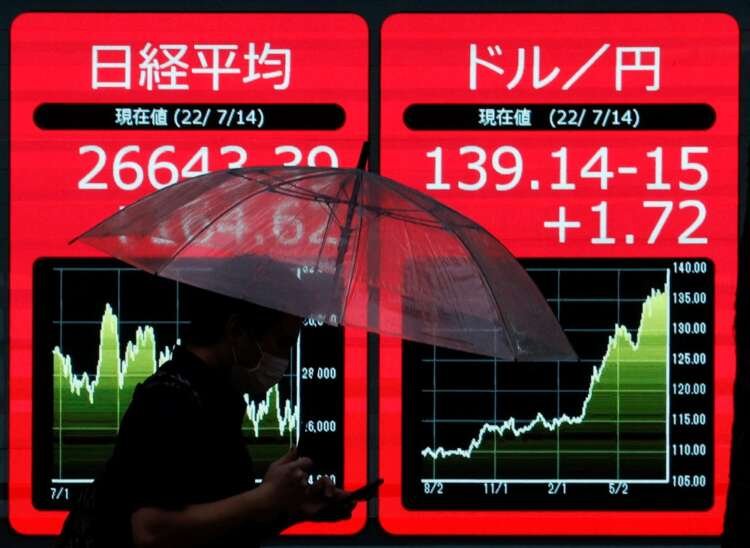

World stocks gain, dollar dips as investors weigh spending data, inflation scares

By Katanga Johnson

WASHINGTON (Reuters) – Global equities rebounded on Friday as U.S. spending data beat forecasts, while the dollar dipped and oil rose as investors digested an easing of Italy’s political crisis and tempered expectations of a more aggressive U.S. rate rise this month.

Markets are still roiled by concerns, however, that the world economy is headed for recession as central banks rush to get on top of galloping inflation, with steep interest rate rises seen this week in Canada, New Zealand, Chile, South Korea and the Philippines.

Fears of an economic downturn were fanned further on Friday by Chinese data showing annualised 0.4% growth in the second quarter, the worst since at least 1992, excluding early 2020 when the COVID pandemic erupted.

The data reflect the colossal hit from widespread COVID lockdowns. It sent Chinese shares 1.7% lower and dragged an Asian ex-Japan index to two-year lows.

But investors elsewhere looked on the bright side.

“Today’s price action… would come down to Fed governors potentially ruling out 100 basis points, so some cooling off of the panic price action we had seen earlier in the week,” said Rohan Khanna, a strategist at UBS.

He referred to Thursday’s comments by Federal Reserve Governor Christopher Waller and St. Louis Fed President James Bullard.

Considered policy hawks, both officials said they favoured a 75 basis-point rate hike in July rather than the 100 bps some had bet on after data showed June U.S. inflation at 9.1%.

Meanwhile, Italy’s president rejected Prime Minister Mario Draghi’s resignation, heading off an immediate government collapse of the government though the fate of the coalition remains in balance.

The pan-European STOXX 600 index rose 1.31% and MSCI’s gauge of stocks across the globe gained 1.17%. Wall Street’s main indexes opened higher on Friday as upbeat retail sales data allayed some concerns about an economic slowdown, while shares of Citigroup surged after quarterly results.

Traders may be pressured overall, however, by companies’ second-quarter earnings, which so far have mostly underwhelmed.

Several European firms posted downbeat results on Friday, while U.S. bank Wells Fargo reported a profits fall, with more money set aside to cover bad loans.

That follows relatively weak figures from JPMorgan and Morgan Stanley.

The Dow Jones Industrial Average rose 1.48%, the S&P 500 gained 1.24% and the Nasdaq Composite added 0.97%.

GRAPHIC: US fed funds and inflation https://fingfx.thomsonreuters.com/gfx/mkt/lbvgnxqebpq/U.S.%20fed%20funds%20and%20inflation.PNG

RECESSIONARY SET-UP

Weakening growth has forced markets to tone down rate hike expectations. With Europe facing an energy supply crunch, traders have dialled back bets on European Central Bank policy tightening by year-end.

U.S. markets are pencilling in rate cuts after March 2023.

“The recession angle is becoming stronger, backed by data showing things are cracking underneath the surface,” said Salman Ahmed, global head of macro at Fidelity International.

“We moved rapidly from a stagflationary set-up to more of a recession-dominated one, and very strong inflation is adding to fears that the Fed will need to do more front-loaded tightening.”

Treasury yields slipped two-three bps across the curve while two-year yields held firmly bps above the 10-year segment, the curve inversion that often presages recession.

The yield on 10-year Treasury notes was down 2.7 basis points to 2.932%. The two-year U.S. Treasury yield, which typically moves in step with interest rate expectations, was down 1.7 basis points at 3.128%.

In Europe, German 10-year yields fell 11 bps to 1.071%, the lowest since May 31. Italy’s borrowing costs slipped after Thursday’s 20 bps jump though its yield premium over Germany stayed near one-month highs.

The Fed officials’ comments knocked the dollar index off two-decade highs while the euro rose 0.3% to around $1.00530. The single currency has slid more than 1% this week, having hit parity against the greenback for the first time in 20 years.

The dollar index fell 0.359%, with the euro up 0.48% to $1.0064.

The yen firmed 0.2% to 138.8, retreating from lows of almost 140 per dollar, levels last hit in 1998.

The growth worries weighed on commodities, with copper prices set for their worst weekly loss in more than two years and U.S. crude recently rose 2.06% to $97.75 per barrel while Brent was at $101.07, up 1.99% on the day.

(Additional reporting by Tom Westbrook in Singapore and Yoruk Bahceli in London; Editing by Mark Potter, Chizu Nomiyama, William Maclean)

Inflation is the rate at which the general level of prices for goods and services rises, eroding purchasing power. It is typically measured annually.

Interest rates are the cost of borrowing money or the return on savings, expressed as a percentage of the principal amount. They are influenced by central bank policies.

Financial markets are platforms where buyers and sellers engage in the trade of assets such as stocks, bonds, currencies, and derivatives, facilitating capital flow.

Economic growth refers to the increase in the production of goods and services in an economy over time, typically measured by GDP growth.

Explore more articles in the Investing category